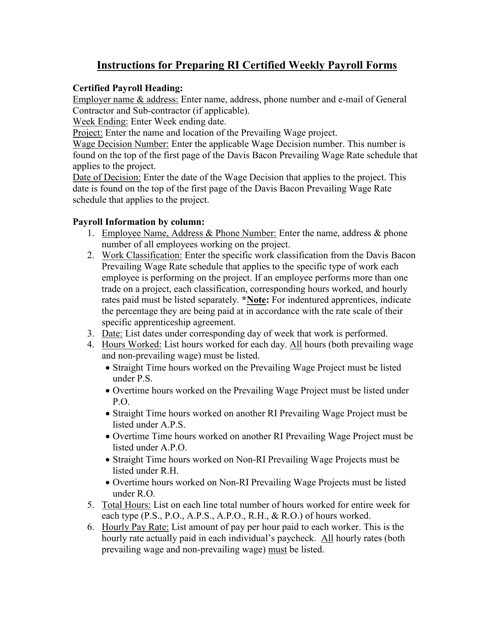

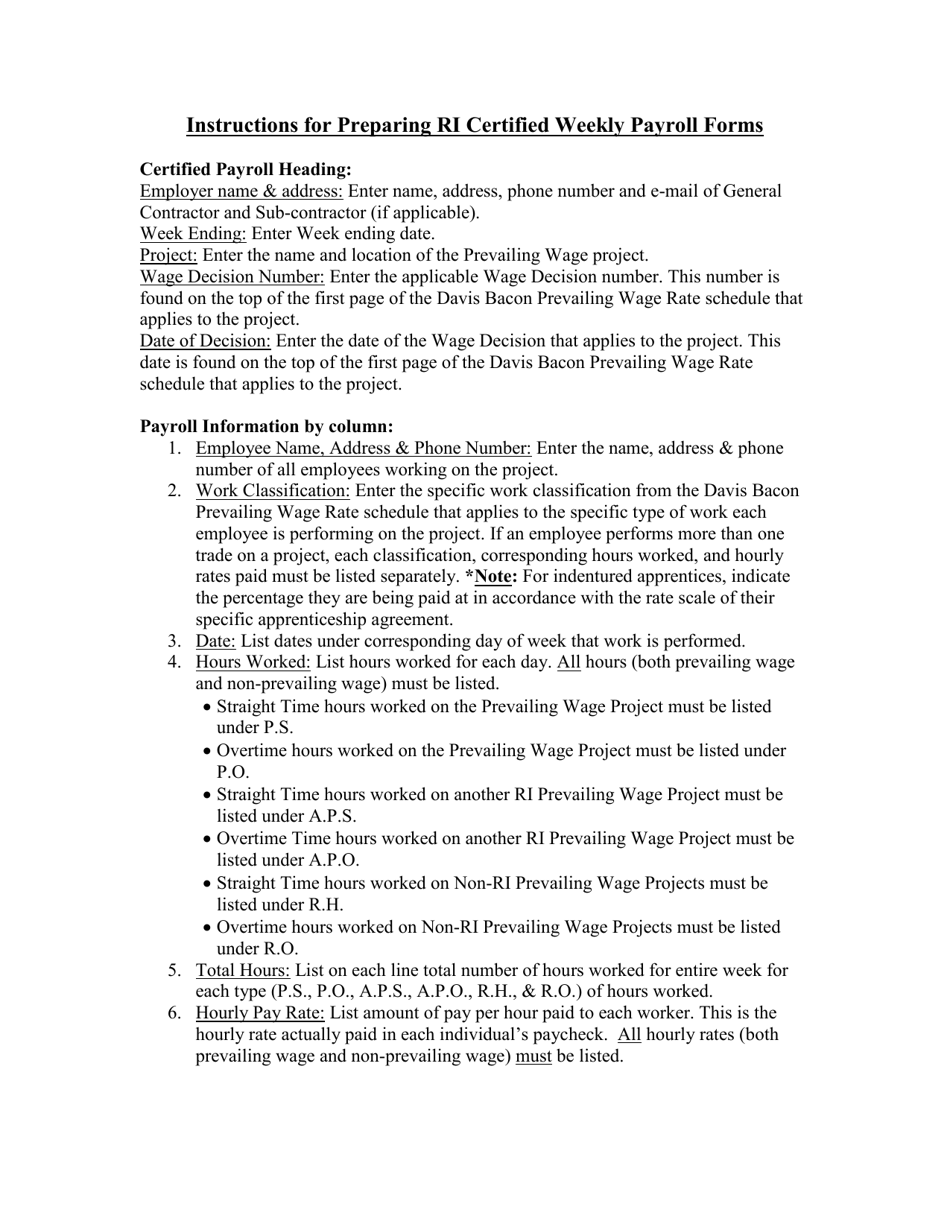

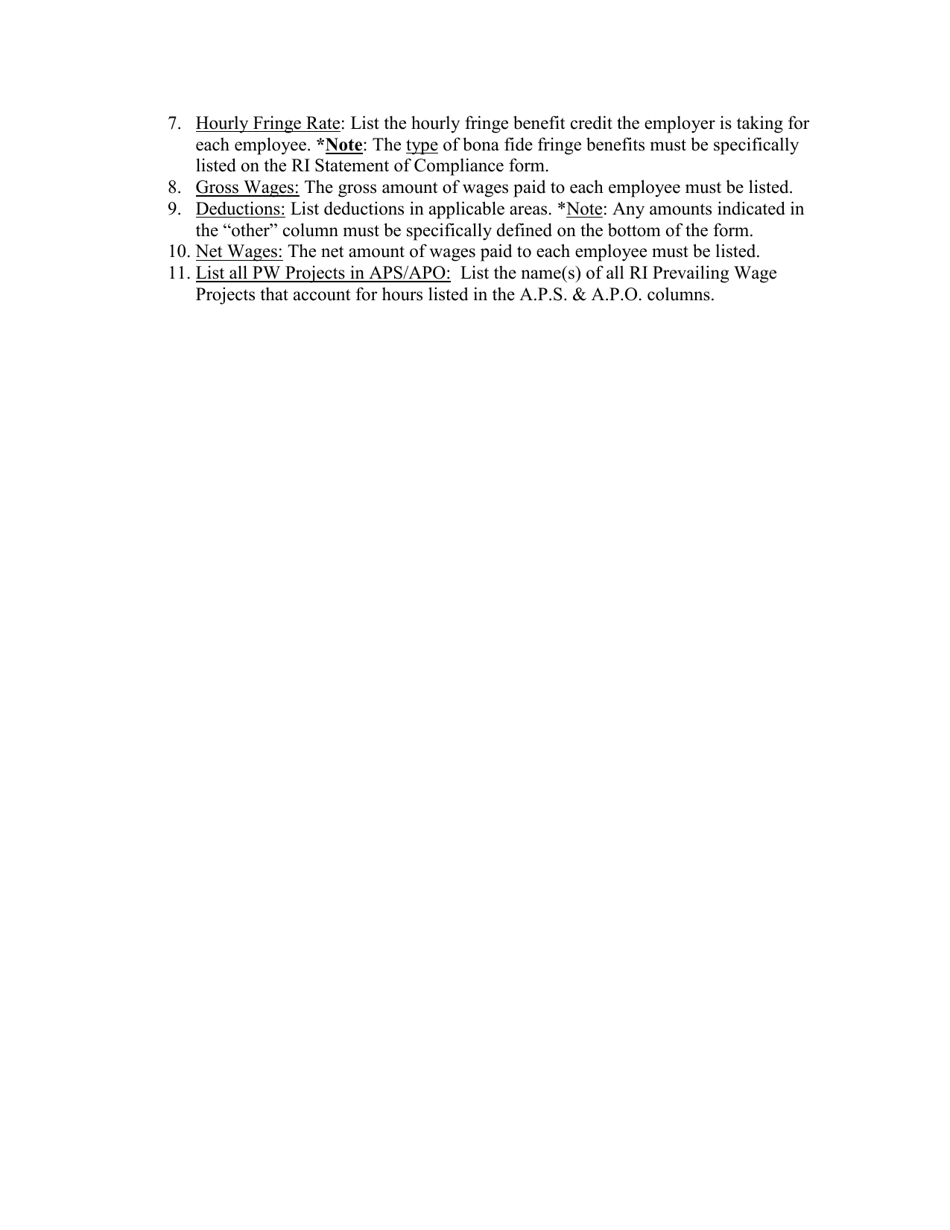

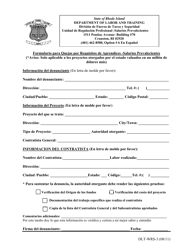

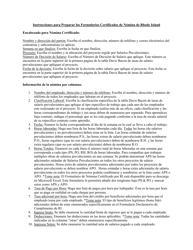

Instructions for Form DLT-WRS-1 Rhode Island Certified Weekly Payroll - Rhode Island

This document contains official instructions for Form DLT-WRS-1 , Rhode Island Certified Weekly Payroll - a form released and collected by the Rhode Island Department of Labor and Training. An up-to-date fillable Form DLT-WRS-1 is available for download through this link.

FAQ

Q: What is Form DLT-WRS-1?

A: Form DLT-WRS-1 is the Rhode Island Certified Weekly Payroll form.

Q: Who needs to fill out Form DLT-WRS-1?

A: Employers in Rhode Island who have employees working on public works projects need to fill out Form DLT-WRS-1.

Q: What is the purpose of Form DLT-WRS-1?

A: Form DLT-WRS-1 is used to report the weekly payroll information of employees working on public works projects.

Q: When should Form DLT-WRS-1 be filed?

