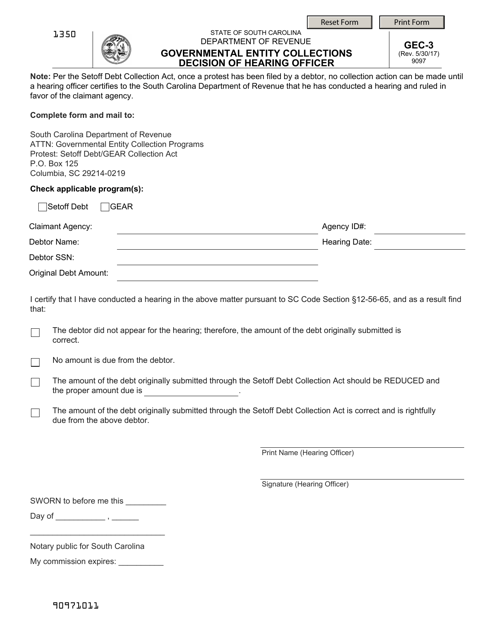

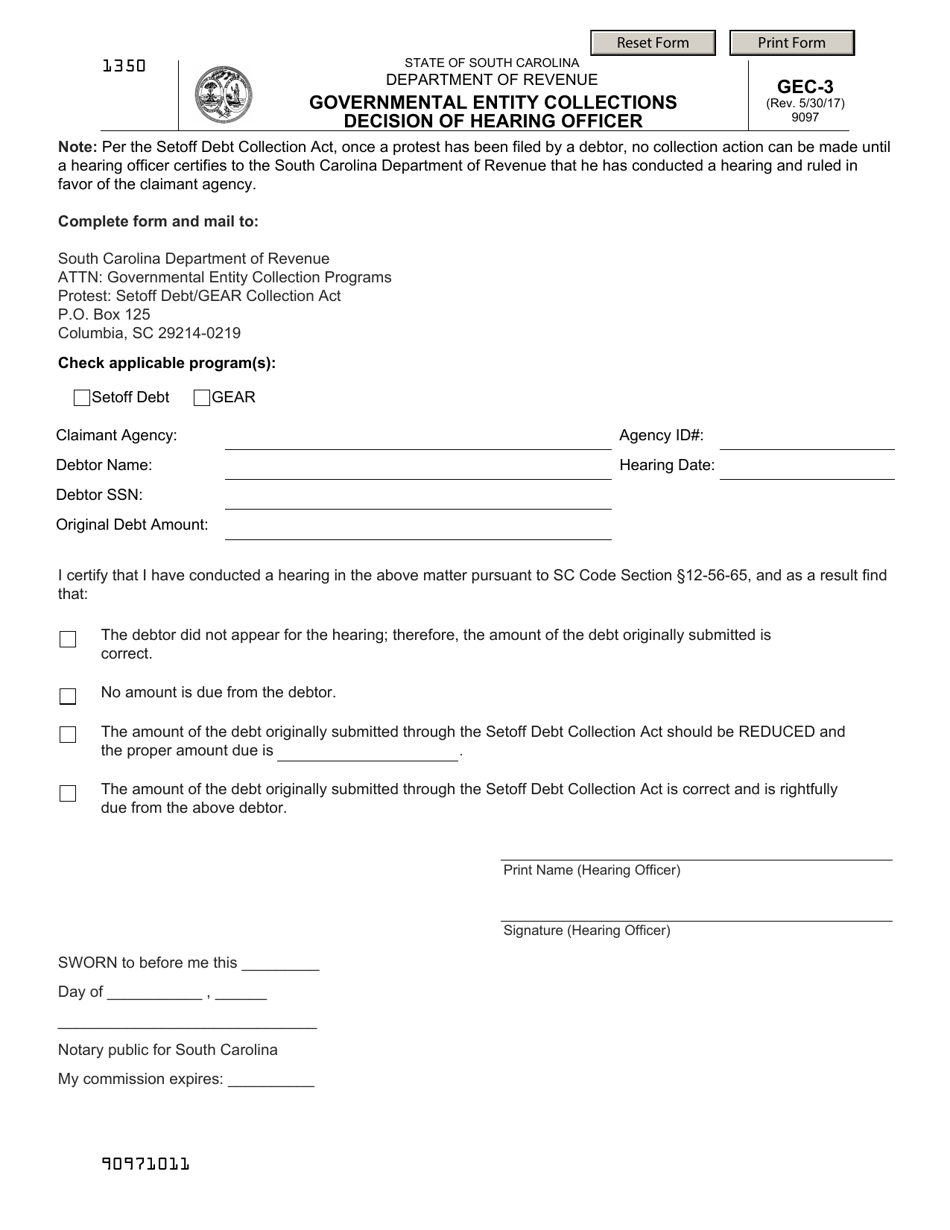

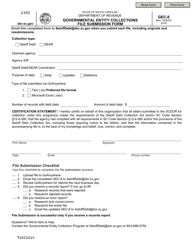

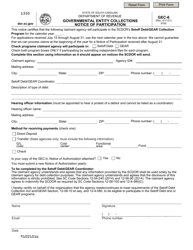

Form GEC-3 Governmental Entity Collections Decision of Hearing Officer - South Carolina

What Is Form GEC-3?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GEC-3?

A: GEC-3 stands for Governmental Entity Collections Decision of Hearing Officer. It is a form used in South Carolina.

Q: What is the purpose of GEC-3?

A: GEC-3 is used to document decisions made by a hearing officer regarding governmental entity collections in South Carolina.

Q: Who can use GEC-3?

A: GEC-3 is used by hearing officers in South Carolina who are responsible for making decisions related to governmental entity collections.

Q: What is a governmental entity collection?

A: A governmental entity collection refers to the process of collecting debts owed to a government entity, such as unpaid taxes or fines.

Q: What is the role of a hearing officer in a governmental entity collection?

A: A hearing officer is responsible for reviewing cases related to governmental entity collections and making decisions based on the evidence presented.

Q: What happens after the GEC-3 form is completed?

A: After the GEC-3 form is completed, the hearing officer will make a decision based on the evidence presented and issue a written decision to all parties involved.

Q: Can I appeal the decision made by a hearing officer?

A: Yes, you have the right to appeal the decision made by a hearing officer. The appeals process varies depending on the jurisdiction, so it is advisable to consult with a legal professional for guidance.

Form Details:

- Released on May 30, 2017;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GEC-3 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.