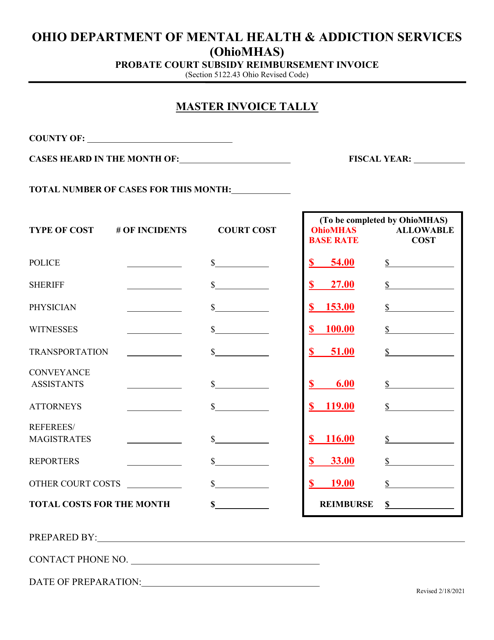

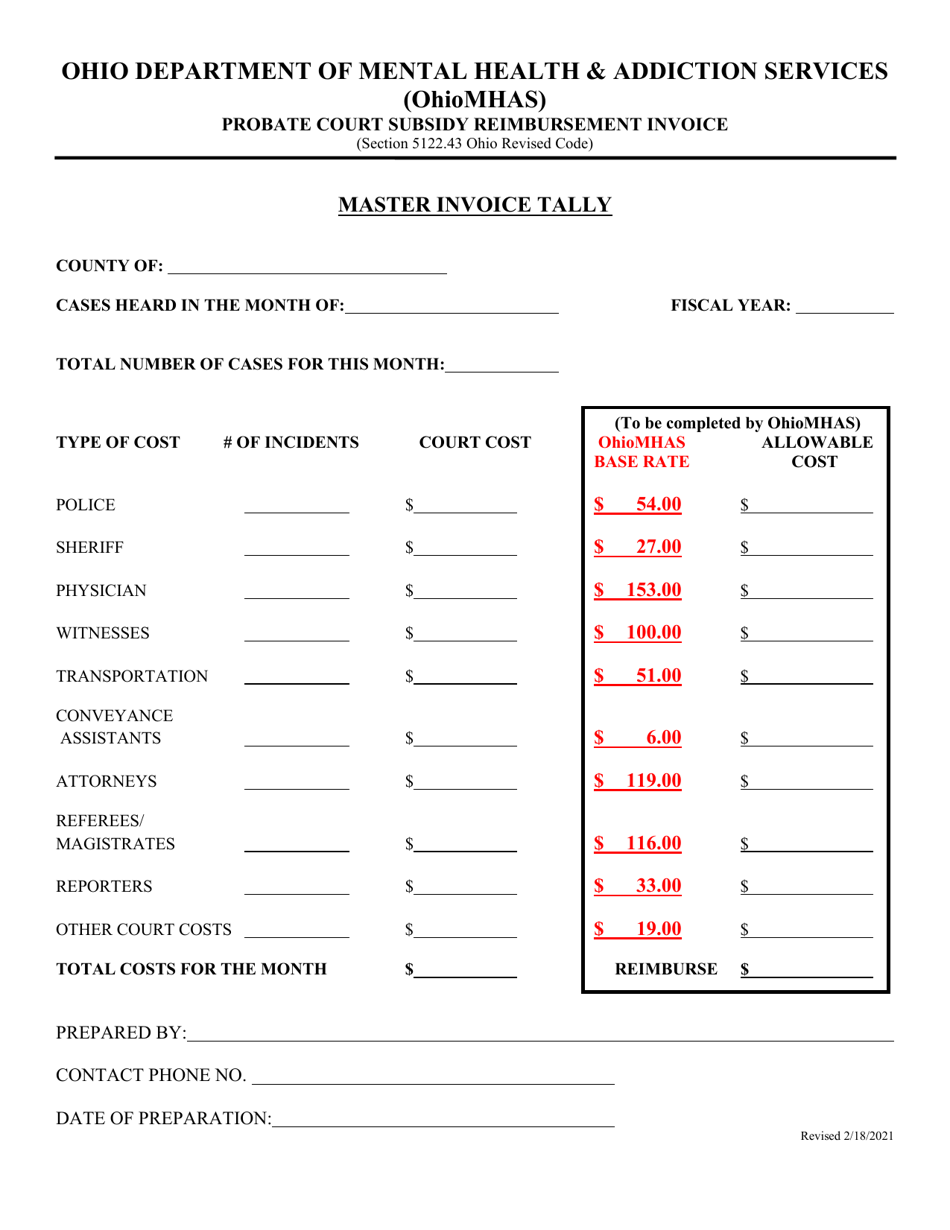

Master Invoice Tally - Ohio

Master Invoice Tally is a legal document that was released by the Ohio Department of Mental Health and Addiction Services - a government authority operating within Ohio.

FAQ

Q: What is the Master Invoice Tally?

A: The Master Invoice Tally is a document that records all the invoices issued by a business.

Q: Why is the Master Invoice Tally important?

A: The Master Invoice Tally helps businesses keep track of their invoicing activity and maintain accurate financial records.

Q: What information is included in the Master Invoice Tally?

A: The Master Invoice Tally typically includes details such as invoice numbers, dates, customer names, and invoice amounts.

Q: Who prepares the Master Invoice Tally?

A: The Master Invoice Tally is usually prepared by the accounting or finance department of a business.

Q: Is the Master Invoice Tally required by law?

A: The requirement for maintaining a Master Invoice Tally may vary depending on the state and industry. It is recommended to consult with a local tax professional or regulatory authority for specific requirements in Ohio.

Q: How often should the Master Invoice Tally be updated?

A: The Master Invoice Tally should be updated regularly, ideally on a daily or weekly basis, to ensure accurate and up-to-date records.

Q: Can the Master Invoice Tally be used for tax purposes?

A: Yes, the Master Invoice Tally is an important tool for tax purposes as it helps calculate sales tax liabilities and provides a record of transactions for tax reporting.

Q: Can the Master Invoice Tally be used in audits?

A: Yes, the Master Invoice Tally can be used as supporting documentation during financial audits to verify the accuracy and completeness of invoicing records.

Q: How long should the Master Invoice Tally be kept?

A: It is generally recommended to keep the Master Invoice Tally and related records for a minimum of seven years, or as required by legal and regulatory requirements.

Q: Is there a specific format for the Master Invoice Tally?

A: There is no specific format for the Master Invoice Tally, but it should contain all the necessary information to accurately track and record invoices.

Form Details:

- Released on February 18, 2021;

- The latest edition currently provided by the Ohio Department of Mental Health and Addiction Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Mental Health and Addiction Services.