This version of the form is not currently in use and is provided for reference only. Download this version of

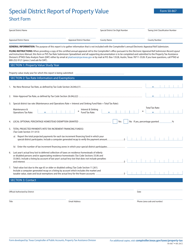

Form 50-253

for the current year.

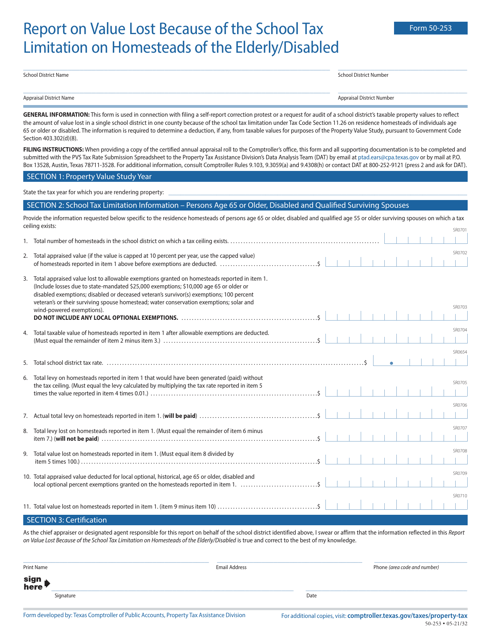

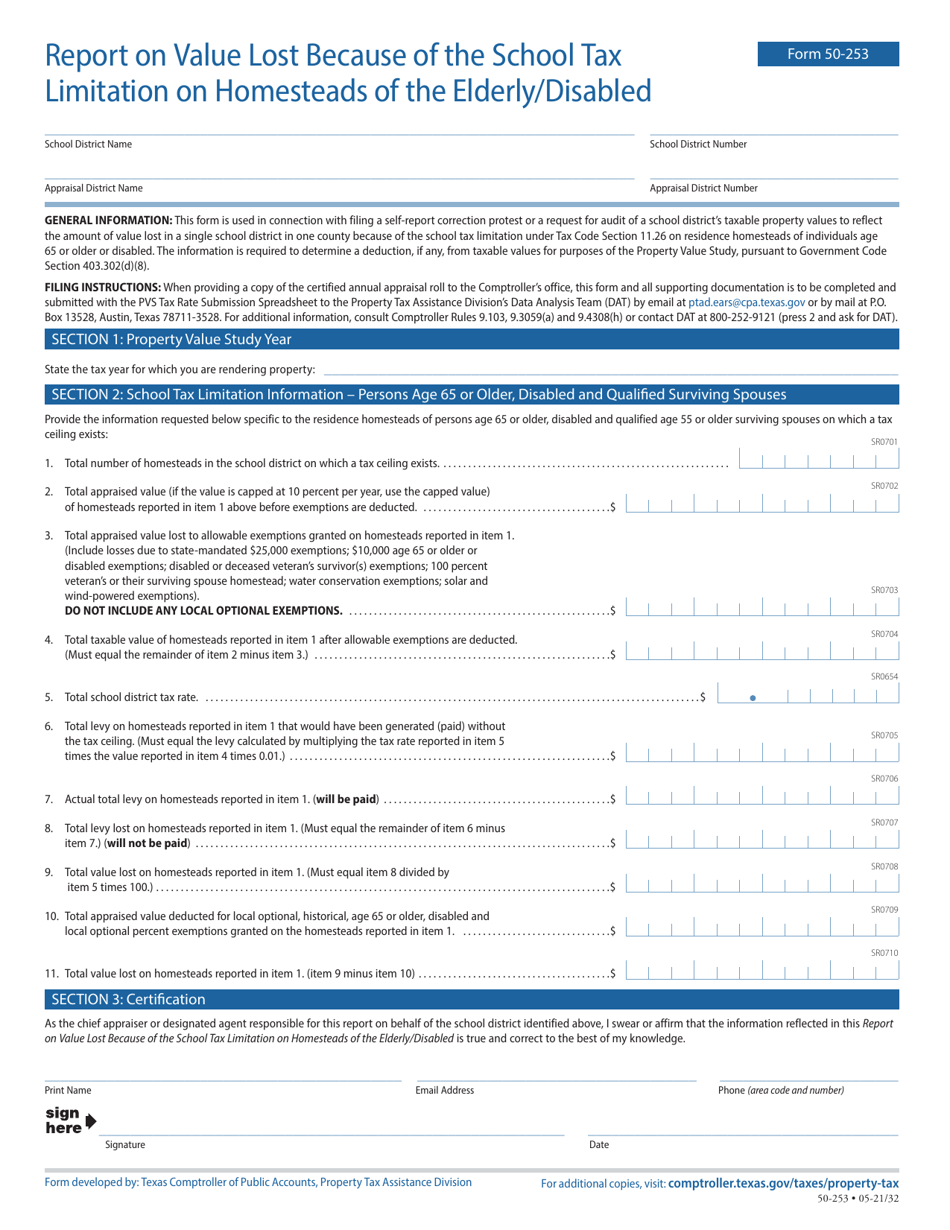

Form 50-253 Report on Value Lost Because of the School Tax Limitation on Homesteads of the Elderly / Disabled - Texas

What Is Form 50-253?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-253?

A: Form 50-253 is a report used in Texas to calculate the value lost because of the school tax limitation on homesteads of the elderly/disabled.

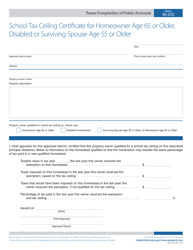

Q: Who uses Form 50-253?

A: Form 50-253 is used by elderly or disabled homeowners in Texas who want to report the value lost due to the school tax limitation.

Q: What is the purpose of Form 50-253?

A: The purpose of Form 50-253 is to calculate and report the value lost by eligible homeowners as a result of the school tax limitation on their homesteads.

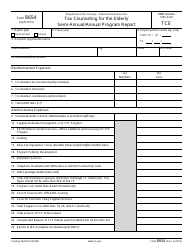

Q: When is Form 50-253 due?

A: Form 50-253 is due no later than one year after the delinquency date of the taxes on the homestead.

Q: What information is required on Form 50-253?

A: Form 50-253 requires information such as the property owner's name, address, social security number, property value before and after the limitation, and other relevant details.

Q: Is there a fee to file Form 50-253?

A: No, there is no fee to file Form 50-253.

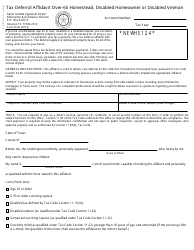

Q: Who should I contact for assistance with Form 50-253?

A: For assistance with Form 50-253, you can contact your local appraisal district or the Texas Comptroller of Public Accounts.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-253 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.