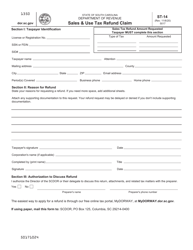

This version of the form is not currently in use and is provided for reference only. Download this version of

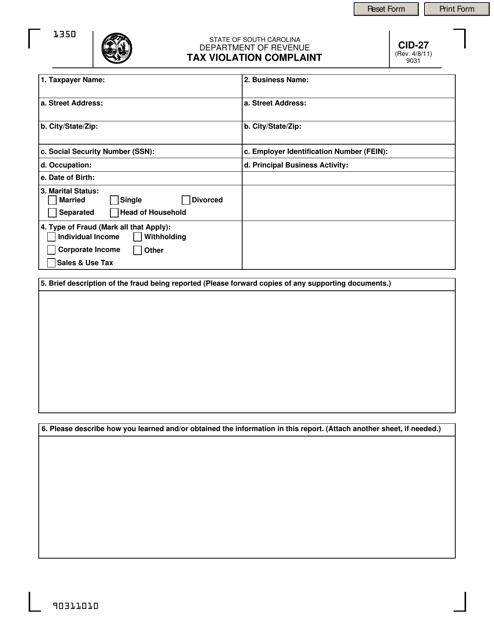

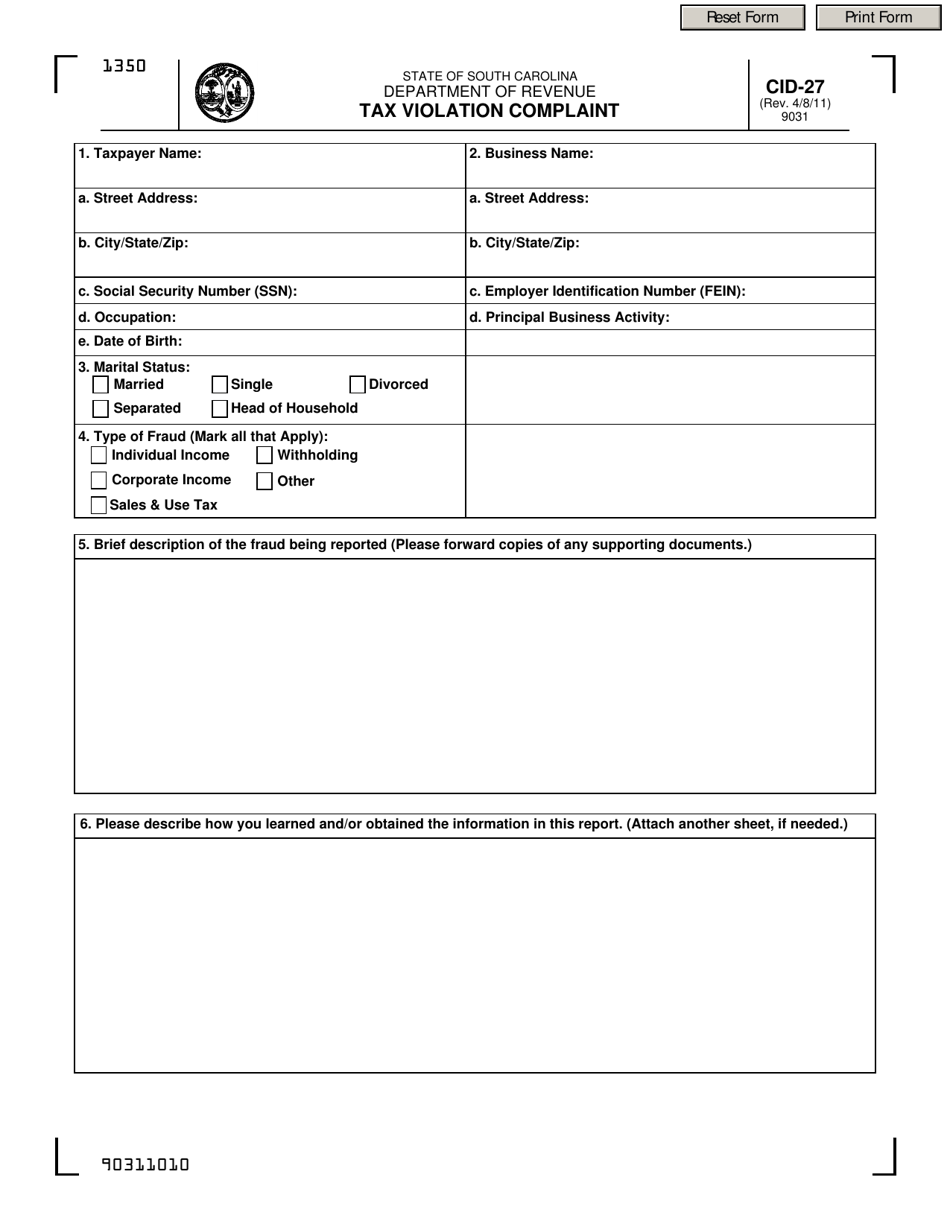

Form CID-27

for the current year.

Form CID-27 Tax Violation Complaint - South Carolina

What Is Form CID-27?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CID-27 form?

A: A CID-27 form is a form used to file a tax violation complaint in South Carolina.

Q: What information do I need to provide on the CID-27 form?

A: You will need to provide your personal information, details about the alleged tax violation, and any supporting evidence.

Q: What happens after I submit the CID-27 form?

A: The South Carolina Department of Revenue will review your complaint and investigate the alleged tax violation.

Q: Can I remain anonymous when filing a CID-27 form?

A: Yes, you can choose to remain anonymous when filing a CID-27 form, but providing your contact information may help with the investigation.

Q: Are there any deadlines for filing a CID-27 form?

A: There may be specific deadlines for filing a CID-27 form, so it's important to check the instructions or contact the South Carolina Department of Revenue for more information.

Form Details:

- Released on April 8, 2011;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CID-27 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.