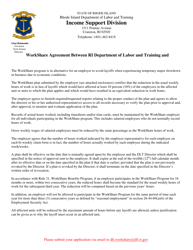

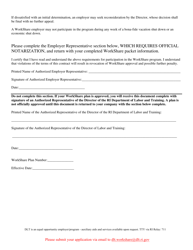

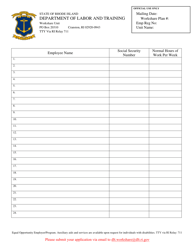

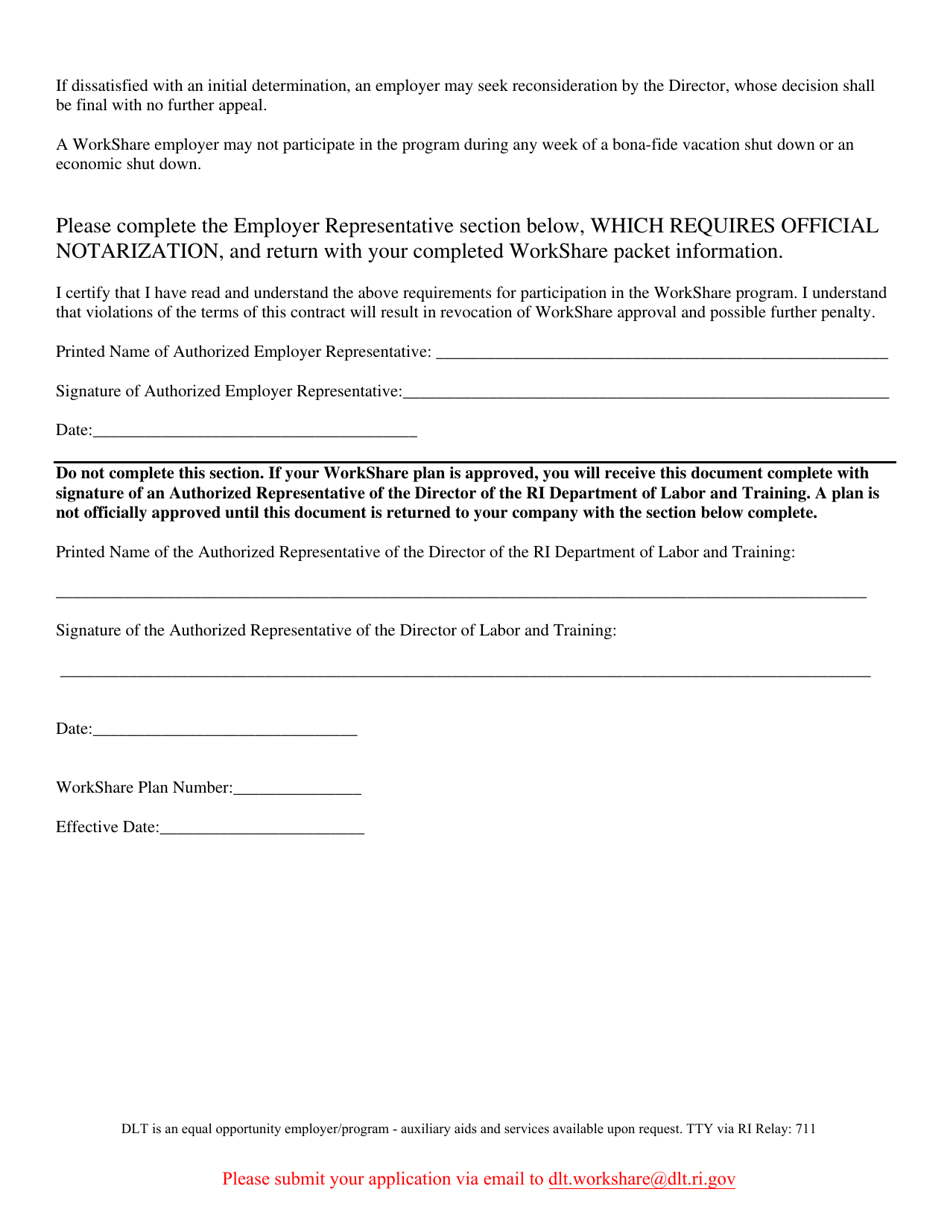

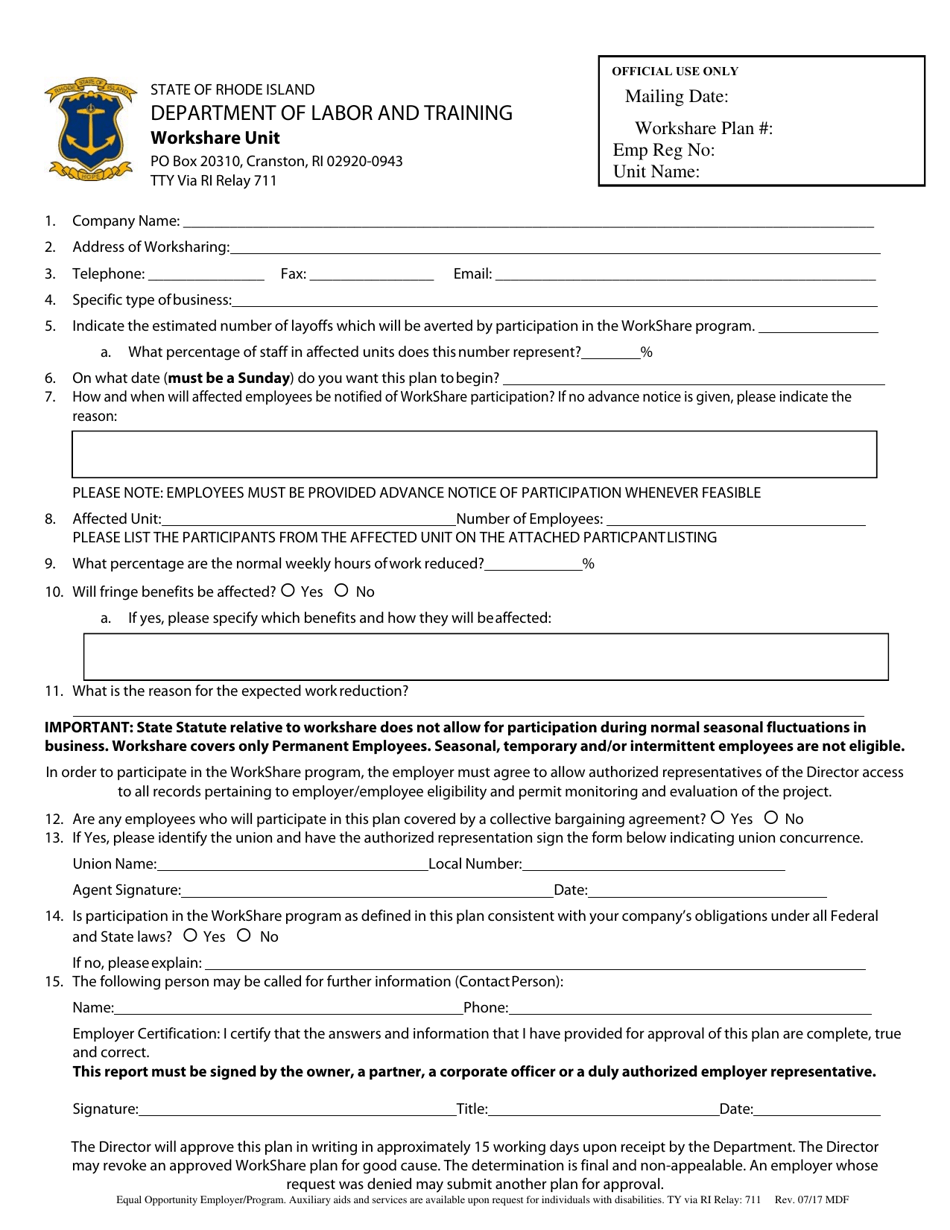

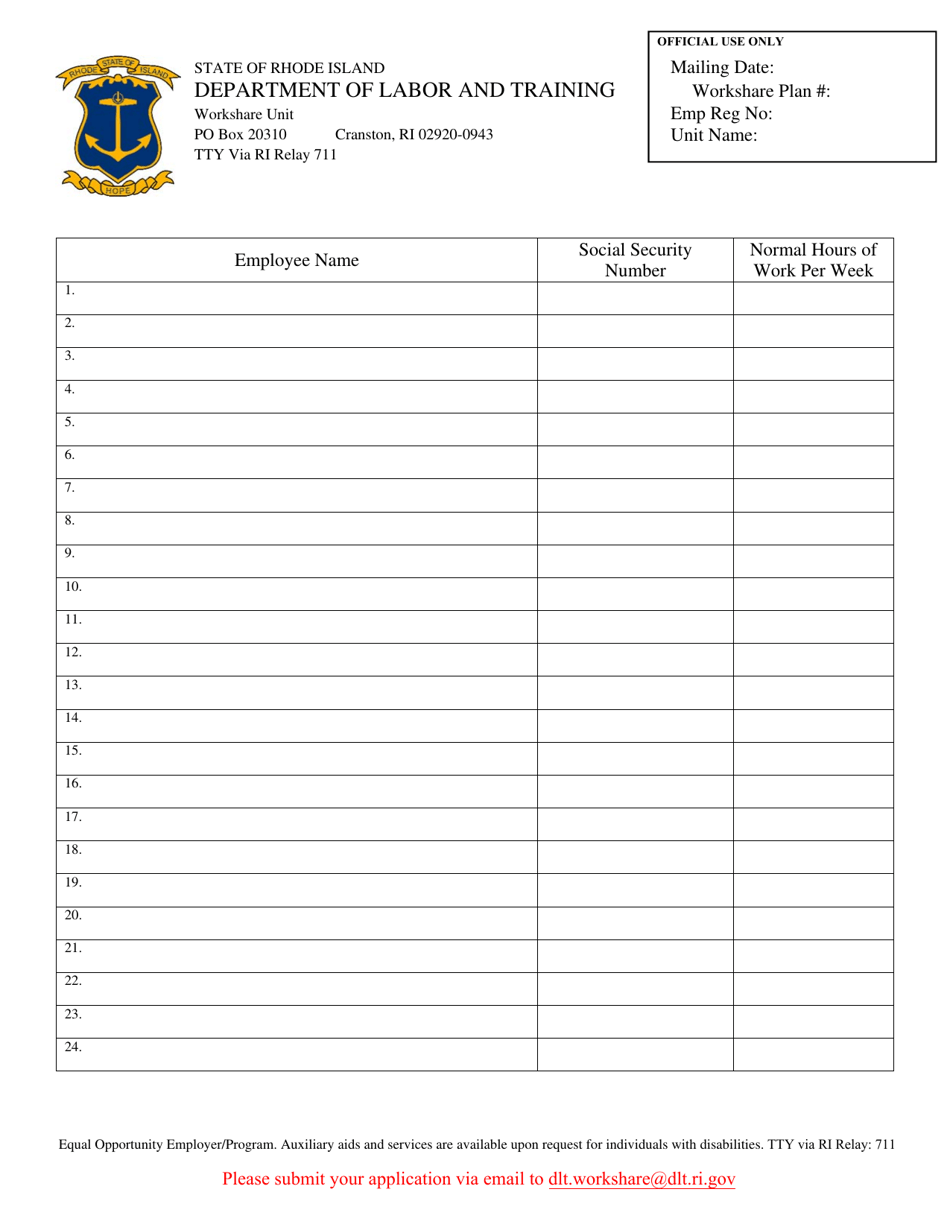

Workshare Application Packet - Rhode Island

Workshare Application Packet is a legal document that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island.

FAQ

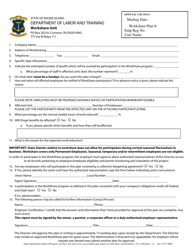

Q: What is the Workshare program?

A: The Workshare program is a program that allows employers to reduce the hours of work for a group of employees instead of laying them off completely.

Q: Who is eligible for the Workshare program in Rhode Island?

A: Both private and public sector employers in Rhode Island are eligible to participate in the Workshare program.

Q: How does the Workshare program benefit employees?

A: The Workshare program allows employees to maintain some of their income while working reduced hours.

Q: How does the Workshare program benefit employers?

A: The Workshare program helps employers avoid layoffs and retain skilled workers during temporary slowdowns.

Q: How long can an employer participate in the Workshare program?

A: Employers can participate in the Workshare program for a maximum of 26 weeks.

Q: Is there a waiting period before an employer can participate in the Workshare program?

A: No, there is no waiting period for employers to participate in the Workshare program.

Q: How are Workshare benefits calculated?

A: Workshare benefits are calculated based on the amount of unemployment benefits the employee would have received if they were fully unemployed.

Q: Can an employer terminate the Workshare program?

A: Yes, an employer can terminate the Workshare program at any time.

Q: Are Workshare benefits taxable?

A: Yes, Workshare benefits are considered taxable income and must be reported on federal income tax returns.

Form Details:

- Released on July 1, 2017;

- The latest edition currently provided by the Rhode Island Department of Labor and Training;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.