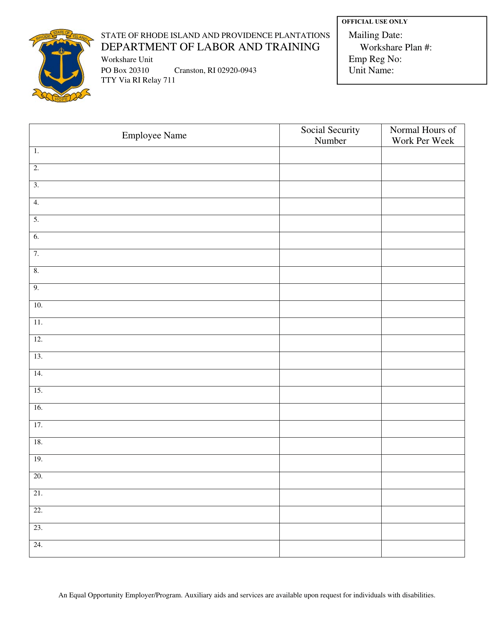

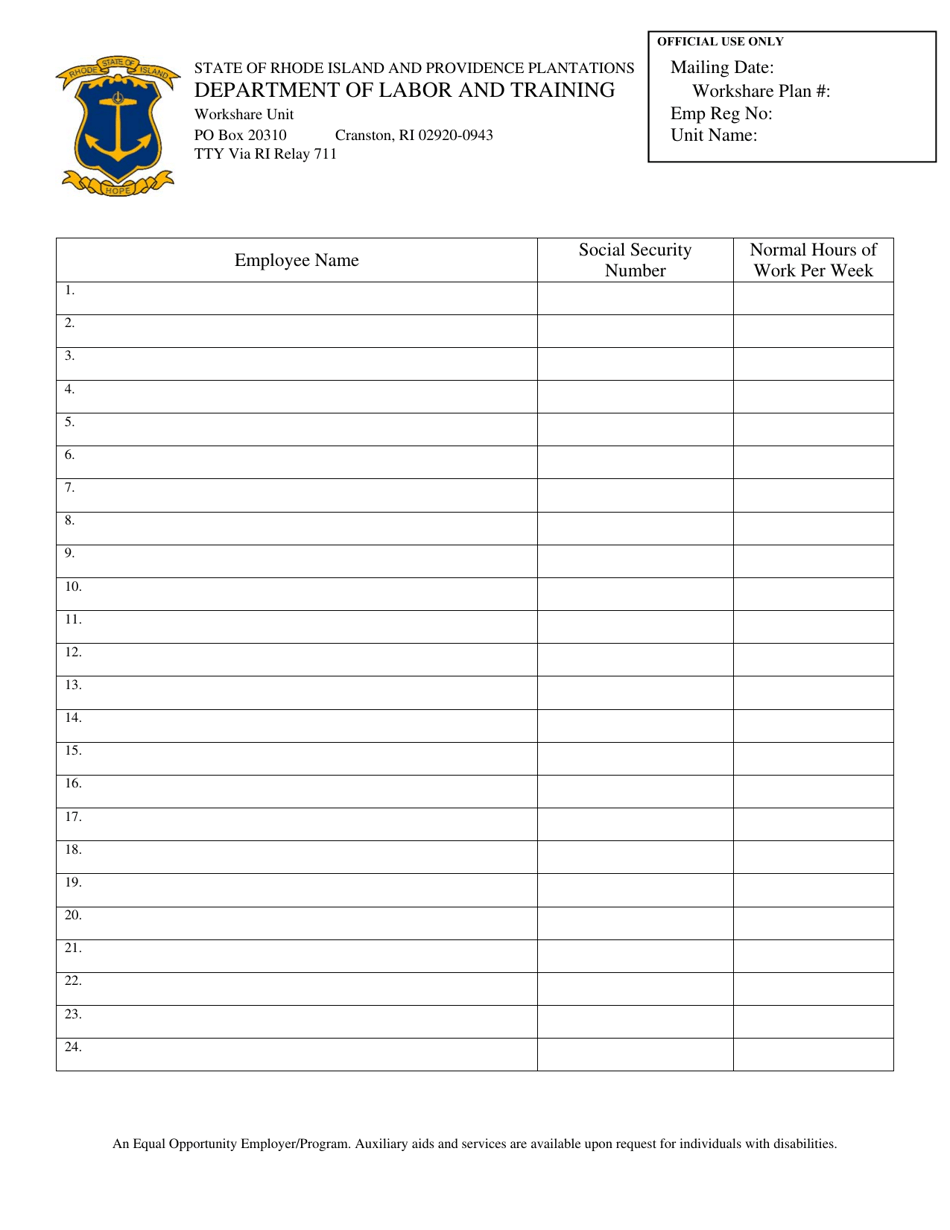

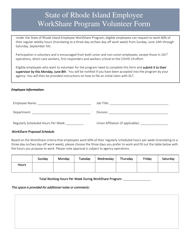

Workshare Participant List Form - Rhode Island

Workshare Participant List Form is a legal document that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island.

FAQ

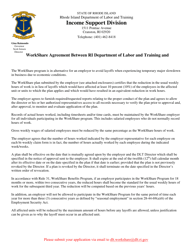

Q: What is the Workshare program?

A: The Workshare program is a voluntary alternative to layoffs that allows eligible employers to reduce the hours of work for a group of employees instead of laying them off.

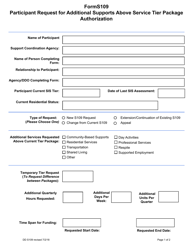

Q: How does the Workshare program work?

A: Under the Workshare program, employers must submit an application to the state for approval. If approved, employers can reduce the work hours of participating employees by at least 10% and up to 50%. The employees then receive partial unemployment benefits to help compensate for the reduced hours.

Q: Who is eligible for the Workshare program?

A: Employers in Rhode Island who have experienced a recent decline in business activity that is beyond their control may be eligible for the Workshare program.

Q: How long can a company participate in the Workshare program?

A: Companies can participate in the Workshare program for a maximum of 26 weeks.

Q: How much unemployment benefits will participating employees receive?

A: Employees participating in the Workshare program will receive a percentage of their weekly unemployment benefits based on the percentage reduction in their work hours. The exact amount will depend on their individual circumstances.

Q: Do employers have to provide benefits to Workshare participants?

A: Yes, employers must continue to provide the same fringe benefits to their Workshare participants that they would have received if they were working full-time. This includes health insurance, retirement benefits, and any other applicable benefits.

Q: Are employers required to notify employees about the Workshare program?

A: Yes, employers are required to notify their employees about their participation in the Workshare program at least 10 days prior to reducing their work hours.

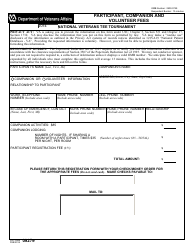

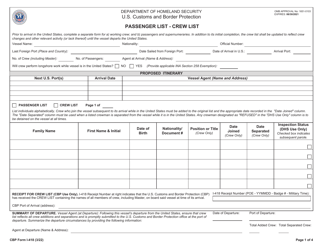

Q: Are employers required to report Workshare participants to the state?

A: Yes, employers must provide the state with a list of participating employees, including their names and Social Security numbers.

Q: Can employees refuse to participate in the Workshare program?

A: Participation in the Workshare program is voluntary for employees. However, if an employee refuses to participate, they may become ineligible for unemployment benefits.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Labor and Training;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.