This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-755

for the current year.

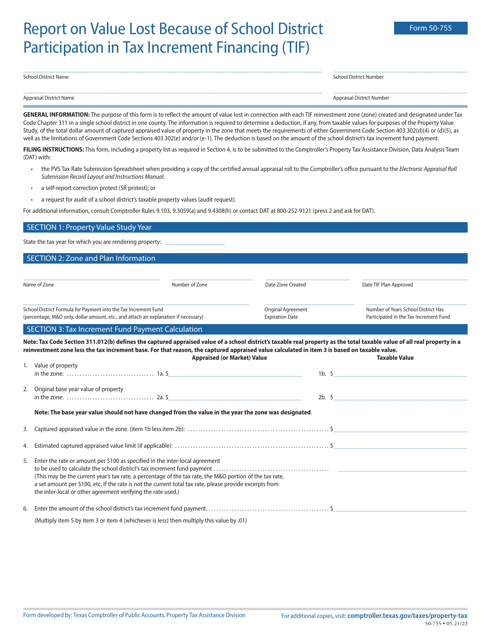

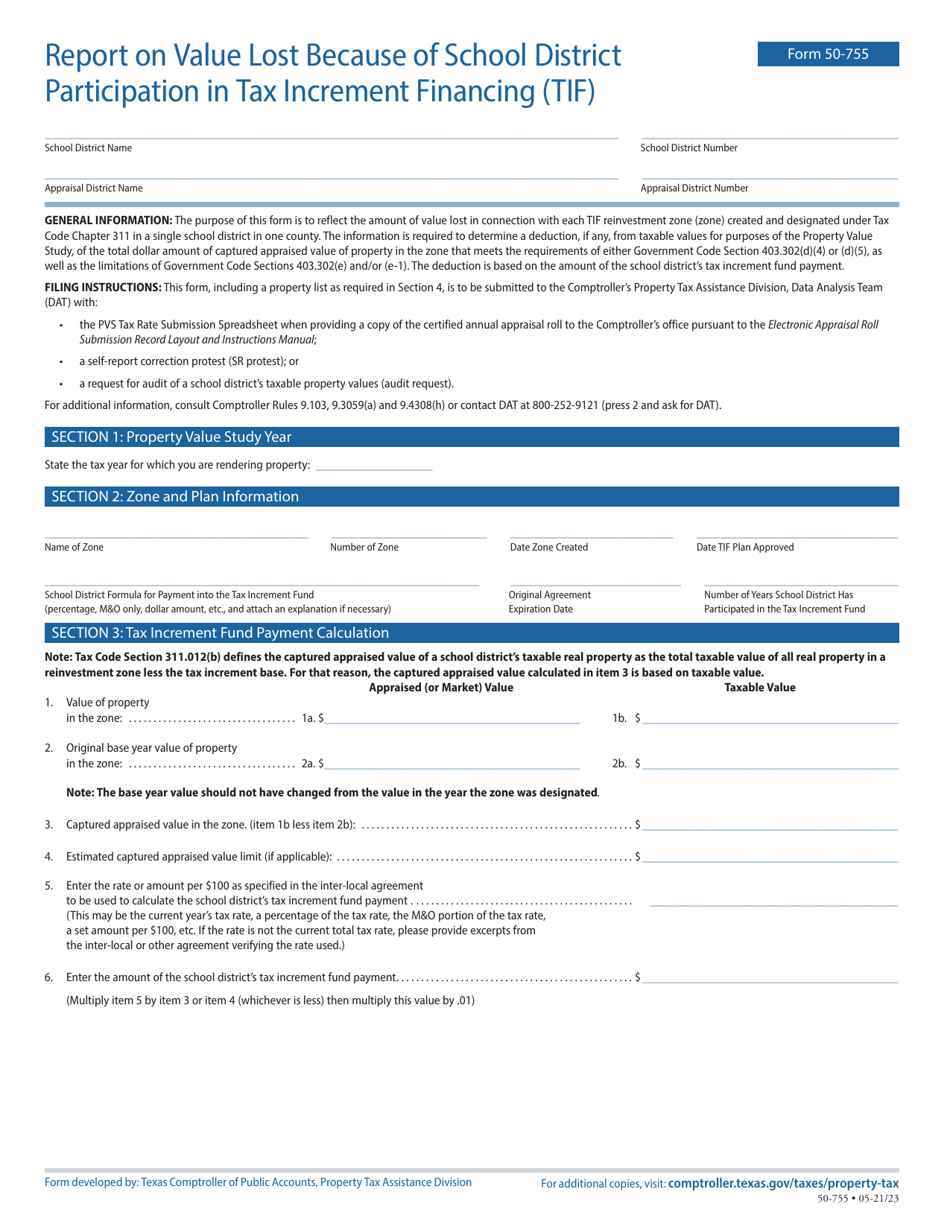

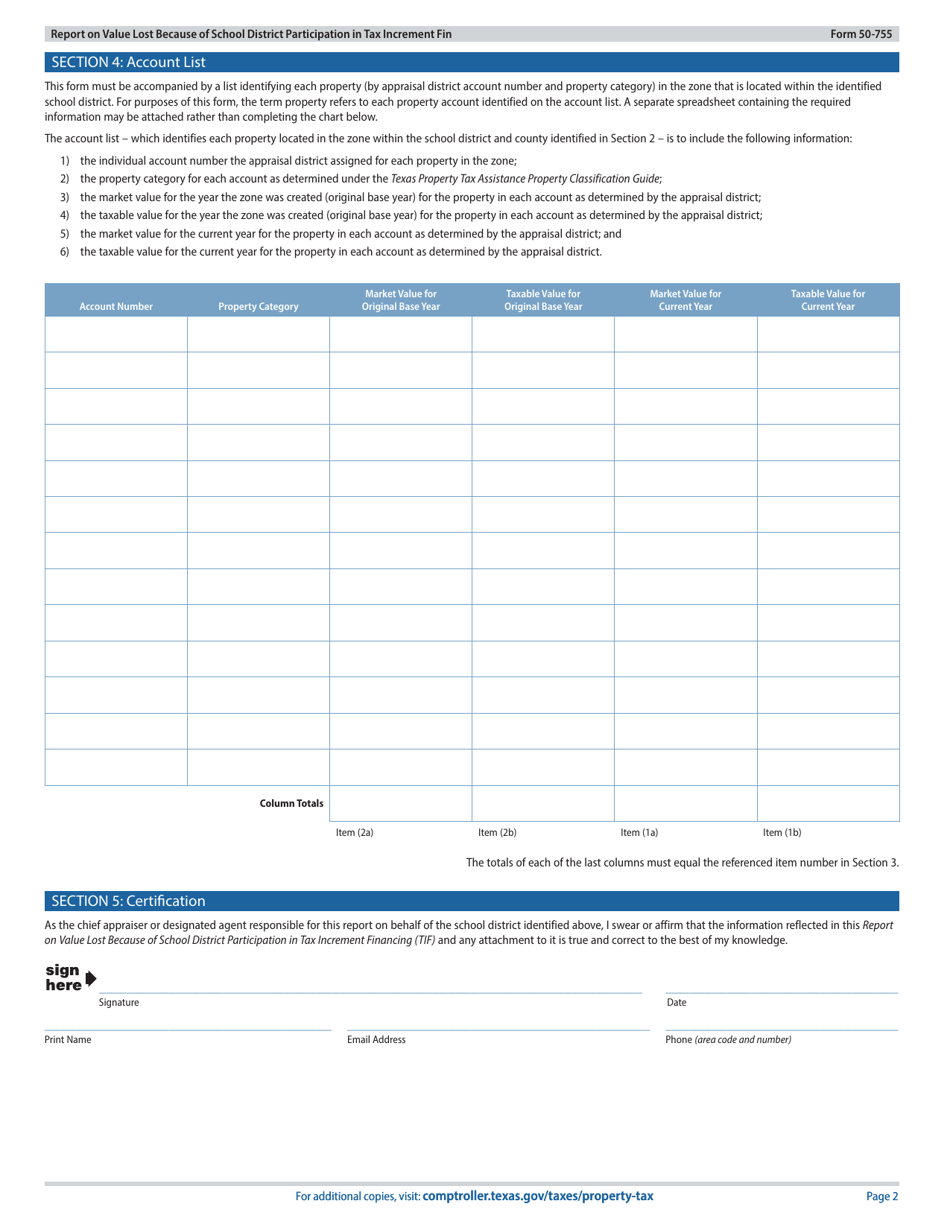

Form 50-755 Report on Value Lost Because of School District Participation in Tax Increment Financing (Tif) - Texas

What Is Form 50-755?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-755?

A: Form 50-755 is a report on the value lost because of school district participation in Tax Increment Financing (TIF) in Texas.

Q: What is the purpose of Form 50-755?

A: The purpose of Form 50-755 is to report the value lost by school districts due to their participation in Tax Increment Financing.

Q: Who is required to submit Form 50-755?

A: School districts in Texas that participate in Tax Increment Financing are required to submit Form 50-755.

Q: What information does Form 50-755 require?

A: Form 50-755 requires information about the school district, the TIF project, and the value lost by the district.

Q: When is the deadline to submit Form 50-755?

A: The deadline to submit Form 50-755 is determined by the Texas Comptroller of Public Accounts and may vary.

Q: Is Form 50-755 specific to Texas?

A: Yes, Form 50-755 is specific to school districts in Texas that participate in Tax Increment Financing.

Q: Why is reporting the value lost important?

A: Reporting the value lost helps monitor the impact of Tax Increment Financing on school districts and inform future decisions.

Q: Are there any penalties for not submitting Form 50-755?

A: Failure to submit Form 50-755 may result in penalties as determined by the Texas Comptroller of Public Accounts.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-755 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.