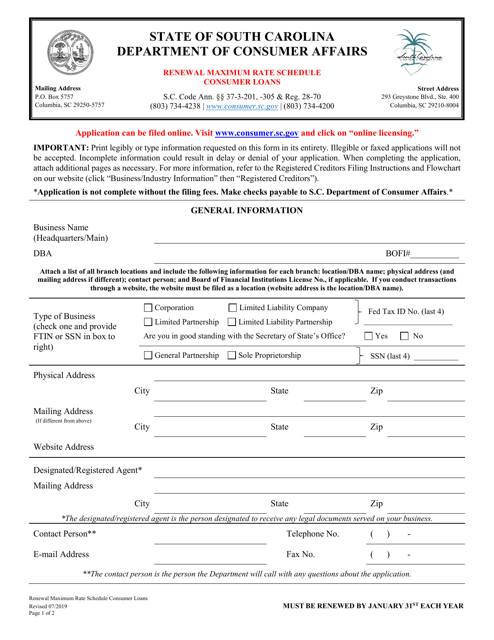

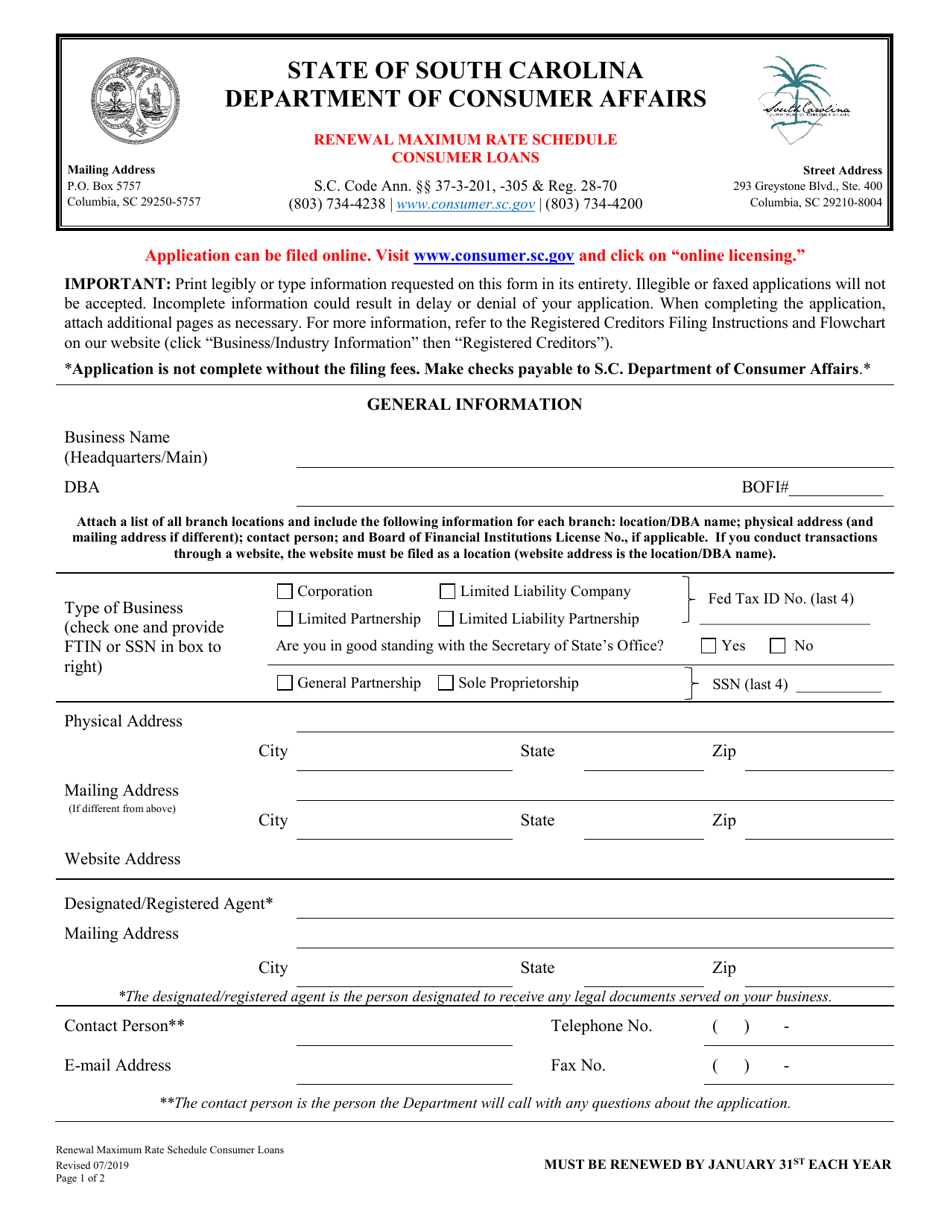

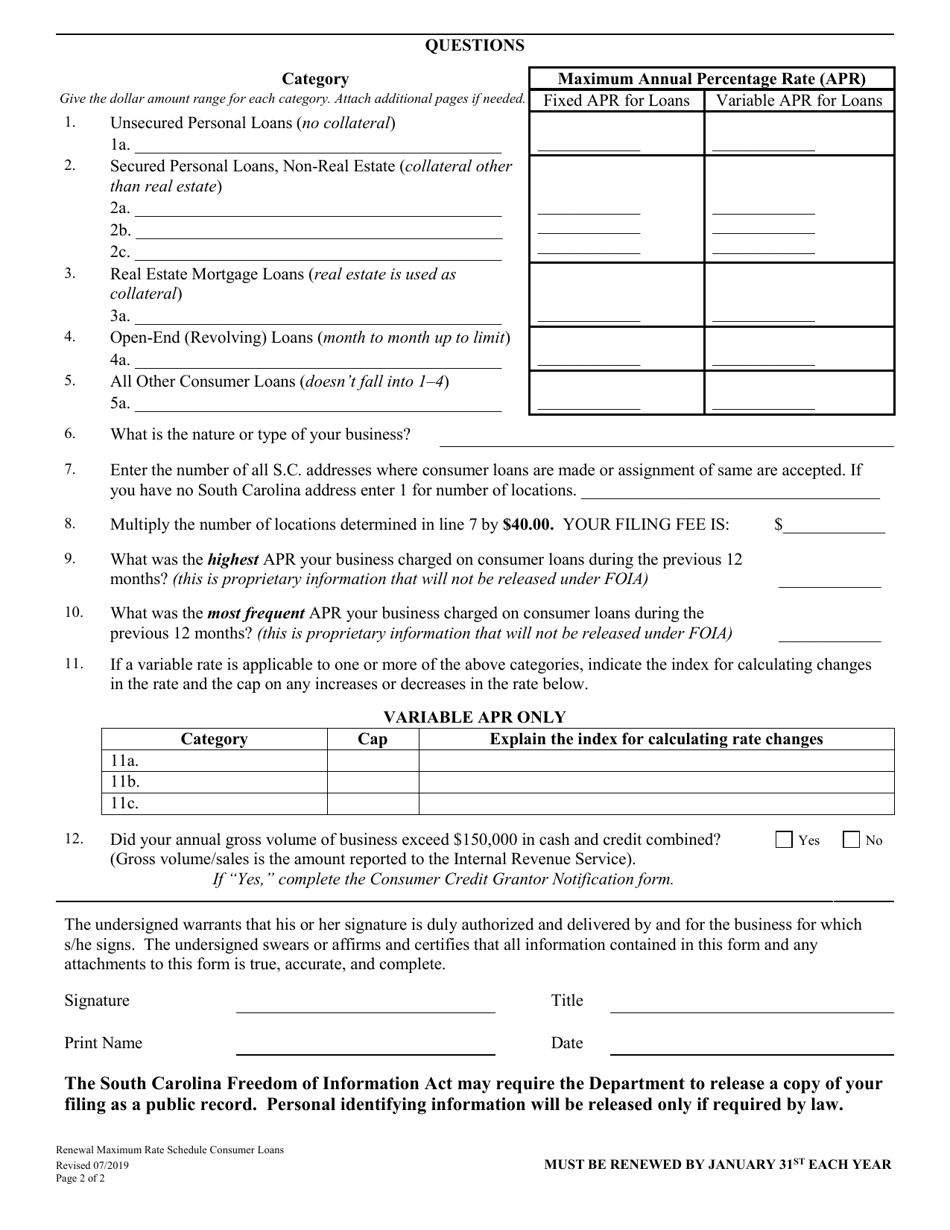

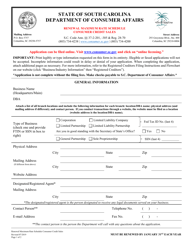

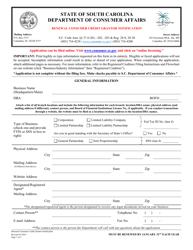

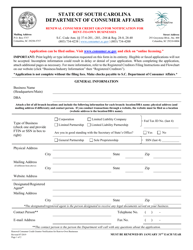

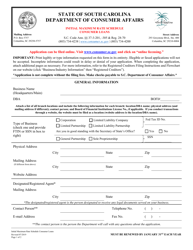

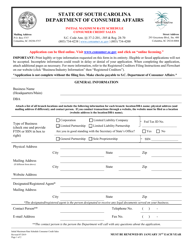

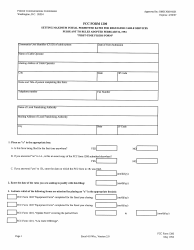

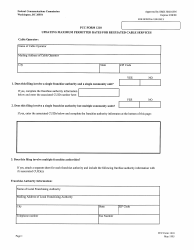

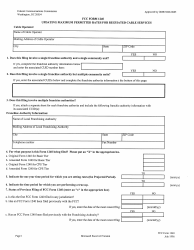

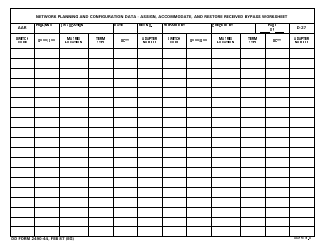

Renewal Maximum Rate Schedule - Consumer Loans - South Carolina

Renewal Maximum Rate Schedule - Consumer Loans is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

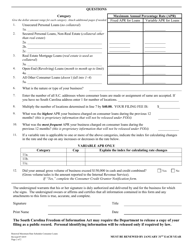

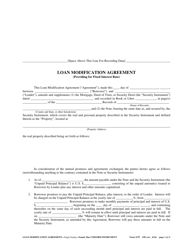

Q: What is the Renewal Maximum Rate Schedule for Consumer Loans in South Carolina?

A: The Renewal Maximum Rate Schedule is the maximum interest rates that can be charged for consumer loans in South Carolina.

Q: What are consumer loans?

A: Consumer loans are loans taken out by individuals for personal use, such as auto loans, credit card debt, or personal loans.

Q: Why is there a maximum rate for consumer loans?

A: The maximum rate is set to protect consumers from excessive interest charges and predatory lending practices.

Q: Are there different maximum rates for different types of consumer loans?

A: Yes, the maximum rates vary based on the type and amount of the loan.

Form Details:

- Released on July 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.