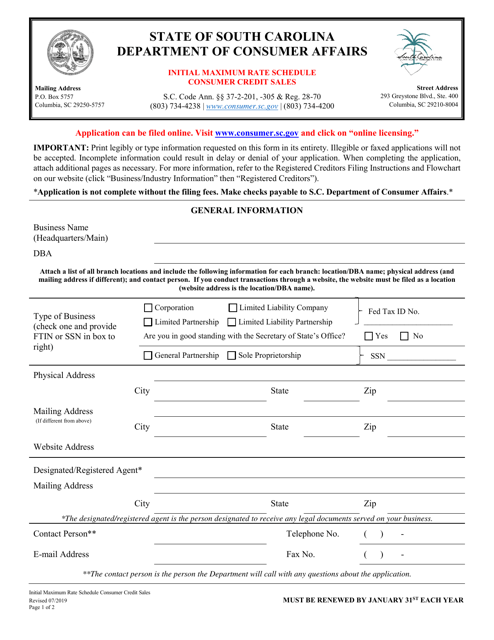

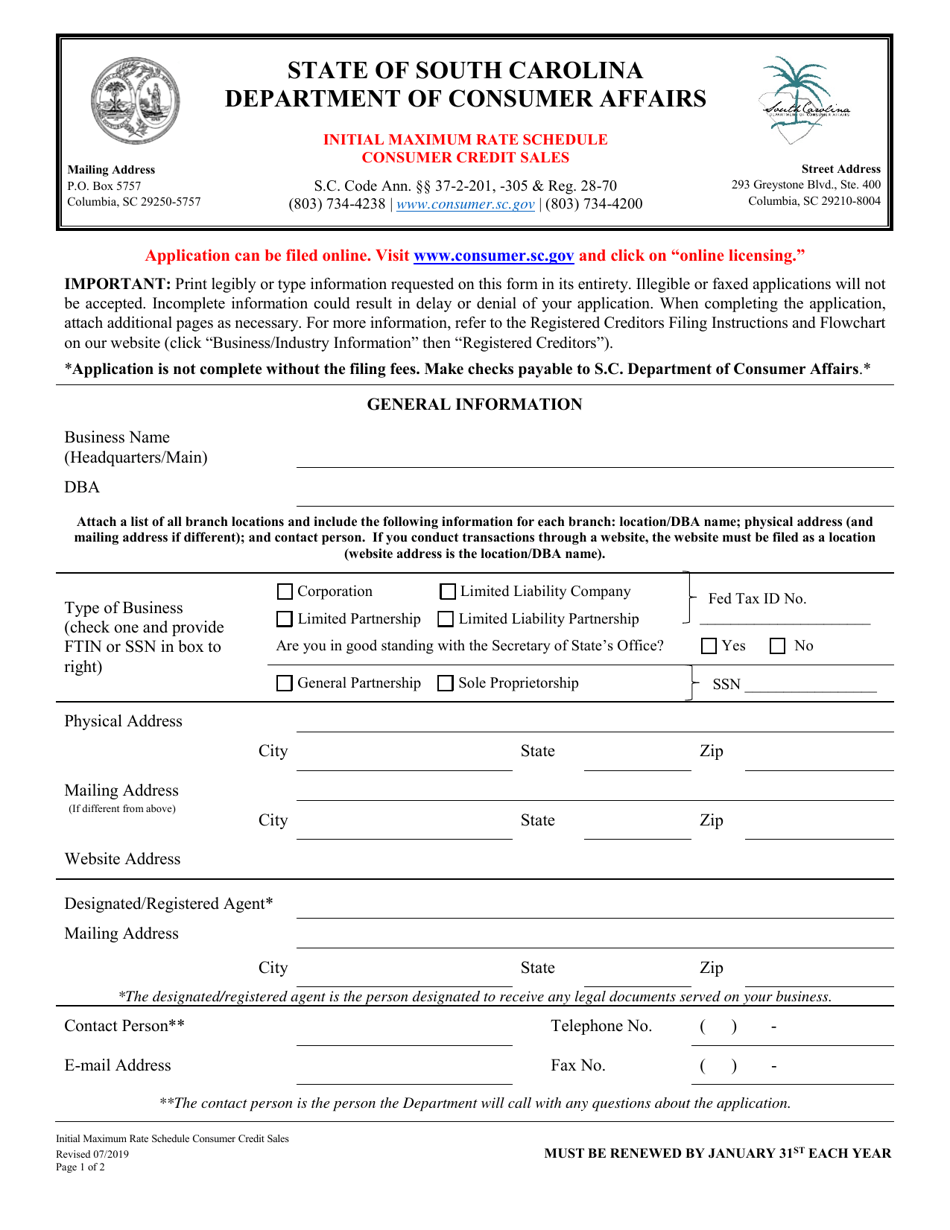

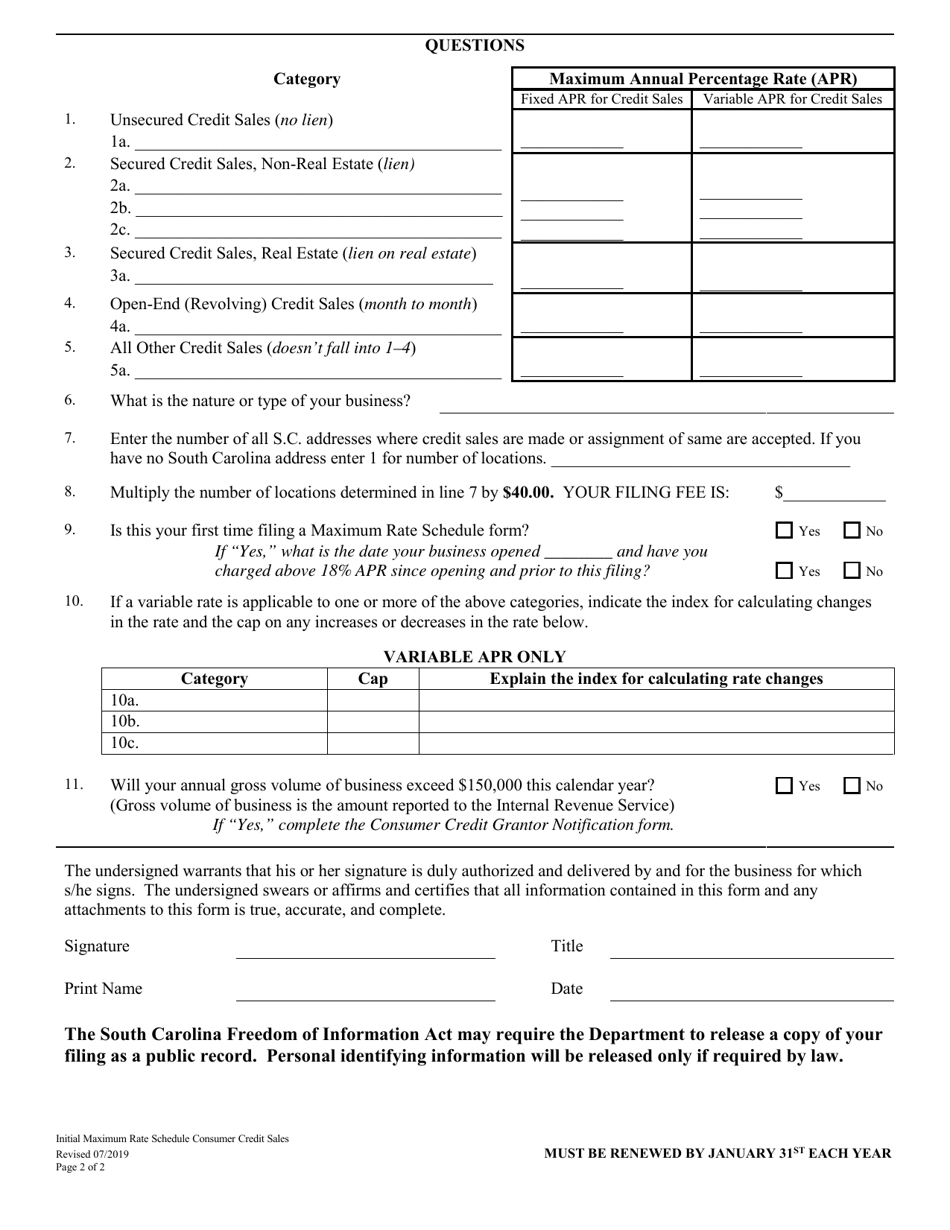

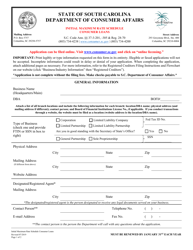

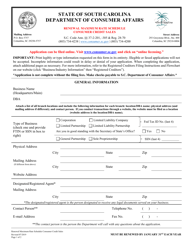

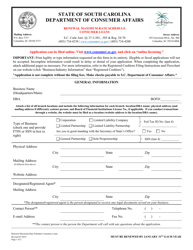

Initial Maximum Rate Schedule - Consumer Credit Sales - South Carolina

Initial Maximum Rate Schedule - Consumer Credit Sales is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

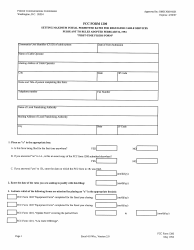

Q: What is the Initial Maximum Rate Schedule?

A: The Initial Maximum Rate Schedule is a document that specifies the maximum interest rates that can be charged on consumer credit sales in South Carolina.

Q: What does the Initial Maximum Rate Schedule cover?

A: The Initial Maximum Rate Schedule covers consumer credit sales in South Carolina.

Q: What is a consumer credit sale?

A: A consumer credit sale is a transaction where credit is extended to a consumer to finance the purchase of goods or services.

Q: Why is the Initial Maximum Rate Schedule important?

A: The Initial Maximum Rate Schedule is important because it protects consumers from excessive interest rates and helps ensure fair lending practices.

Q: Who sets the maximum interest rates in South Carolina?

A: The maximum interest rates in South Carolina are set by the state government based on the Initial Maximum Rate Schedule.

Q: Are there different maximum rates for different types of consumer credit sales?

A: Yes, the Initial Maximum Rate Schedule may have different maximum rates for different types of consumer credit sales, such as installment sales or open-end credit.

Q: Can the maximum rates change over time?

A: Yes, the maximum rates specified in the Initial Maximum Rate Schedule can be amended or revised by the state government.

Form Details:

- Released on July 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.