This version of the form is not currently in use and is provided for reference only. Download this version of

Form 50-851

for the current year.

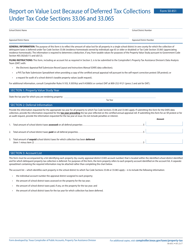

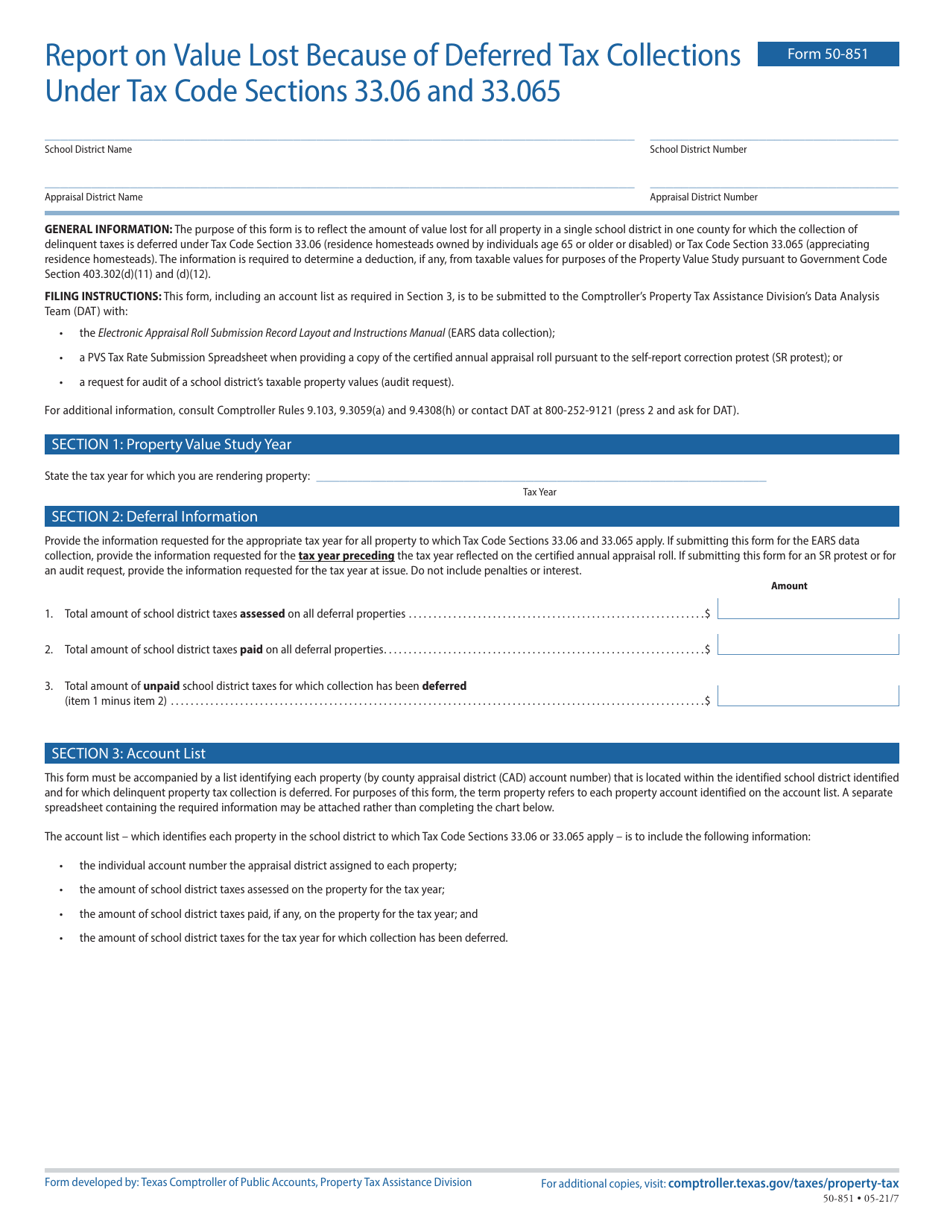

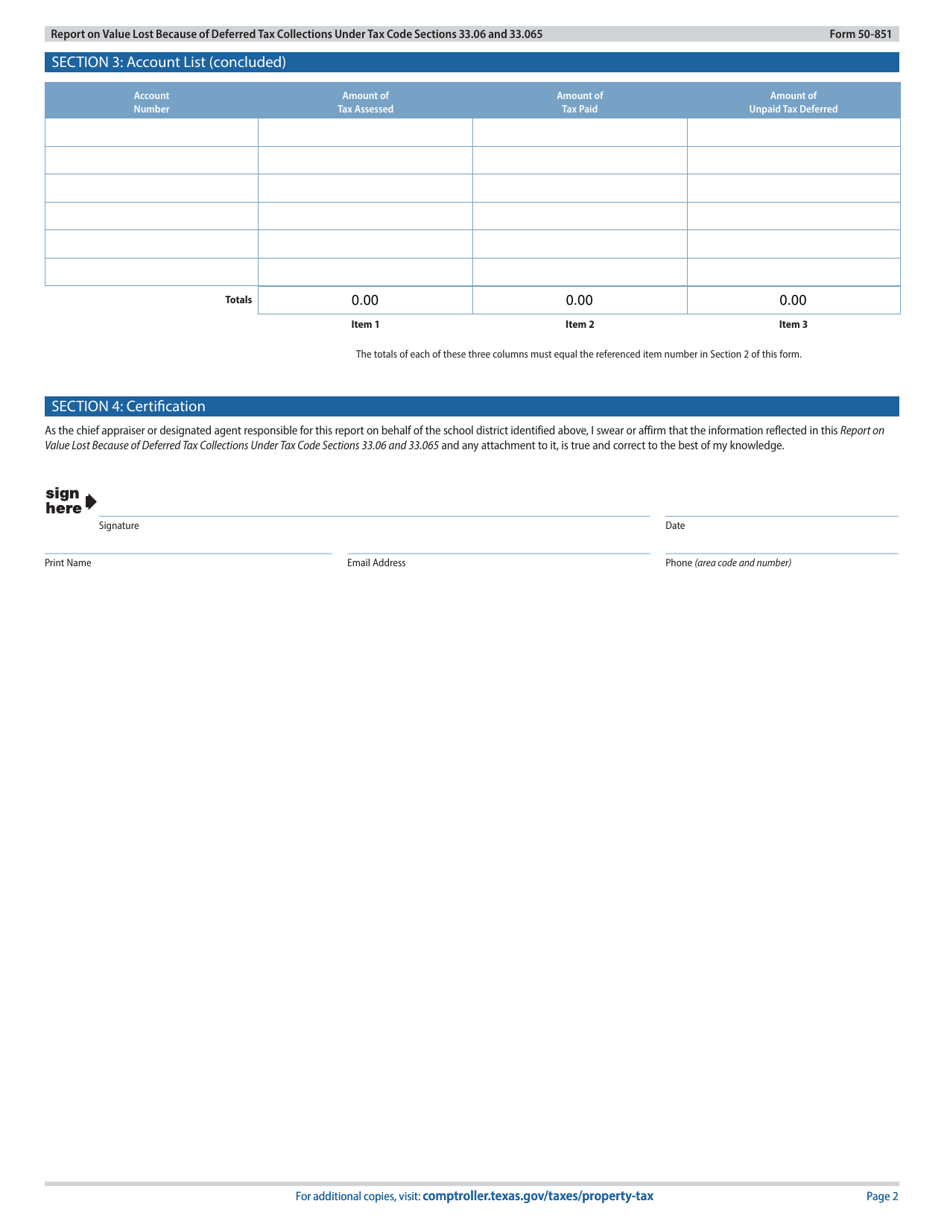

Form 50-851 Report on Value Lost Because of Deferred Tax Collections Under Tax Code Sections 33.06 and 33.065 - Texas

What Is Form 50-851?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-851?

A: Form 50-851 is a report used in Texas to report value lost due to deferred tax collections.

Q: What is the purpose of Form 50-851?

A: The purpose of Form 50-851 is to calculate and report the value lost by taxing units due to the deferral of tax collections.

Q: When is Form 50-851 used?

A: Form 50-851 is used when a taxing unit in Texas wants to report the value lost due to deferred tax collections.

Q: What are Tax Code Sections 33.06 and 33.065?

A: Tax Code Sections 33.06 and 33.065 are sections of the Texas Tax Code that deal with the deferral of tax collections.

Q: Who uses Form 50-851?

A: Form 50-851 is used by taxing units in Texas to report the value lost due to deferred tax collections.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-851 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.