This version of the form is not currently in use and is provided for reference only. Download this version of

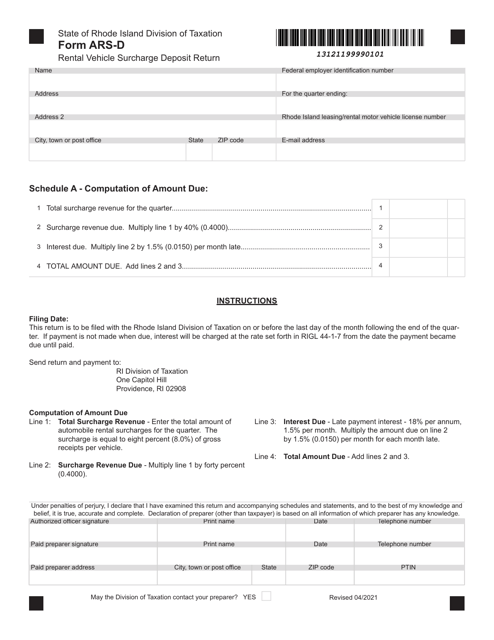

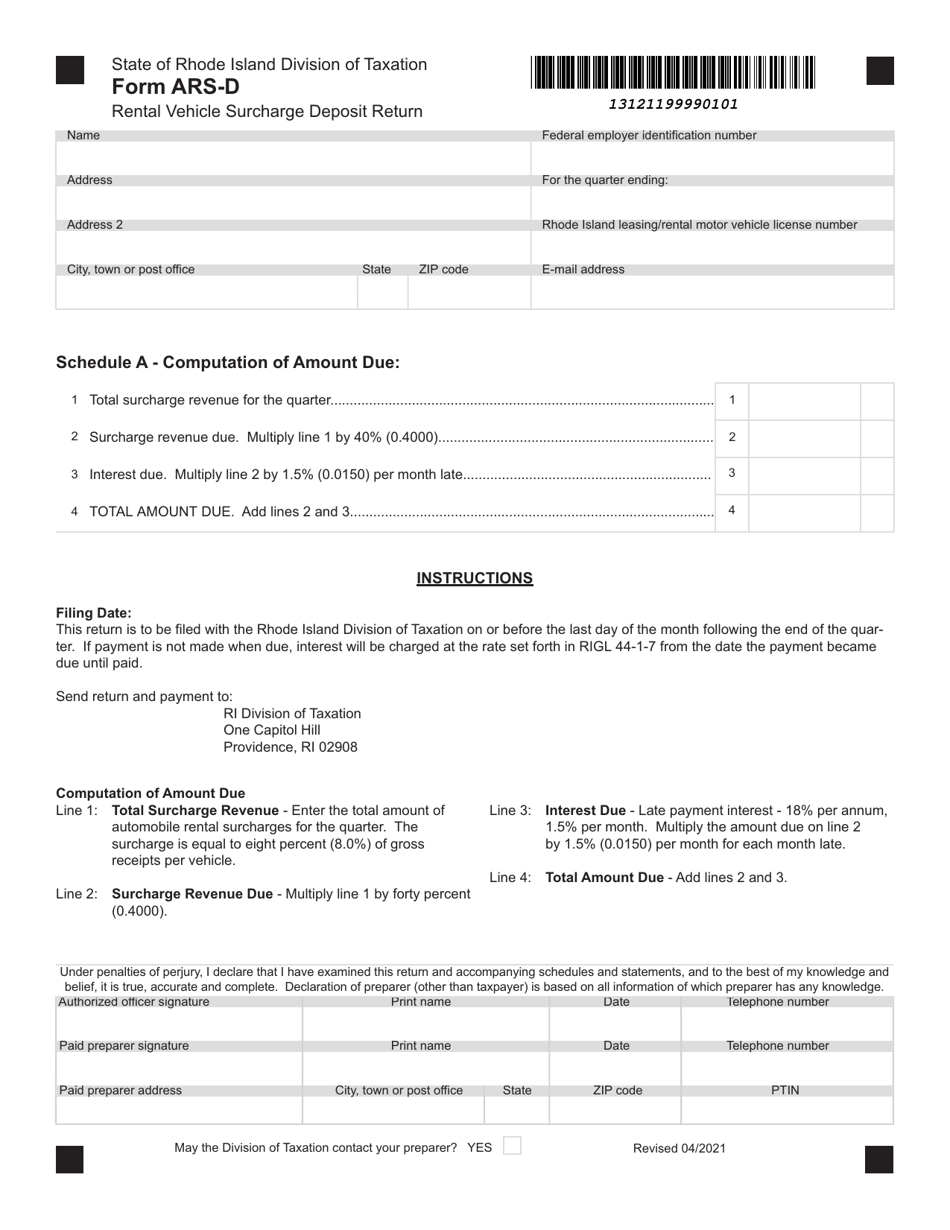

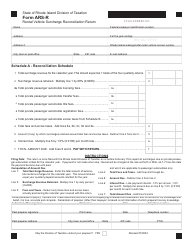

Form ARS-D

for the current year.

Form ARS-D Rental Vehicle Surcharge Deposit Return - Rhode Island

What Is Form ARS-D?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ARS-D?

A: Form ARS-D is the rental vehicle surcharge deposit return form in Rhode Island.

Q: What is the purpose of Form ARS-D?

A: The purpose of Form ARS-D is to request a refund of the rental vehicle surcharge deposit paid in Rhode Island.

Q: Who needs to file Form ARS-D?

A: Anyone who has paid a rental vehicle surcharge deposit in Rhode Island and wishes to request a refund needs to file Form ARS-D.

Q: Is there a deadline for filing Form ARS-D?

A: Yes, Form ARS-D must be filed within six months from the date the rental vehicle surcharge deposit was made.

Q: What information do I need to include in Form ARS-D?

A: You will need to provide your name, address, phone number, rental vehicle company name, rental agreement number, and the amount of the surcharge deposit paid.

Q: How long does it take to receive the refund after filing Form ARS-D?

A: It may take up to four weeks to process and receive the refund after filing Form ARS-D.

Q: Are there any fees associated with filing Form ARS-D?

A: No, there are no fees for filing Form ARS-D or requesting a refund of the rental vehicle surcharge deposit.

Q: What should I do if I have further questions about Form ARS-D?

A: If you have further questions about Form ARS-D, you can contact the Rhode Island Division of Motor Vehicles for assistance.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ARS-D by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.