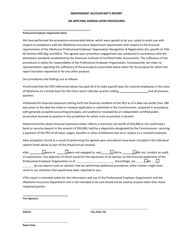

Independent Accountant's Report on Applying Agreed-Upon Procedures - Group Peo - Oklahoma

Independent Accountant's Report on Applying Agreed-Upon Procedures - Group Peo is a legal document that was released by the Oklahoma Insurance Department - a government authority operating within Oklahoma.

FAQ

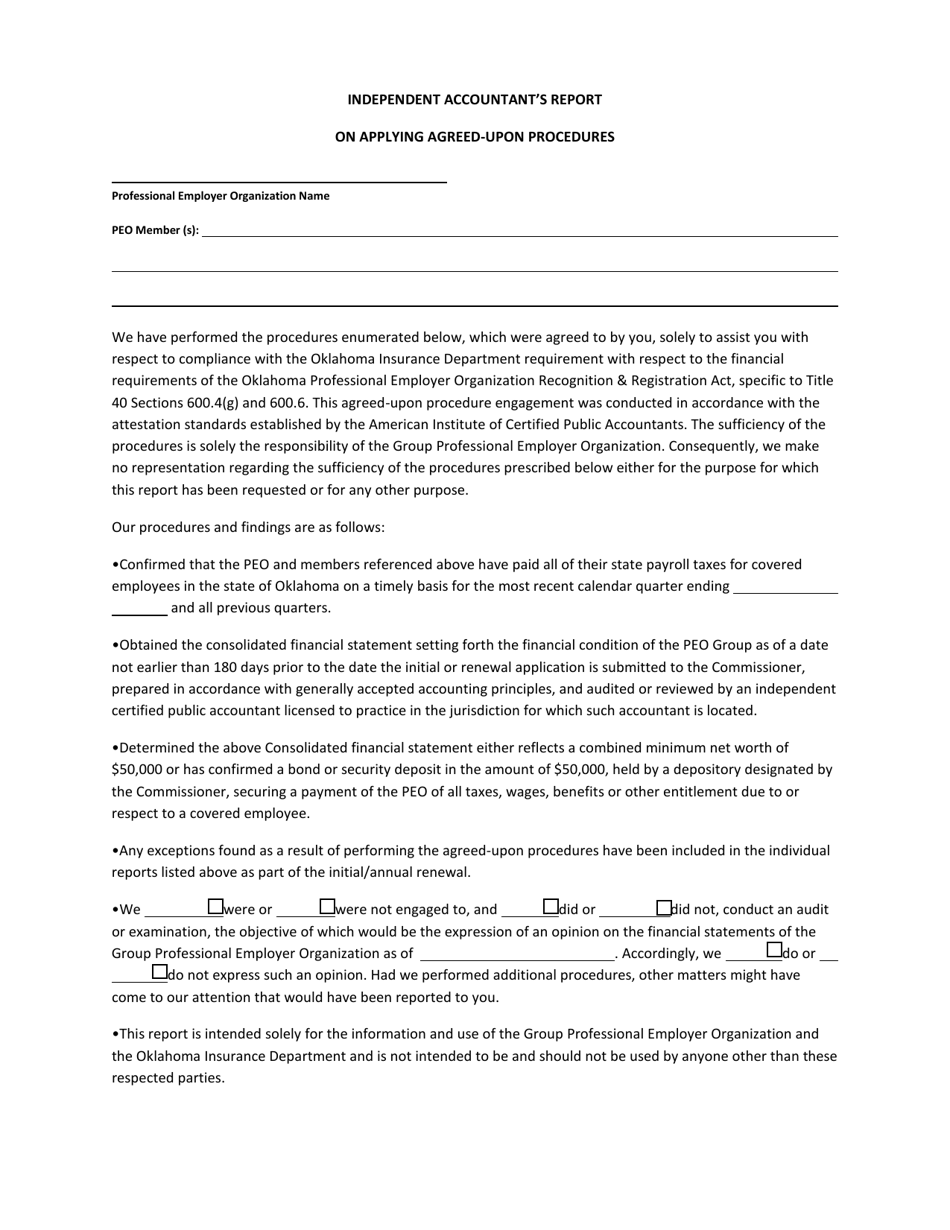

Q: What is an independent accountant's report?

A: An independent accountant's report is a document prepared by a certified public accountant (CPA) that provides an opinion on the financial information or other matters in accordance with agreed-upon procedures.

Q: What are agreed-upon procedures?

A: Agreed-upon procedures are specific procedures that are agreed upon by the client and the independent accountant to be performed in order to meet their specific needs.

Q: What is the purpose of an independent accountant's report?

A: The purpose of an independent accountant's report is to provide users of the report with information about the subject matter, based on the agreed-upon procedures, and to assist them in reaching conclusions about that subject matter.

Q: What is Group Peo - Oklahoma?

A: Group Peo - Oklahoma is likely the name of the entity or organization for which the independent accountant's report is being prepared.

Q: Who prepares an independent accountant's report?

A: An independent accountant, typically a certified public accountant (CPA), prepares an independent accountant's report.

Q: What is the role of a certified public accountant (CPA)?

A: A certified public accountant (CPA) is a professional accountant who has met specific education, experience, and examination requirements, and is licensed to practice in their respective state.

Q: What is the significance of the independent accountant's report?

A: The independent accountant's report provides assurance to users of the report about the accuracy and reliability of the subject matter, based on the agreed-upon procedures performed by the accountant.

Q: What information does an independent accountant's report provide?

A: An independent accountant's report provides information about the subject matter covered by the agreed-upon procedures, including any findings or observations made by the accountant during the performance of those procedures.

Q: Are agreed-upon procedures the same as an audit?

A: No, agreed-upon procedures are not the same as an audit. An audit involves examining and providing an opinion on the financial statements as a whole, while agreed-upon procedures focus on specific procedures agreed upon by the client and the accountant.

Form Details:

- The latest edition currently provided by the Oklahoma Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Insurance Department.