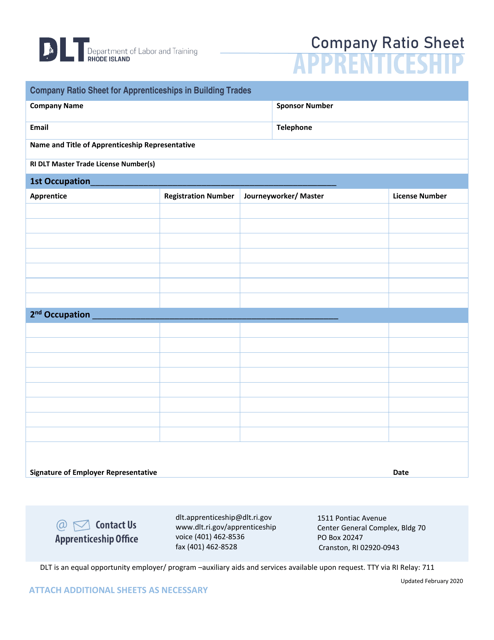

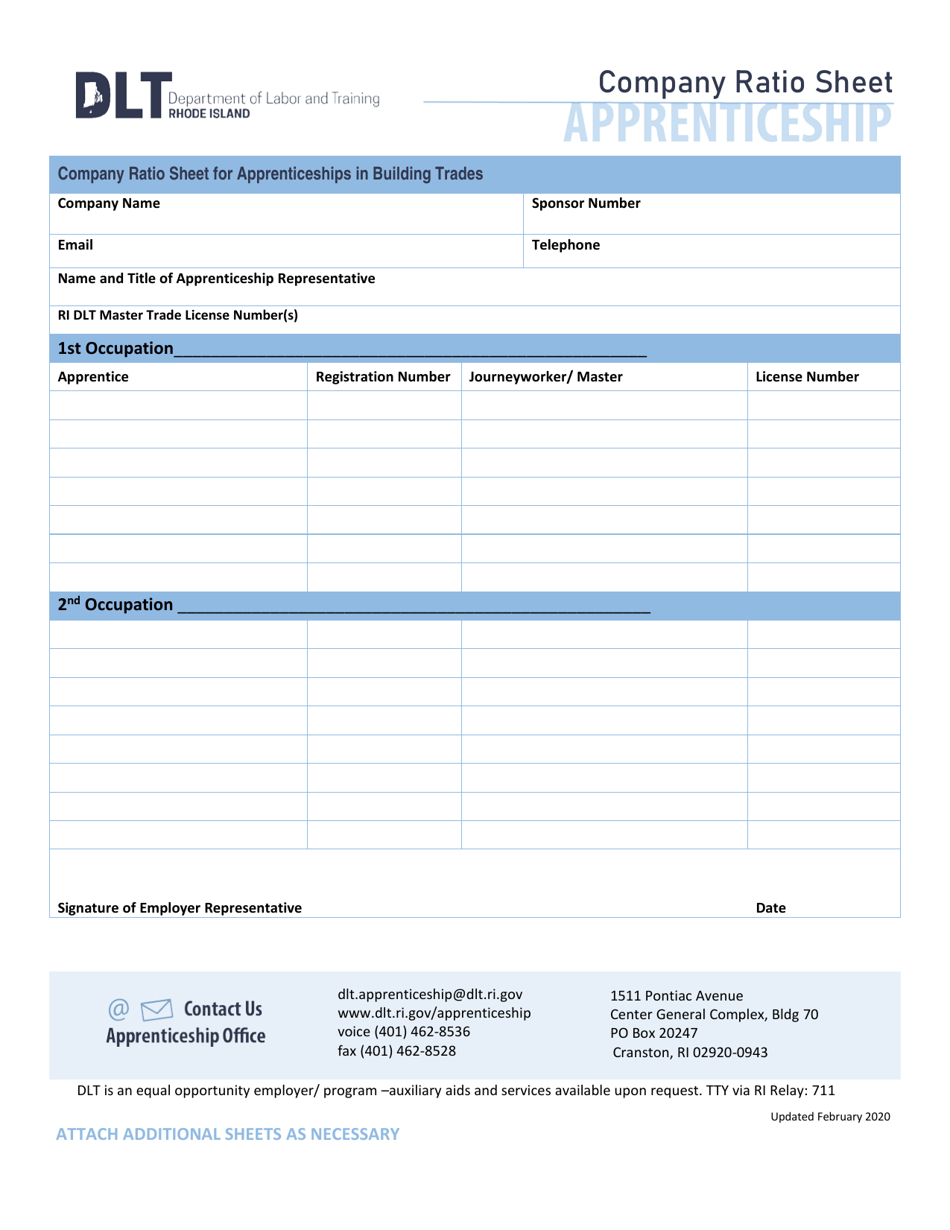

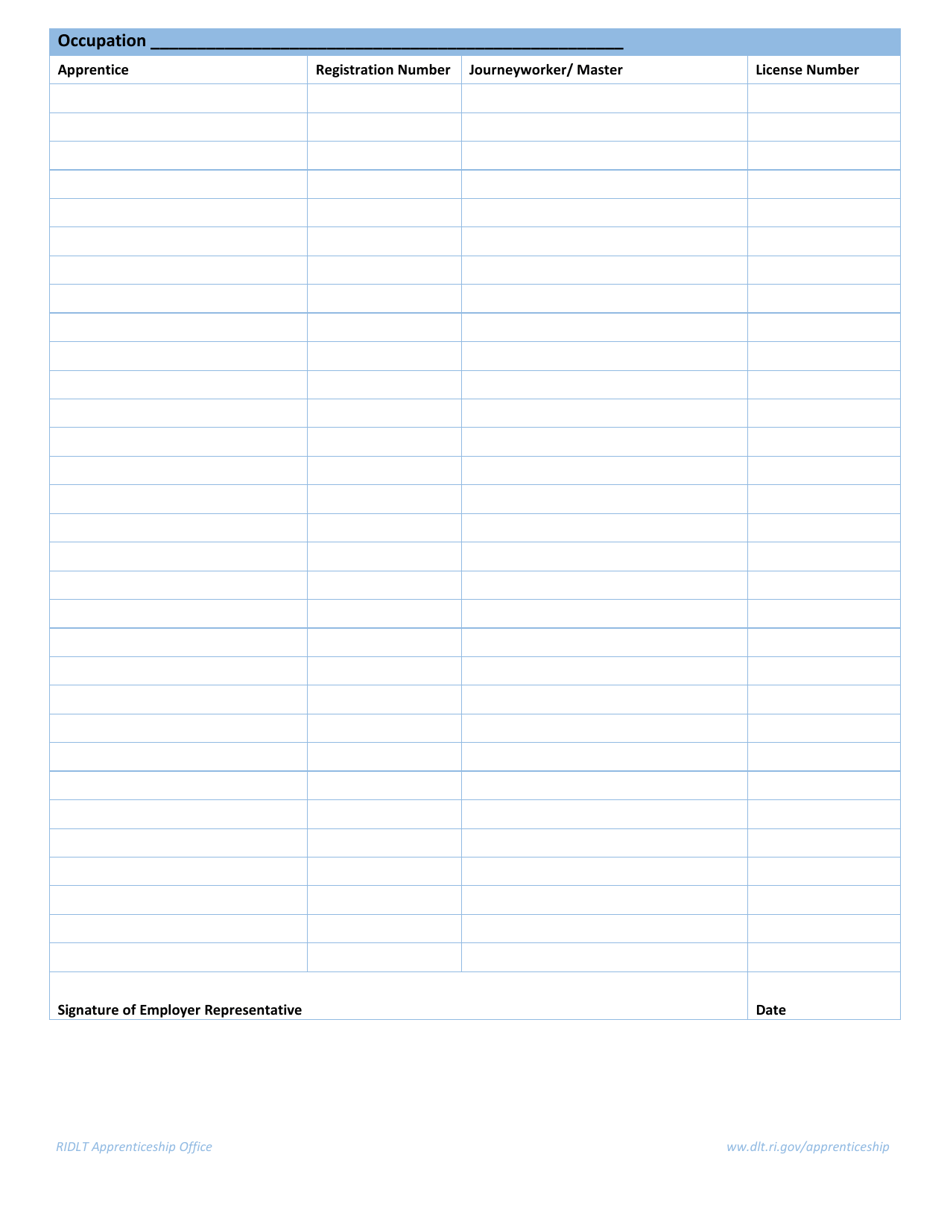

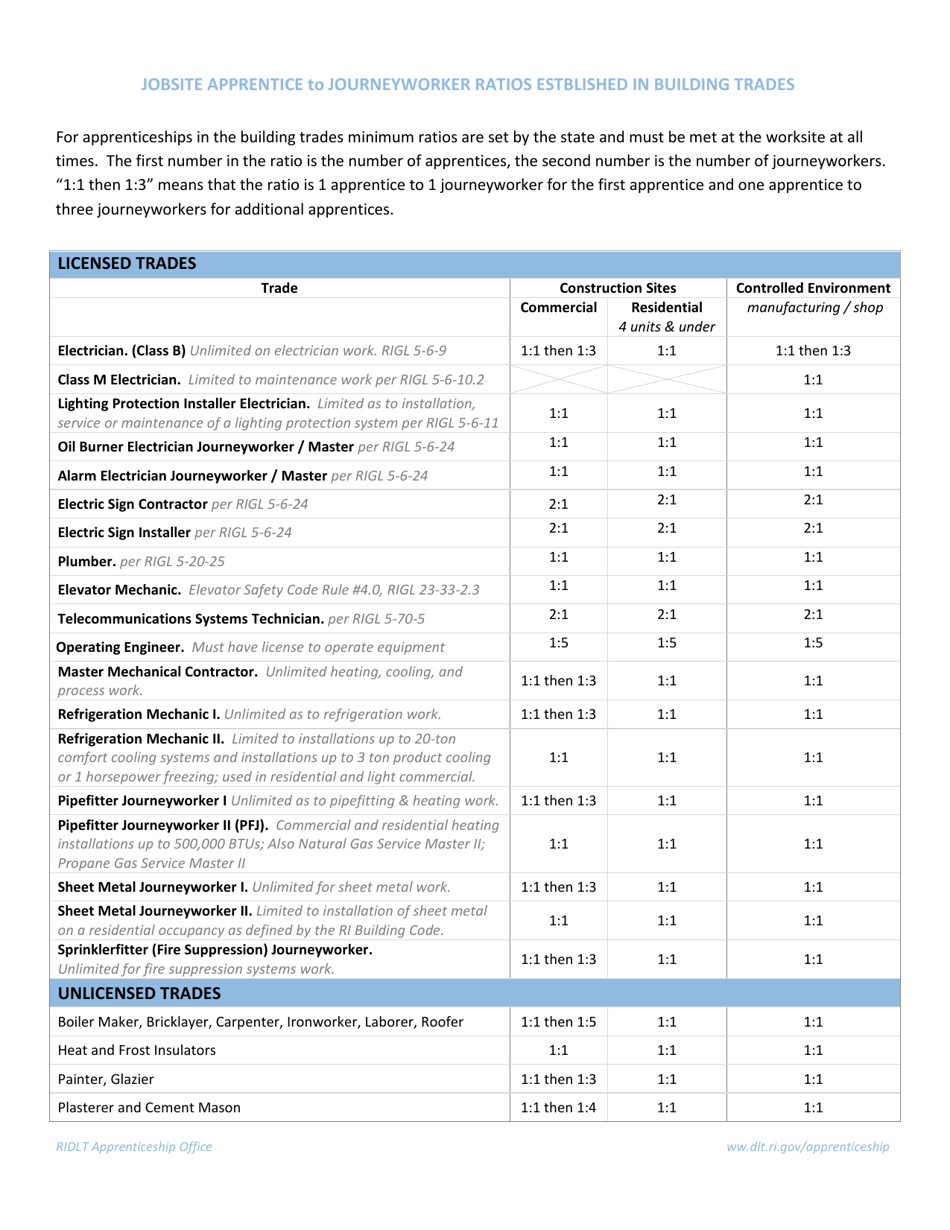

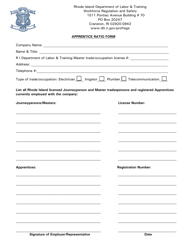

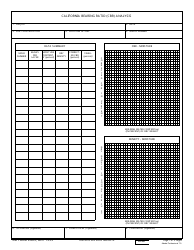

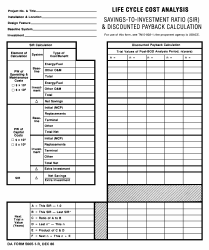

Company Ratio Sheet - Rhode Island

Company Ratio Sheet is a legal document that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island.

FAQ

Q: What is a company ratio sheet?

A: A company ratio sheet is a document that shows the financial ratios of a company.

Q: What is the purpose of a company ratio sheet?

A: The purpose of a company ratio sheet is to assess the financial health and performance of a company.

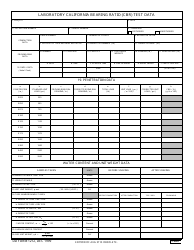

