This version of the form is not currently in use and is provided for reference only. Download this version of

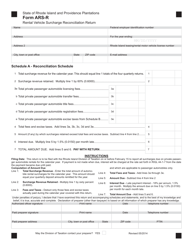

Form ARS-R

for the current year.

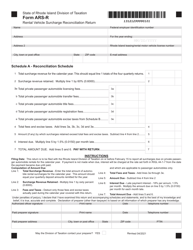

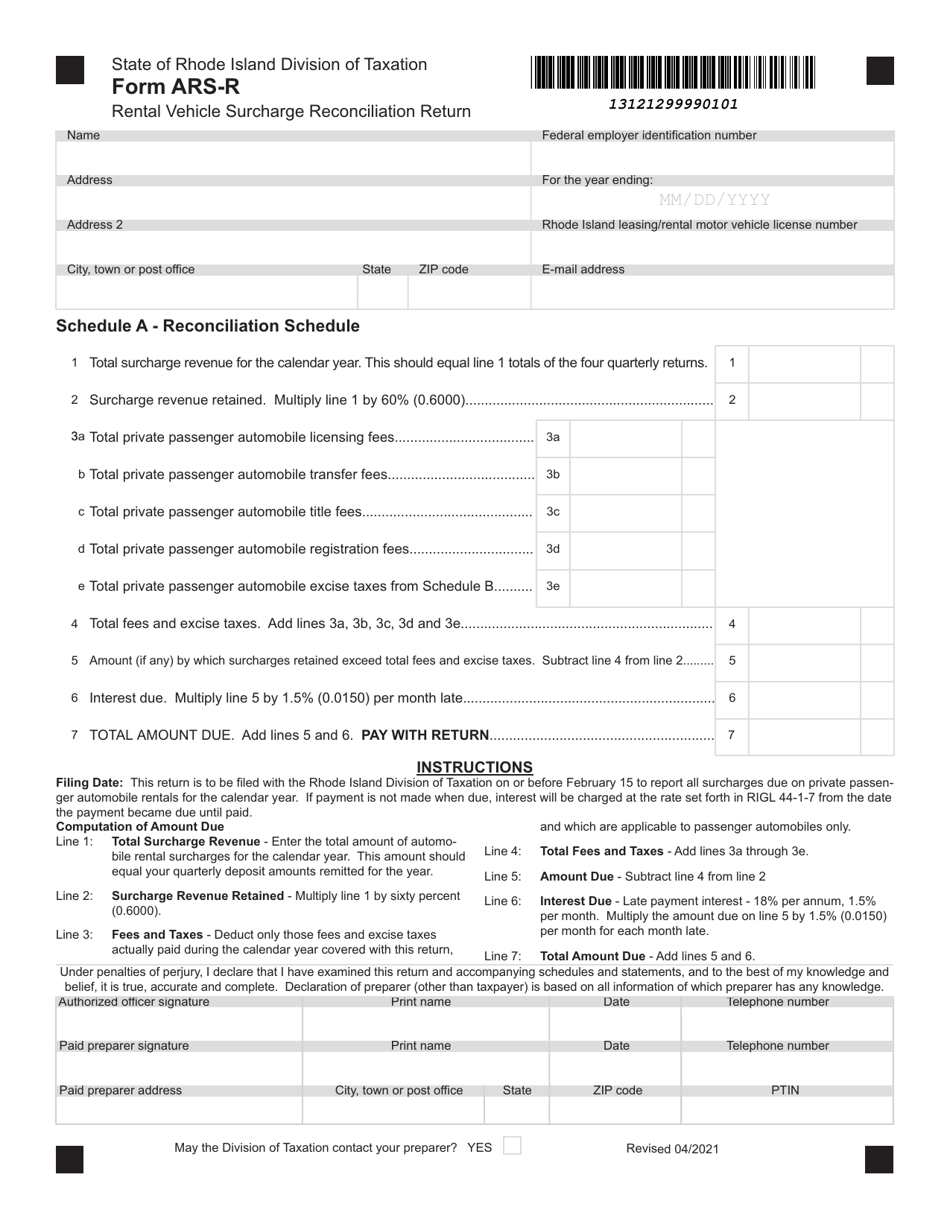

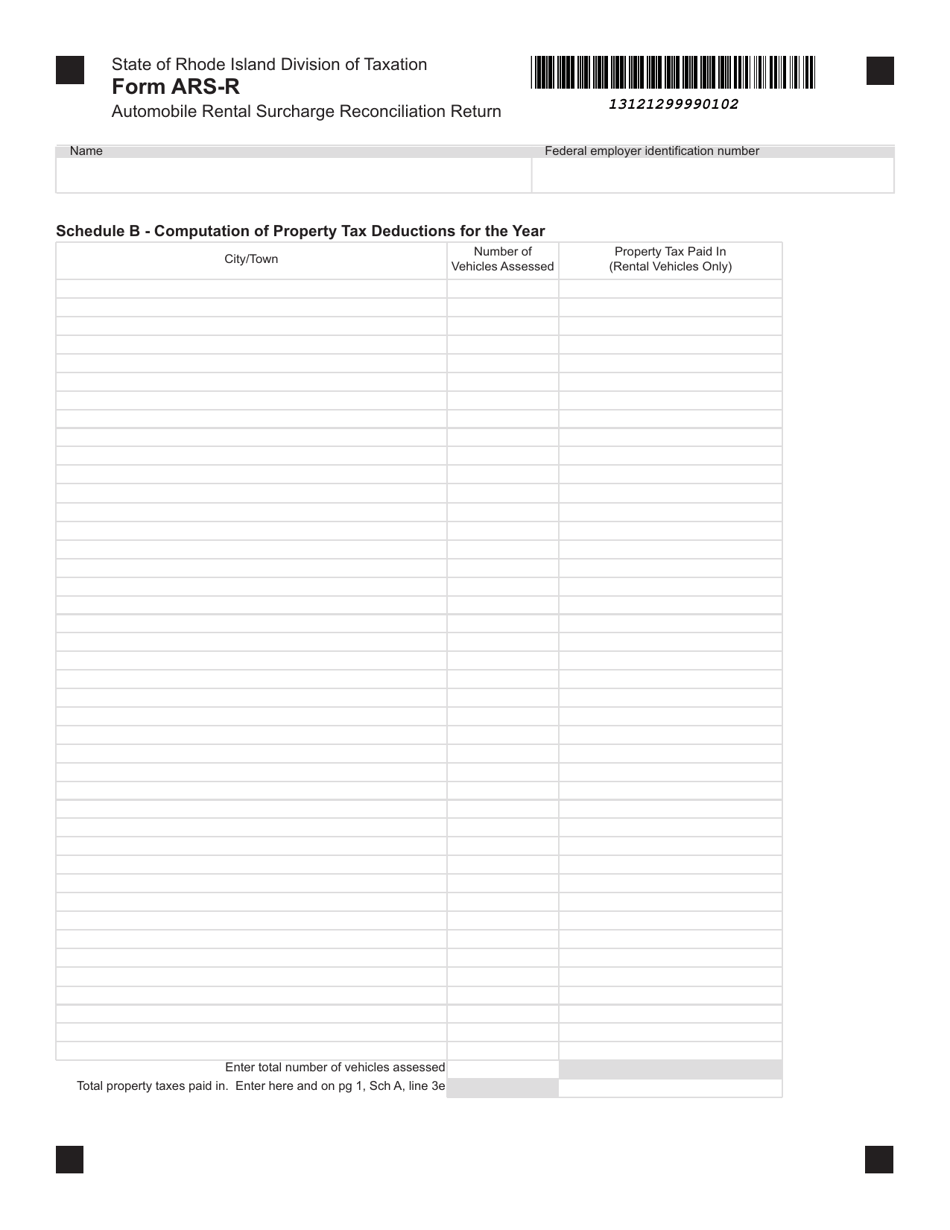

Form ARS-R Rental Vehicle Surcharge Reconciliation Return - Rhode Island

What Is Form ARS-R?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: The ARS-R Rental Vehicle Surcharge Reconciliation Return is a form in Rhode Island used to report and reconcile rental vehicle surcharge taxes.

Q: Who needs to file the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: Anyone who operates a rental vehicle business in Rhode Island and collects rental vehicle surcharge taxes must file this return.

Q: What is the purpose of the rental vehicle surcharge taxes?

A: The rental vehicle surcharge taxes help fund the Rhode Island Public Transit Authority (RIPTA) and support public transportation services.

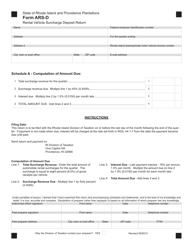

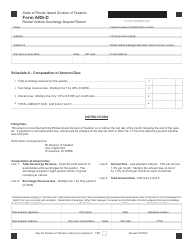

Q: When is the ARS-R Rental Vehicle Surcharge Reconciliation Return due?

A: The return is due on a quarterly basis, with the deadline falling on the last day of the month following the end of each quarter.

Q: Are there any penalties for late or non-filing of the ARS-R Rental Vehicle Surcharge Reconciliation Return?

A: Yes, there are penalties for late or non-filing, including potential interest charges and penalties based on the amount of surcharge taxes owed.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ARS-R by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.