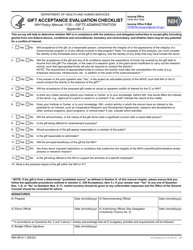

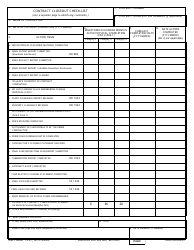

Charitable Gift Annuities - Filing Requirements Checklist - Oklahoma

Charitable Gift Annuities - Filing Requirements Checklist is a legal document that was released by the Oklahoma Insurance Department - a government authority operating within Oklahoma.

FAQ

Q: What is a charitable gift annuity?

A: A charitable gift annuity is a contract between a donor and a charity where the donor makes a gift to the charity in exchange for regular fixed payments for life.

Q: What are the benefits of a charitable gift annuity?

A: The benefits of a charitable gift annuity include a guaranteed income stream, potential tax advantages, and the satisfaction of supporting a charitable cause.

Q: How do I set up a charitable gift annuity?

A: To set up a charitable gift annuity, you should contact the charity of your choice and work with them to establish the terms and conditions of the annuity.

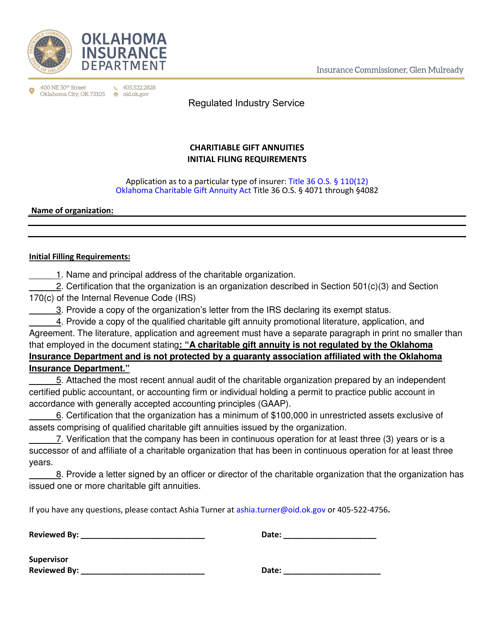

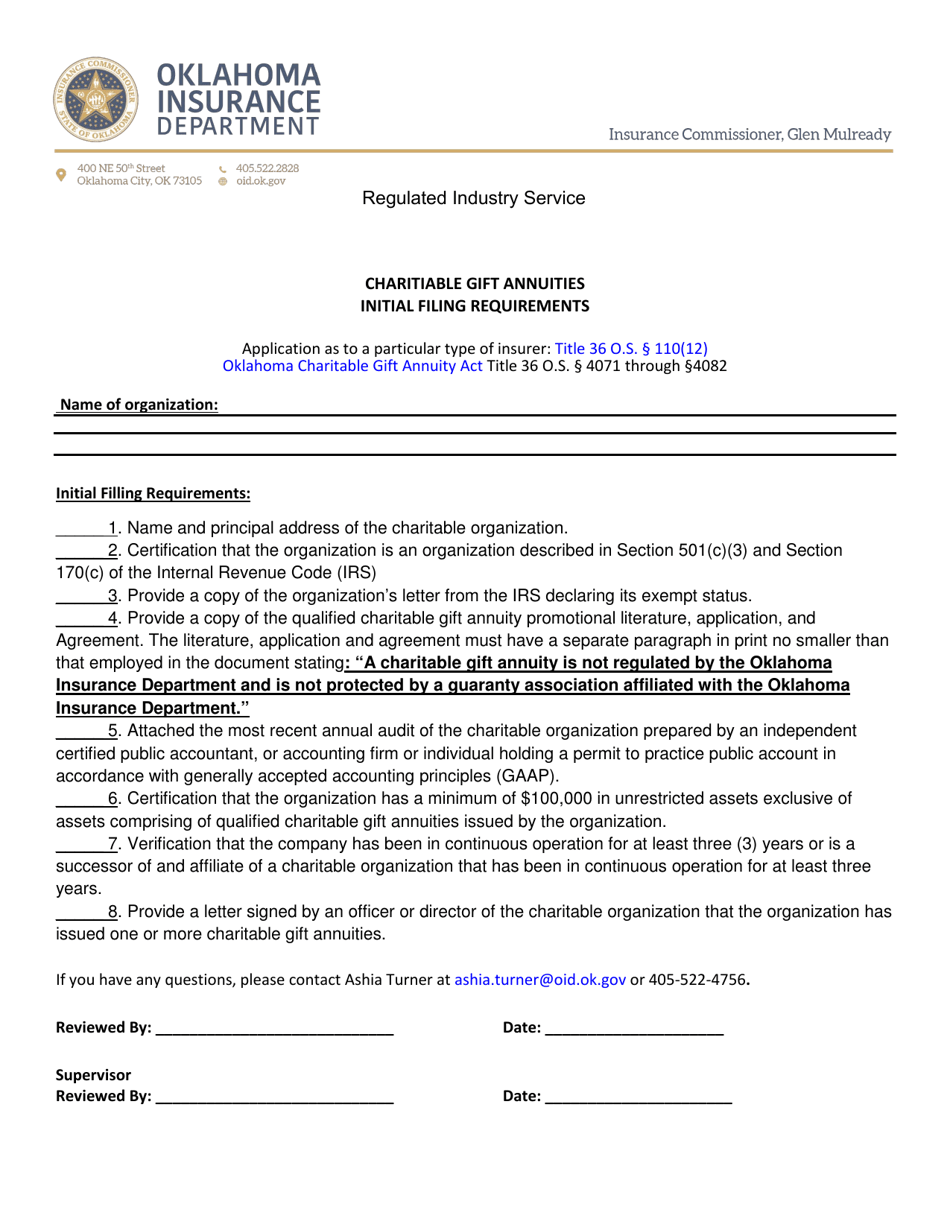

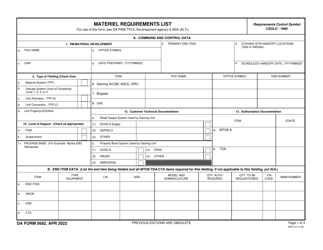

Q: Are there any filing requirements for charitable gift annuities in Oklahoma?

A: Yes, there are filing requirements for charitable gift annuities in Oklahoma. You may need to file certain forms with the Oklahoma Insurance Department.

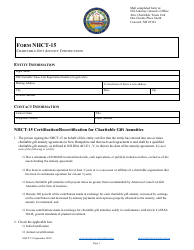

Q: What forms do I need to file for a charitable gift annuity in Oklahoma?

A: The specific forms required for filing a charitable gift annuity in Oklahoma may vary, so it is best to consult the Oklahoma Insurance Department or a legal professional for guidance.

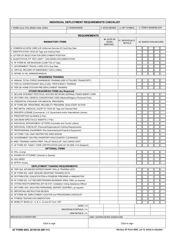

Form Details:

- The latest edition currently provided by the Oklahoma Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Insurance Department.