Q: What are financial ratios?

A: Financial ratios are calculations that help measure the financial performance, liquidity, stability, and profitability of a company.

Q: Why are financial ratios important?

A: Financial ratios are important because they provide insights into the financial strength and performance of a company, which can help investors and analysts make informed decisions.

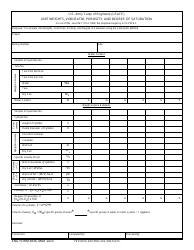

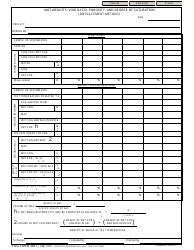

Q: What can be found on a company ratio sheet?

A: A company ratio sheet typically includes various financial ratios such as liquidity ratios, profitability ratios, and leverage ratios.

Q: What are liquidity ratios?

A: Liquidity ratios measure a company's ability to meet short-term obligations and its overall liquidity.

Q: What are profitability ratios?

A: Profitability ratios help assess a company's ability to generate profits and its overall profitability.

Q: What are leverage ratios?

A: Leverage ratios evaluate a company's debt levels and its ability to meet its financial obligations.

Q: How can a company ratio sheet be used?

A: A company ratio sheet can be used to compare the financial performance of different companies, track the performance of a single company over time, and identify areas of strength or weakness in a company's financial position.

Form Details:

- Released on February 1, 2020;

- The latest edition currently provided by the Rhode Island Department of Labor and Training;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.