This version of the form is not currently in use and is provided for reference only. Download this version of

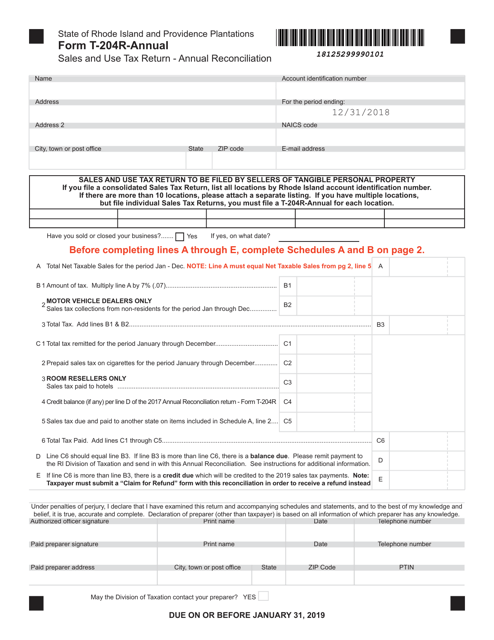

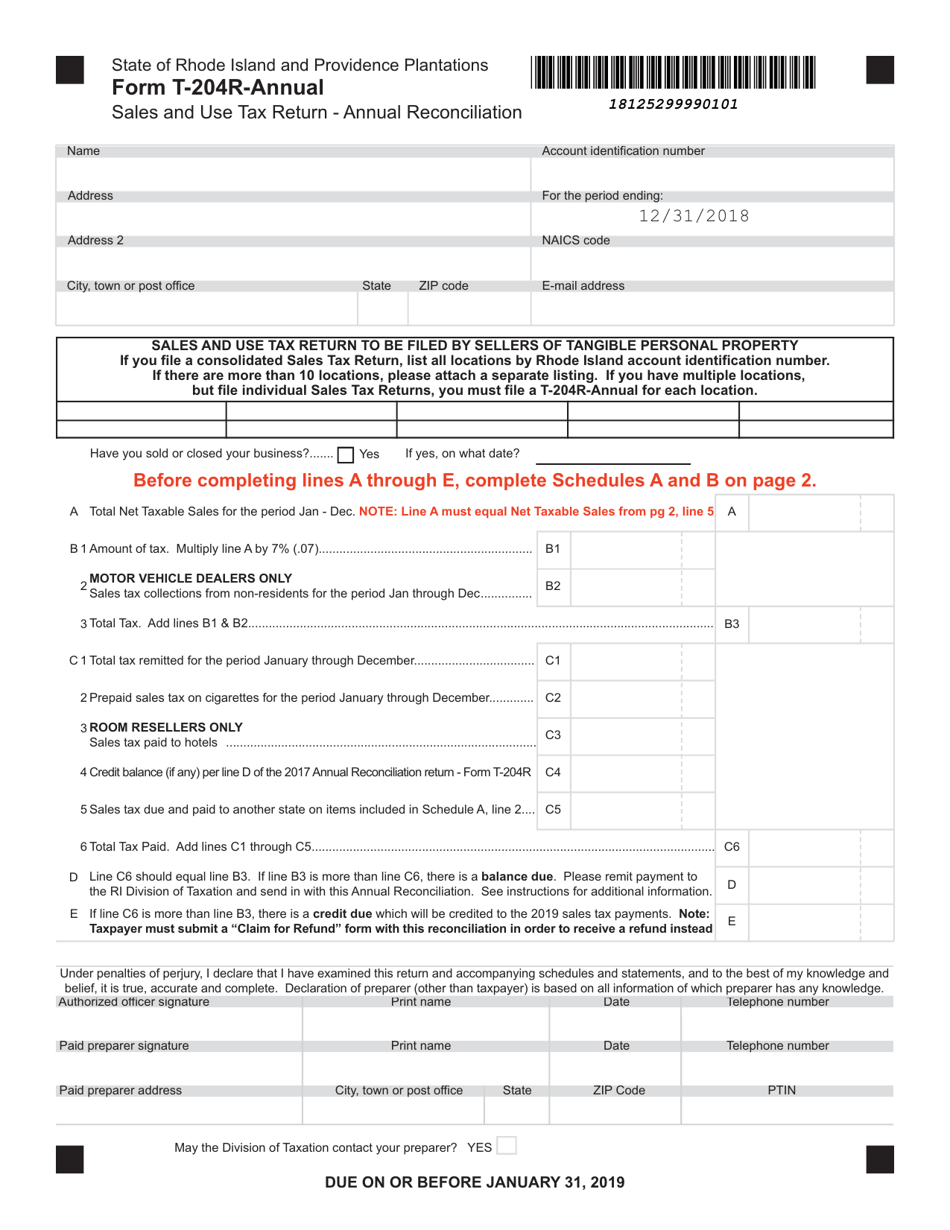

Form T-204R-ANNUAL

for the current year.