A: Form DLT-WRS-1 must be filed weekly, within 7 days from the end of the payroll week.

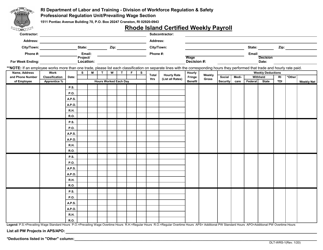

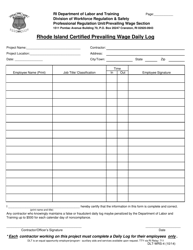

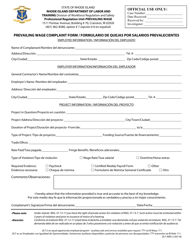

Q: What information is required on Form DLT-WRS-1?

A: Form DLT-WRS-1 requires information such as the employer's name, project information, employee details, hours worked, wages earned, and deductions.

Q: Are there any penalties for not filing Form DLT-WRS-1?

A: Yes, failing to file Form DLT-WRS-1 or providing false information can result in penalties and legal consequences.

Q: Is Form DLT-WRS-1 specific to Rhode Island?

A: Yes, Form DLT-WRS-1 is specific to Rhode Island and is not used for reporting payroll information in other states.

Q: Is Form DLT-WRS-1 mandatory?

A: Yes, employers in Rhode Island who have employees working on public works projects are required to fill out Form DLT-WRS-1.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Also available in Spanish;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Rhode Island Department of Labor and Training.