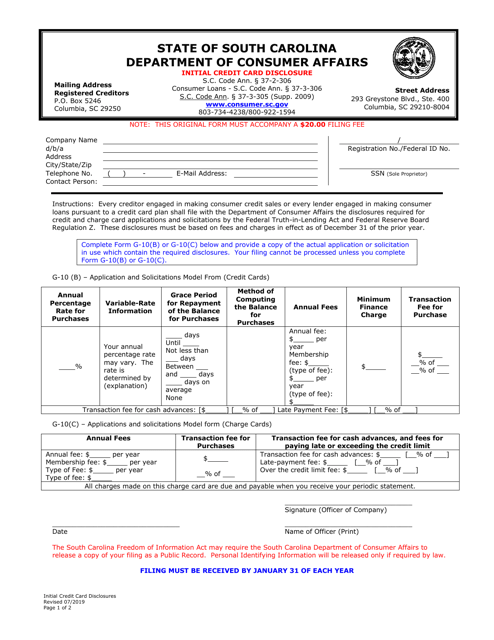

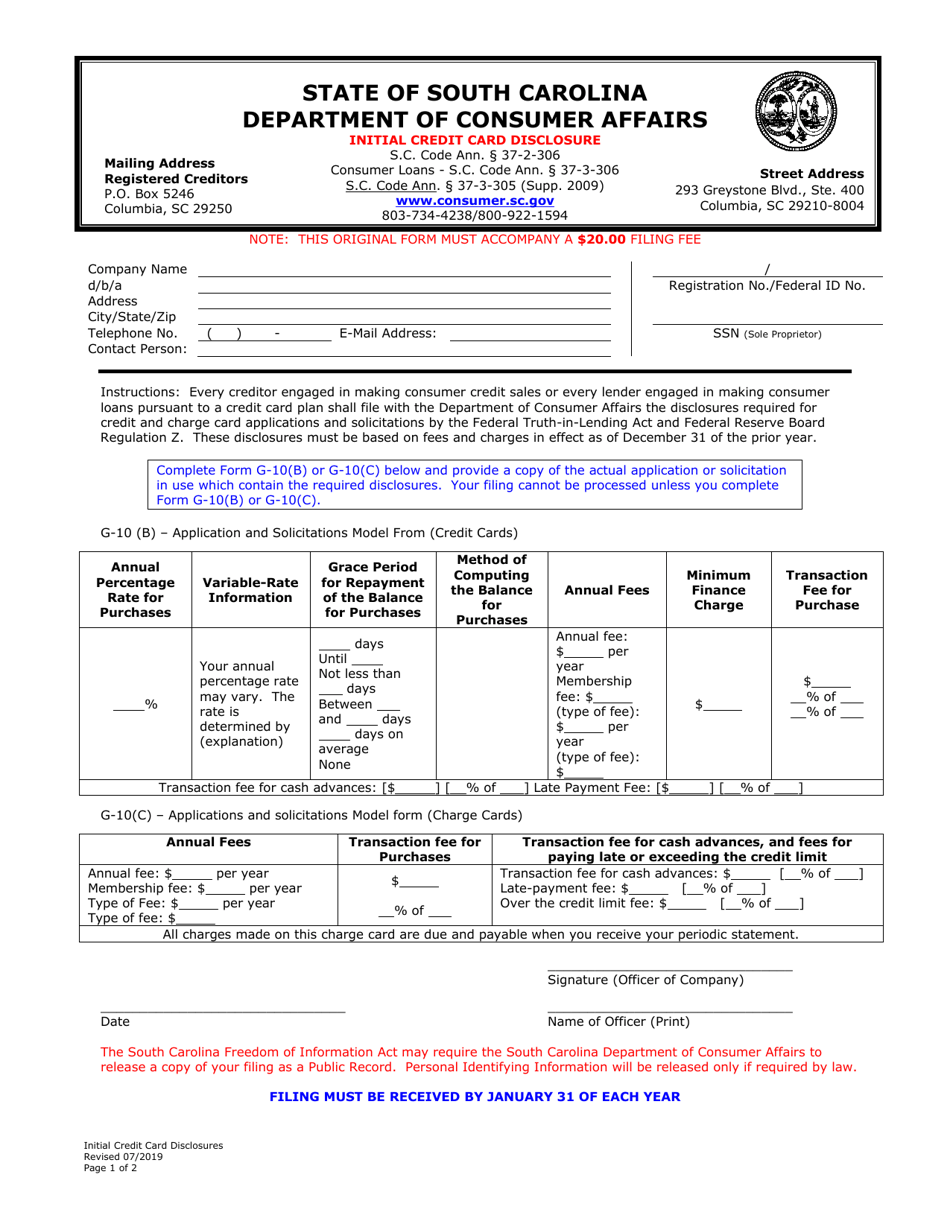

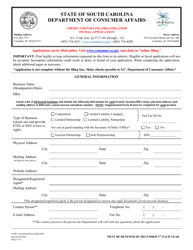

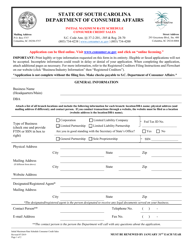

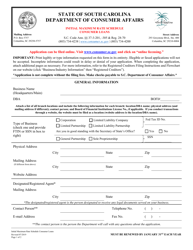

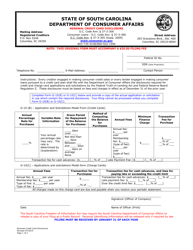

Initial Credit Card Disclosure - South Carolina

Initial Credit Card Disclosure is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

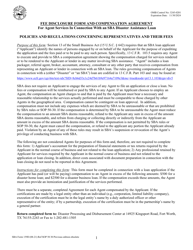

Q: What is an initial credit card disclosure?

A: An initial credit card disclosure is a document provided to consumers by credit card lenders that outlines important information about the credit card.

Q: What information does the initial credit card disclosure contain?

A: The initial credit card disclosure typically includes information about the interest rates, fees, and terms associated with the credit card. It may also provide details about any rewards or benefits offered.

Q: Why is the initial credit card disclosure important?

A: The initial credit card disclosure is important because it helps consumers understand the terms and costs associated with the credit card. It allows them to make informed decisions and compare different credit card offers.

Q: Are credit card lenders required to provide an initial credit card disclosure?

A: Yes, credit card lenders are required by law to provide an initial credit card disclosure to consumers before they open a credit card account.

Q: Can the terms in the initial credit card disclosure change?

A: Yes, the terms in the initial credit card disclosure can change, but the credit card lender must provide notice of any changes in terms.

Form Details:

- Released on July 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.