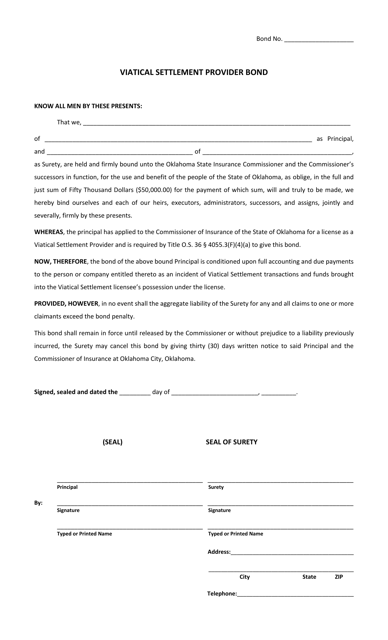

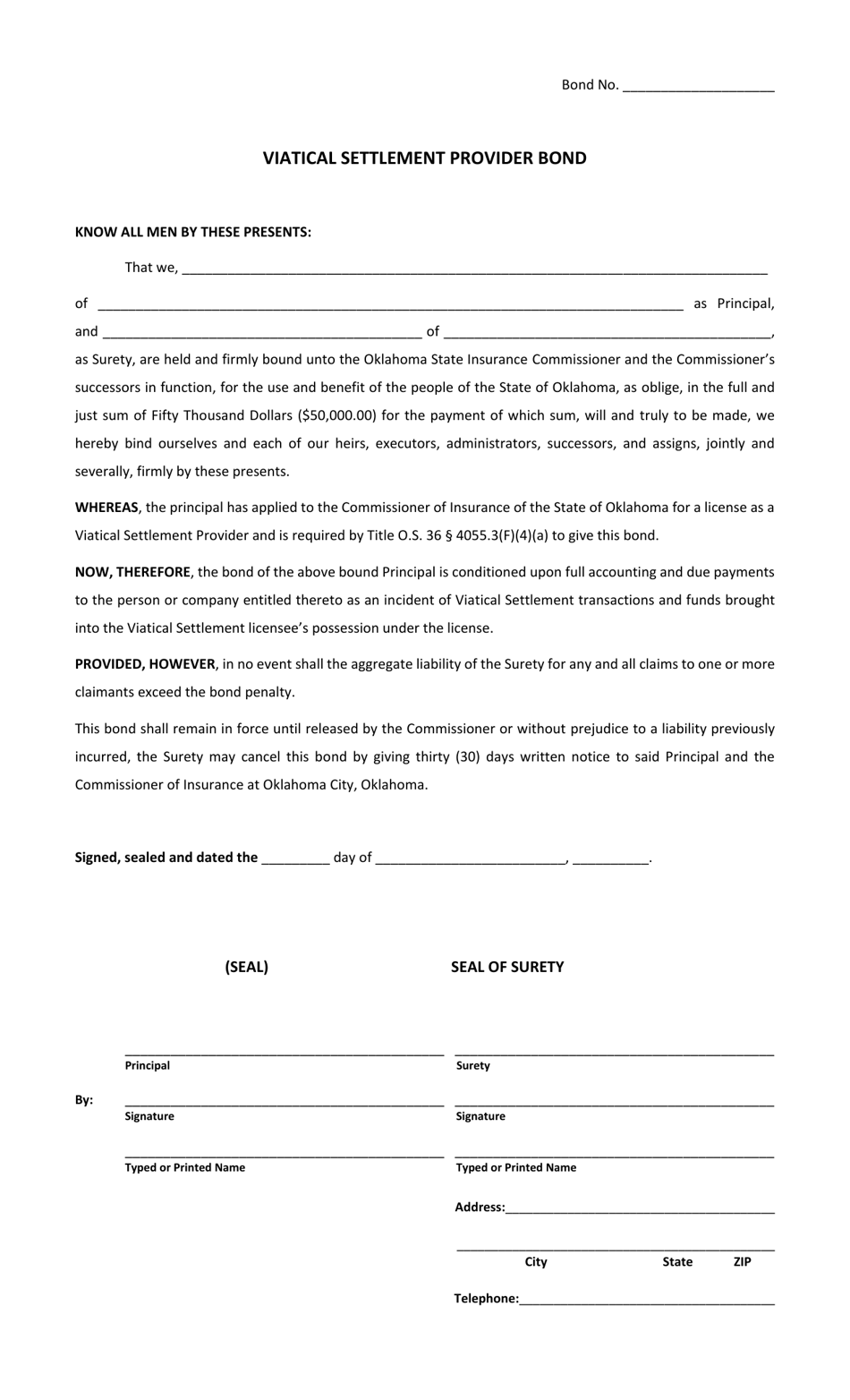

Viatical Settlement Provider Bond - Oklahoma

Viatical Settlement Provider Bond is a legal document that was released by the Oklahoma Insurance Department - a government authority operating within Oklahoma.

FAQ

Q: What is a Viatical Settlement Provider Bond?

A: A Viatical Settlement Provider Bond is a type of surety bond required for companies or individuals that engage in viatical settlements.

Q: What is a viatical settlement?

A: A viatical settlement is a financial transaction in which a person with a terminal illness sells their life insurance policy to a third party for a lump sum payment.

Q: Why is a Viatical Settlement Provider Bond required?

A: A Viatical Settlement Provider Bond is required to protect consumers and ensure compliance with the laws and regulations governing viatical settlements.

Q: Who needs to obtain a Viatical Settlement Provider Bond in Oklahoma?

A: Companies or individuals that want to operate as viatical settlement providers in Oklahoma need to obtain a Viatical Settlement Provider Bond.

Q: How much does a Viatical Settlement Provider Bond cost?

A: The cost of a Viatical Settlement Provider Bond varies depending on factors such as the bond amount and the applicant's creditworthiness.

Q: Are there any alternatives to a Viatical Settlement Provider Bond?

A: In some cases, an alternative to a Viatical Settlement Provider Bond may be a cash deposit or an irrevocable letter of credit.

Q: What happens if a viatical settlement provider fails to comply with the law?

A: If a viatical settlement provider fails to comply with the law, a claim can be made against their Viatical Settlement Provider Bond to provide compensation to affected parties.

Form Details:

- The latest edition currently provided by the Oklahoma Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Insurance Department.