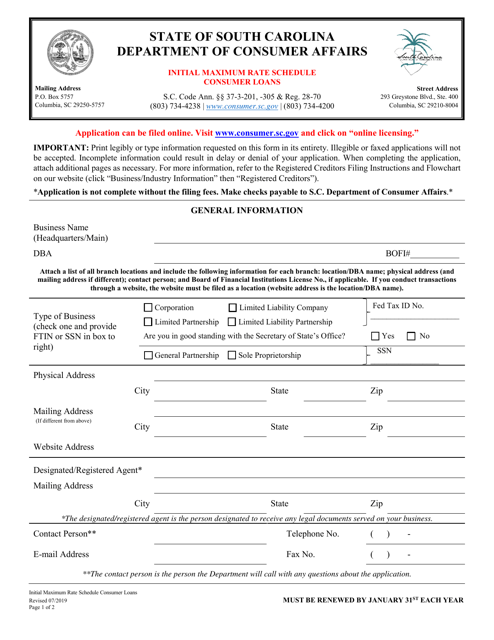

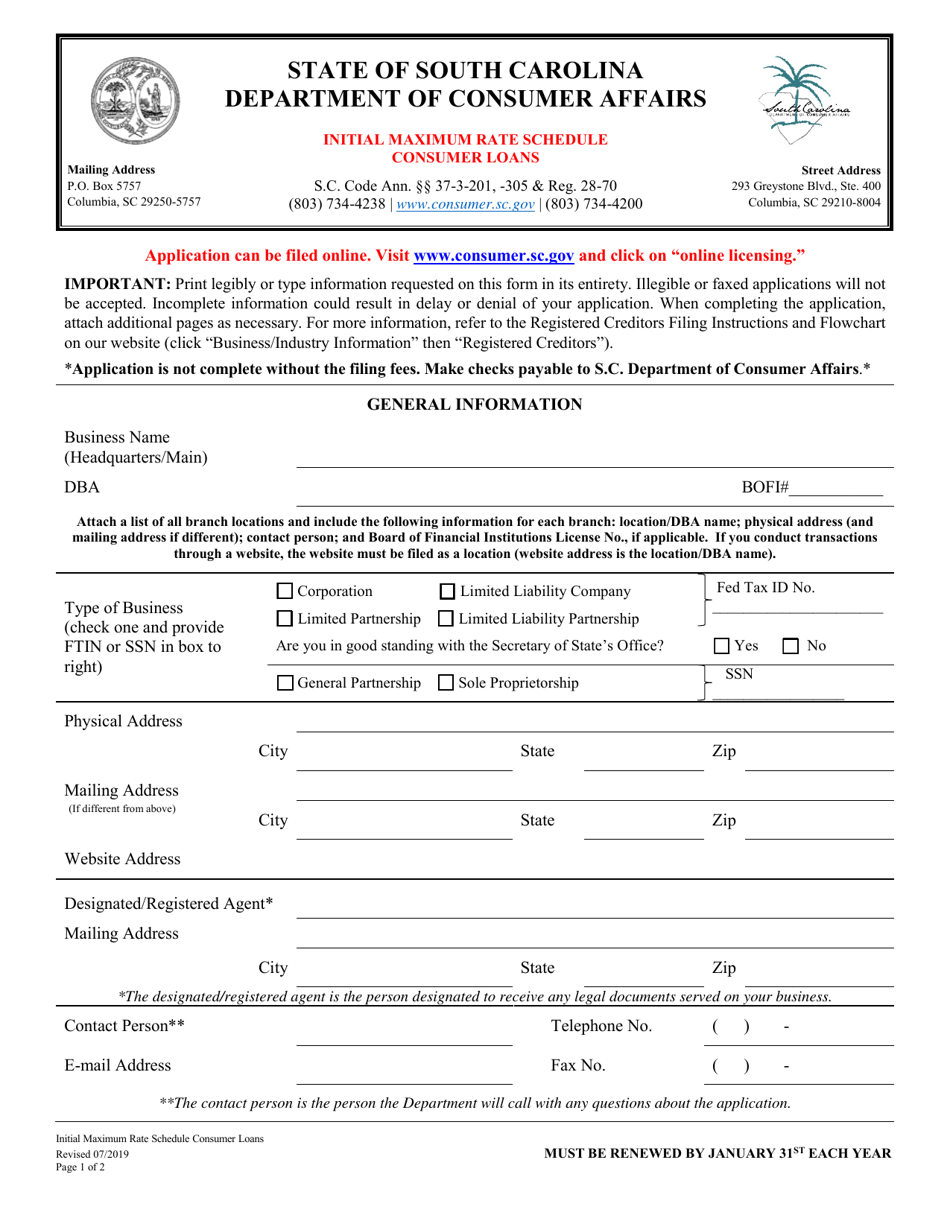

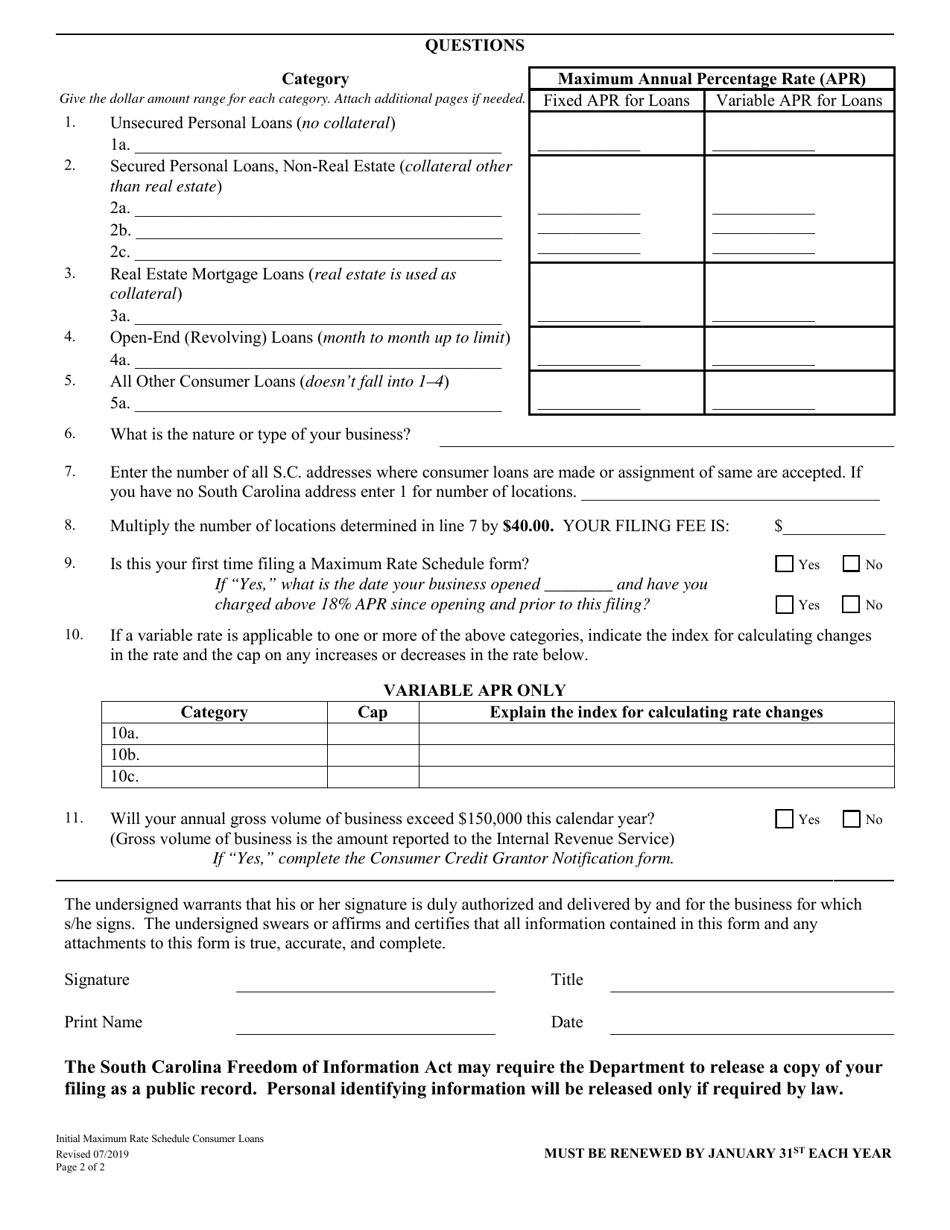

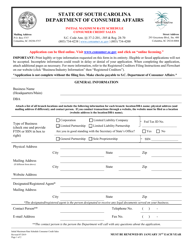

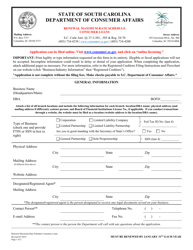

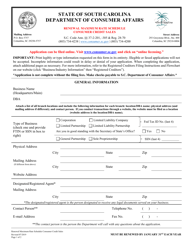

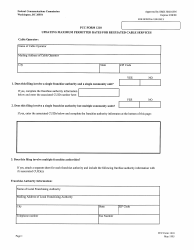

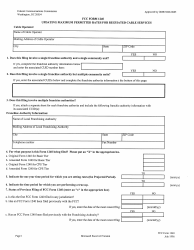

Initial Maximum Rate Schedule - Consumer Loans - South Carolina

Initial Maximum Rate Schedule - Consumer Loans is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

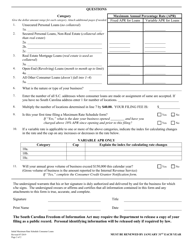

Q: What is the Initial Maximum Rate Schedule for Consumer Loans in South Carolina?

A: The Initial Maximum Rate Schedule for Consumer Loans in South Carolina is a guideline set by the state to determine the maximum interest rates that lenders can charge on consumer loans.

Q: Why is there an Initial Maximum Rate Schedule for Consumer Loans in South Carolina?

A: The Initial Maximum Rate Schedule is in place to protect consumers from excessive interest rates and ensure fair lending practices.

Q: What types of loans are covered under the Initial Maximum Rate Schedule in South Carolina?

A: The Initial Maximum Rate Schedule covers various types of consumer loans, such as personal loans, auto loans, and payday loans.

Q: Are there different maximum rates for different types of loans?

A: Yes, the Initial Maximum Rate Schedule sets different maximum rates for different types of loans to reflect the risk and nature of each loan.

Form Details:

- Released on July 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.