This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-767

for the current year.

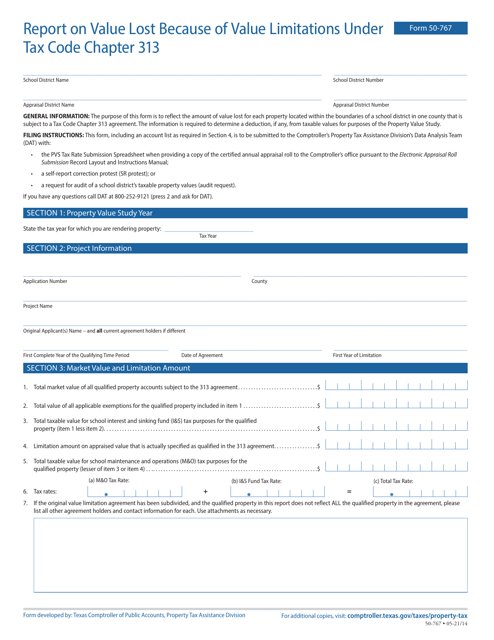

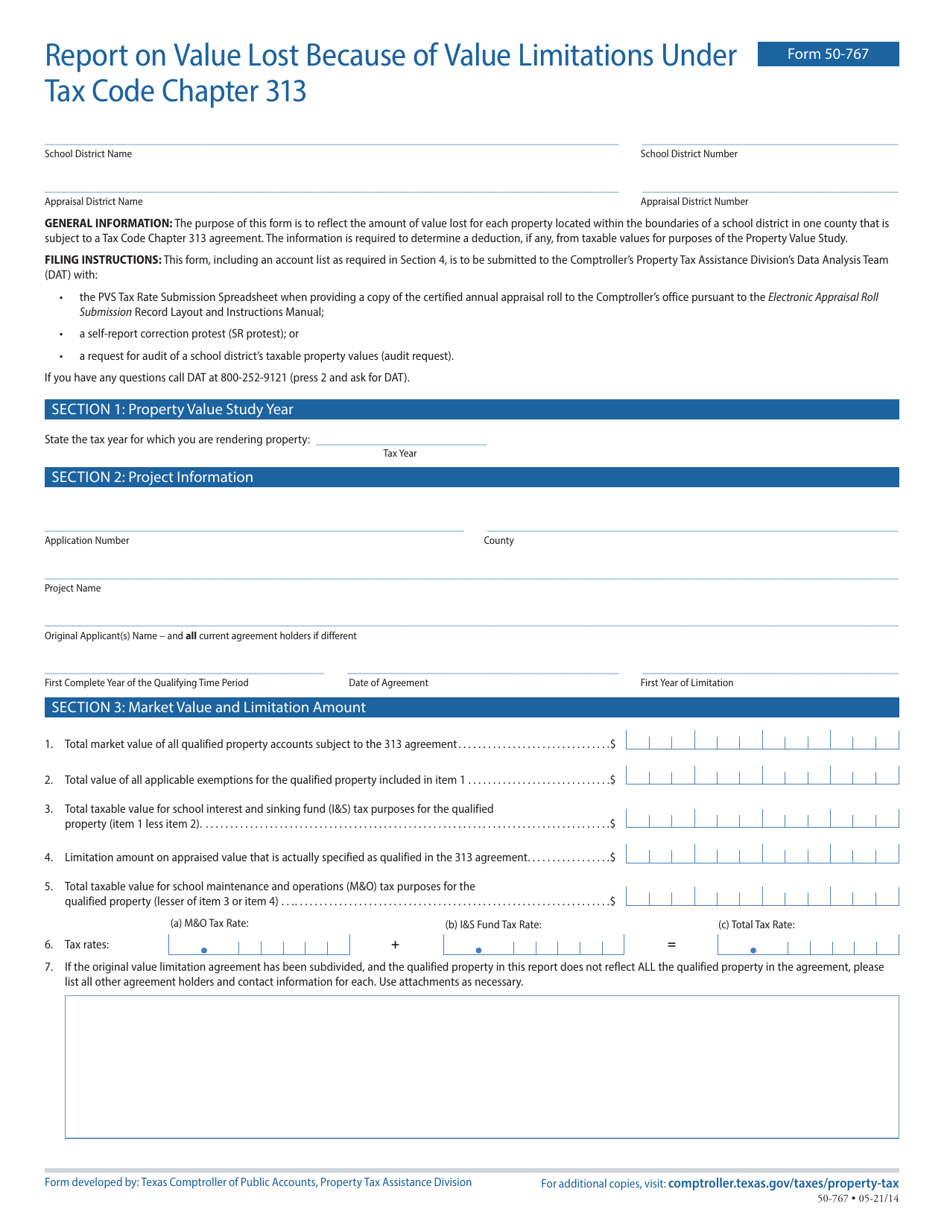

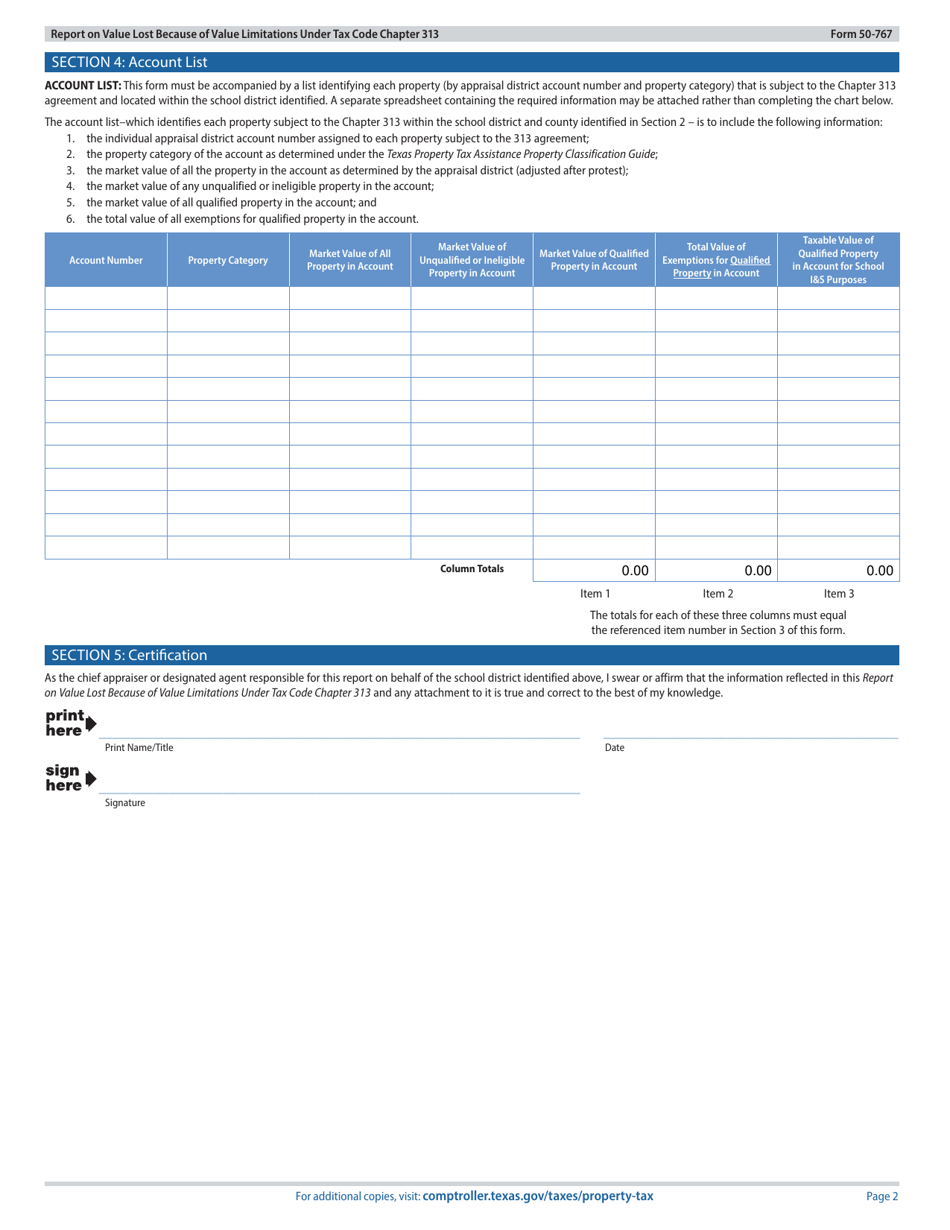

Form 50-767 Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 - Texas

What Is Form 50-767?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-767?

A: Form 50-767 is the Report on Value Lost Because of Value Limitations Under Tax Code Chapter 313 in Texas.

Q: What is Tax Code Chapter 313 in Texas?

A: Tax Code Chapter 313 in Texas provides limited value property tax limitations for certain qualifying industries.

Q: Who needs to file Form 50-767?

A: Entities that have qualified under Tax Code Chapter 313 in Texas and have experienced value limitations need to file Form 50-767.

Q: What is the purpose of filing Form 50-767?

A: The purpose of filing Form 50-767 is to report the value lost by an entity due to value limitations under Tax Code Chapter 313 in Texas.

Q: When is Form 50-767 due?

A: Form 50-767 is due on April 1st of each year.

Q: Are there any penalties for not filing Form 50-767?

A: Yes, there are penalties for not filing Form 50-767, which may include monetary fines and potential loss of tax benefits under Tax Code Chapter 313 in Texas.

Q: Are there any filing fees for Form 50-767?

A: No, there are no filing fees for Form 50-767.

Q: Can I amend a filed Form 50-767?

A: Yes, you can amend a filed Form 50-767 by submitting a revised form to the Texas Comptroller of Public Accounts.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-767 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.