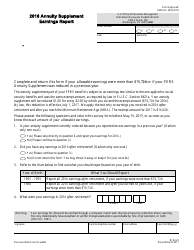

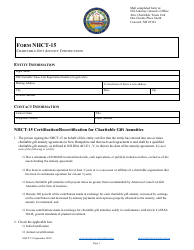

Charitiable Gift Annuities Report Filing Requirements - Oklahoma

Charitiable Gift Annuities Report Filing Requirements is a legal document that was released by the Oklahoma Insurance Department - a government authority operating within Oklahoma.

FAQ

Q: What are the filing requirements for Charitable Gift Annuities in Oklahoma?

A: Charitable organizations must file an annual report with the Oklahoma Insurance Department.

Q: What is a Charitable Gift Annuity?

A: A Charitable Gift Annuity is a financial agreement where a person donates assets to a charity in exchange for regular fixed payments for life.

Q: Who needs to file the annual report?

A: Charitable organizations that offer Charitable Gift Annuities in Oklahoma.

Q: What is the purpose of the annual report?

A: The annual report provides information about the financial status of the charitable organization and ensures compliance with state regulations.

Q: Is there a deadline for filing the report?

A: Yes, the annual report must be filed by March 15th of each year.

Q: What information is required in the annual report?

A: The report must include financial statements, disclosure of annuity agreements, and other relevant information.

Q: Are there any fees associated with filing the report?

A: Yes, a filing fee of $25 is required.

Q: What happens if a charitable organization fails to file the report?

A: Failure to file the annual report may result in penalties or suspension of authorization to issue Charitable Gift Annuities.

Form Details:

- The latest edition currently provided by the Oklahoma Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Insurance Department.