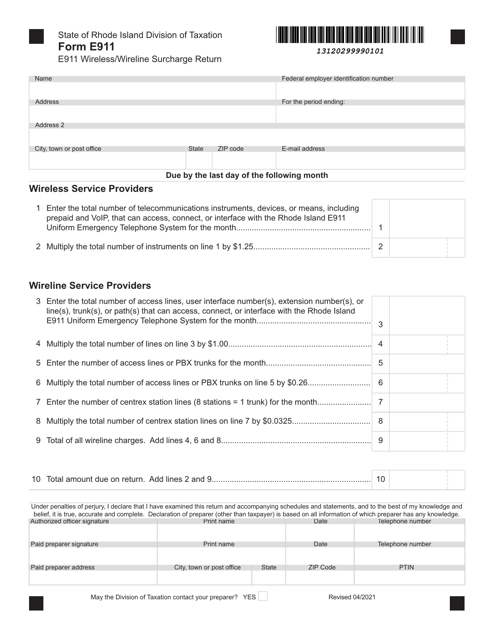

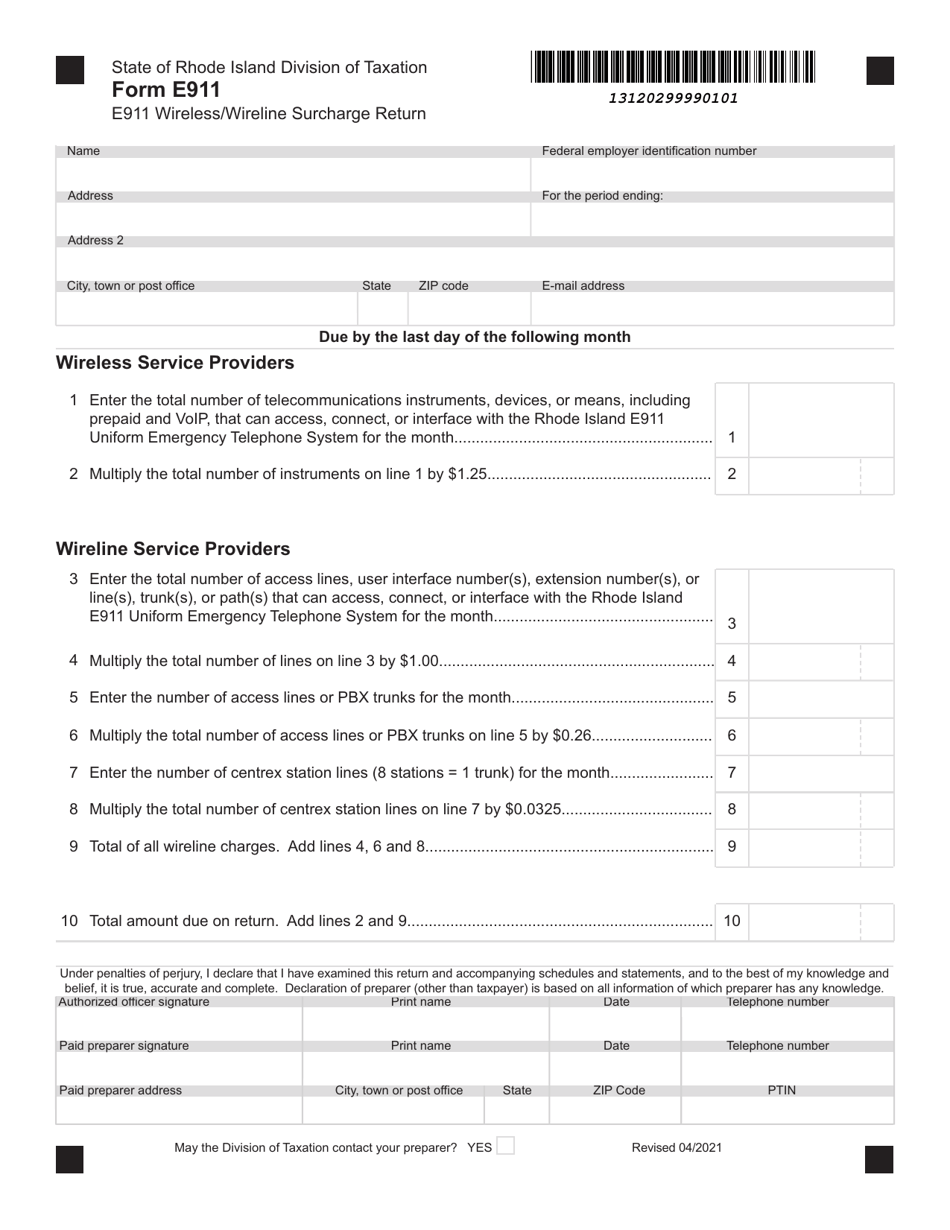

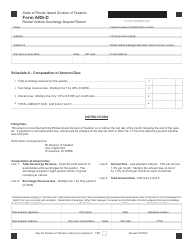

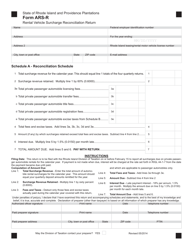

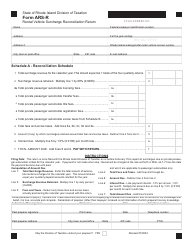

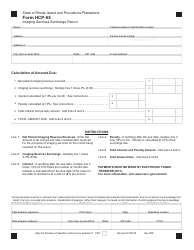

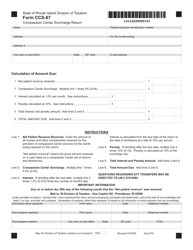

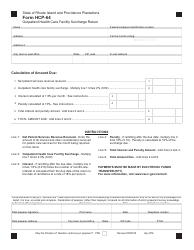

Form E911 E911 Wireless / Wireline Surcharge Return - Rhode Island

What Is Form E911?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the E911 Wireless/Wireline Surcharge Return?

A: The E911 Wireless/Wireline Surcharge Return is a form used in Rhode Island to report and remit surcharges related to the Enhanced 911 (E911) system.

Q: Who is required to file the E911 Wireless/Wireline Surcharge Return?

A: Telecommunication service providers in Rhode Island are required to file the E911 Wireless/Wireline Surcharge Return.

Q: What is the purpose of the E911 surcharge?

A: The E911 surcharge is used to fund and support emergency services, specifically the Enhanced 911 system, which helps in identifying and locating callers during emergencies.

Q: How often is the E911 Wireless/Wireline Surcharge Return filed?

A: The E911 Wireless/Wireline Surcharge Return is filed quarterly, on a calendar year basis.

Q: Are there any penalties for late or non-filing of the E911 Wireless/Wireline Surcharge Return?

A: Yes, penalties may apply for late or non-filing of the E911 Wireless/Wireline Surcharge Return. It is important to file the return on time to avoid penalties.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form E911 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.