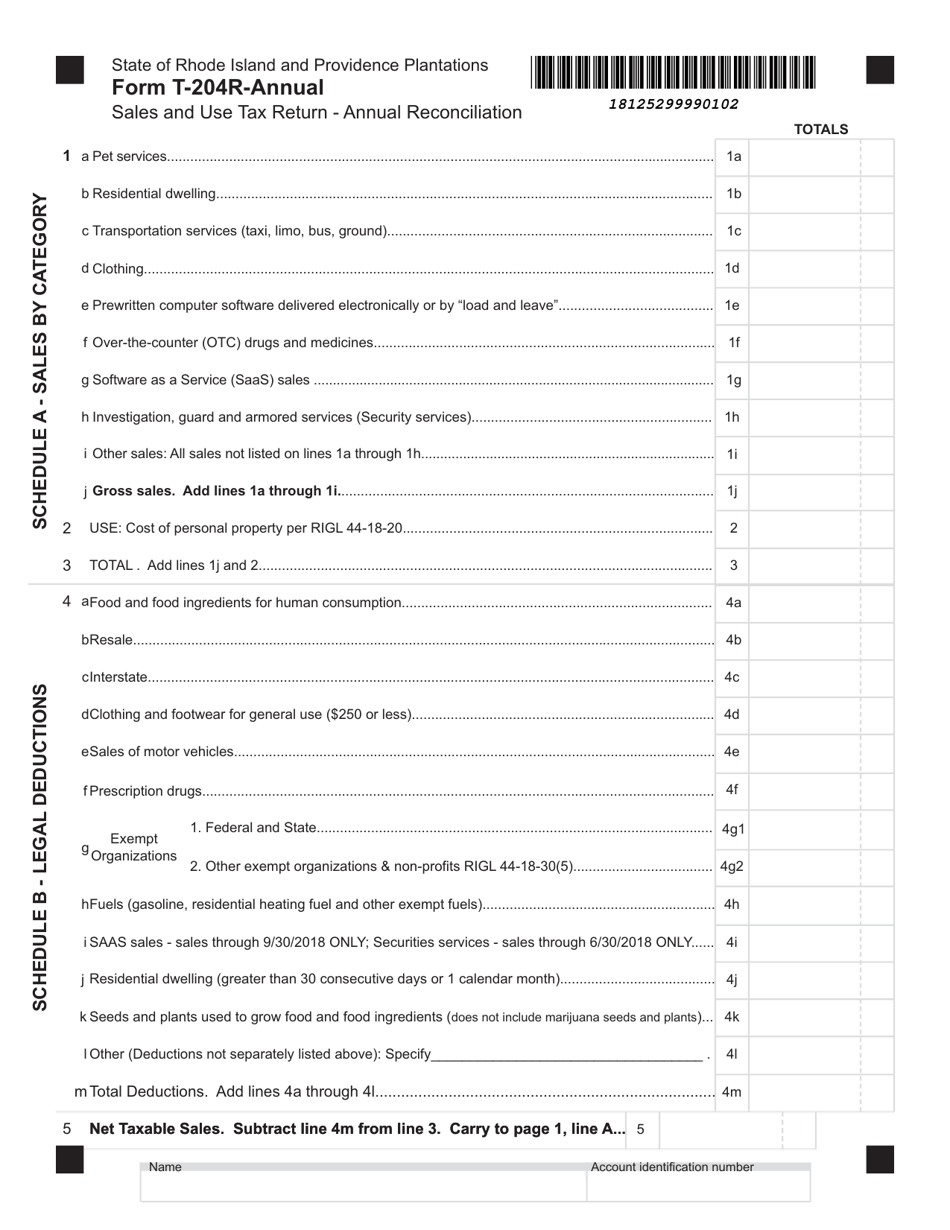

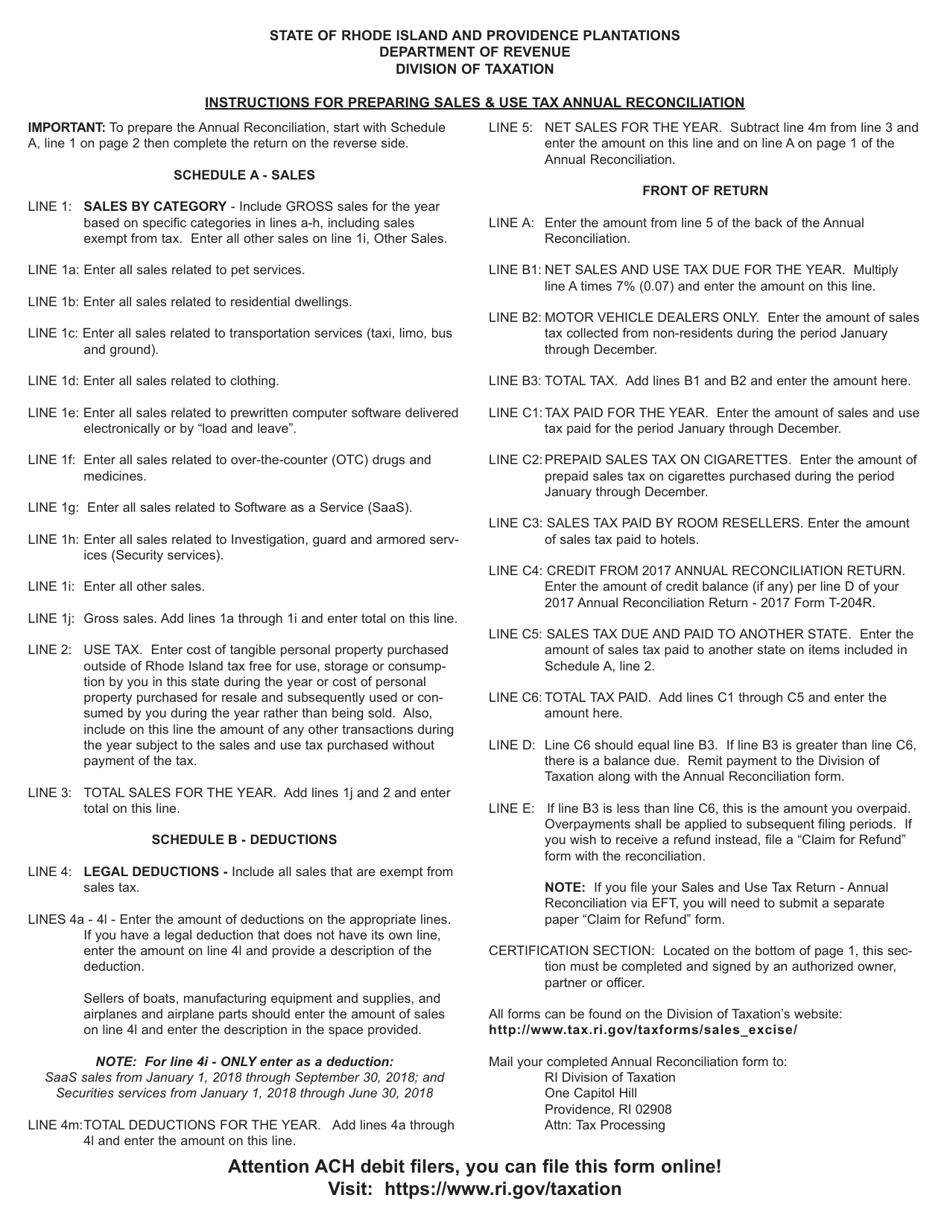

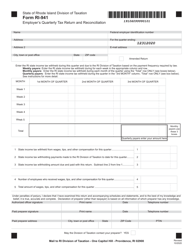

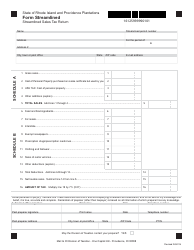

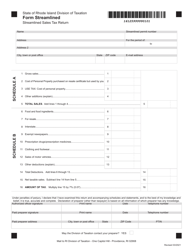

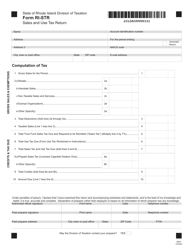

Form T-204R-ANNUAL Sales and Use Tax Return - Annual Reconciliation for Sellers of Tangible Property - Rhode Island

What Is Form T-204R-ANNUAL?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-204R?

A: Form T-204R is the Annual Sales and Use Tax Return - Annual Reconciliation for Sellers of Tangible Property in Rhode Island.

Q: Who needs to file Form T-204R?

A: Sellers of tangible property in Rhode Island need to file Form T-204R.

Q: What is the purpose of Form T-204R?

A: Form T-204R is used to reconcile the sales and use tax collected by sellers of tangible property in Rhode Island.

Q: When is Form T-204R due?

A: Form T-204R is due on the 20th day of the month following the end of the annual reporting period.

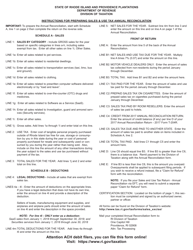

Q: What information is required on Form T-204R?

A: Form T-204R requires sellers to provide detailed information about their sales and use tax collections, including taxable sales, exempt sales, and the amount of tax collected.

Q: Are there any penalties for late or incorrect filing of Form T-204R?

A: Yes, there are penalties for late or incorrect filing of Form T-204R, including interest charges and possible fines.

Q: Do I need to include payment with my Form T-204R?

A: Yes, sellers are required to remit payment for the sales and use tax owed along with their completed Form T-204R.

Q: Is there a minimum sales threshold for filing Form T-204R?

A: Yes, sellers who had less than $200 in taxable sales during the reporting period are not required to file Form T-204R.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-204R-ANNUAL by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.