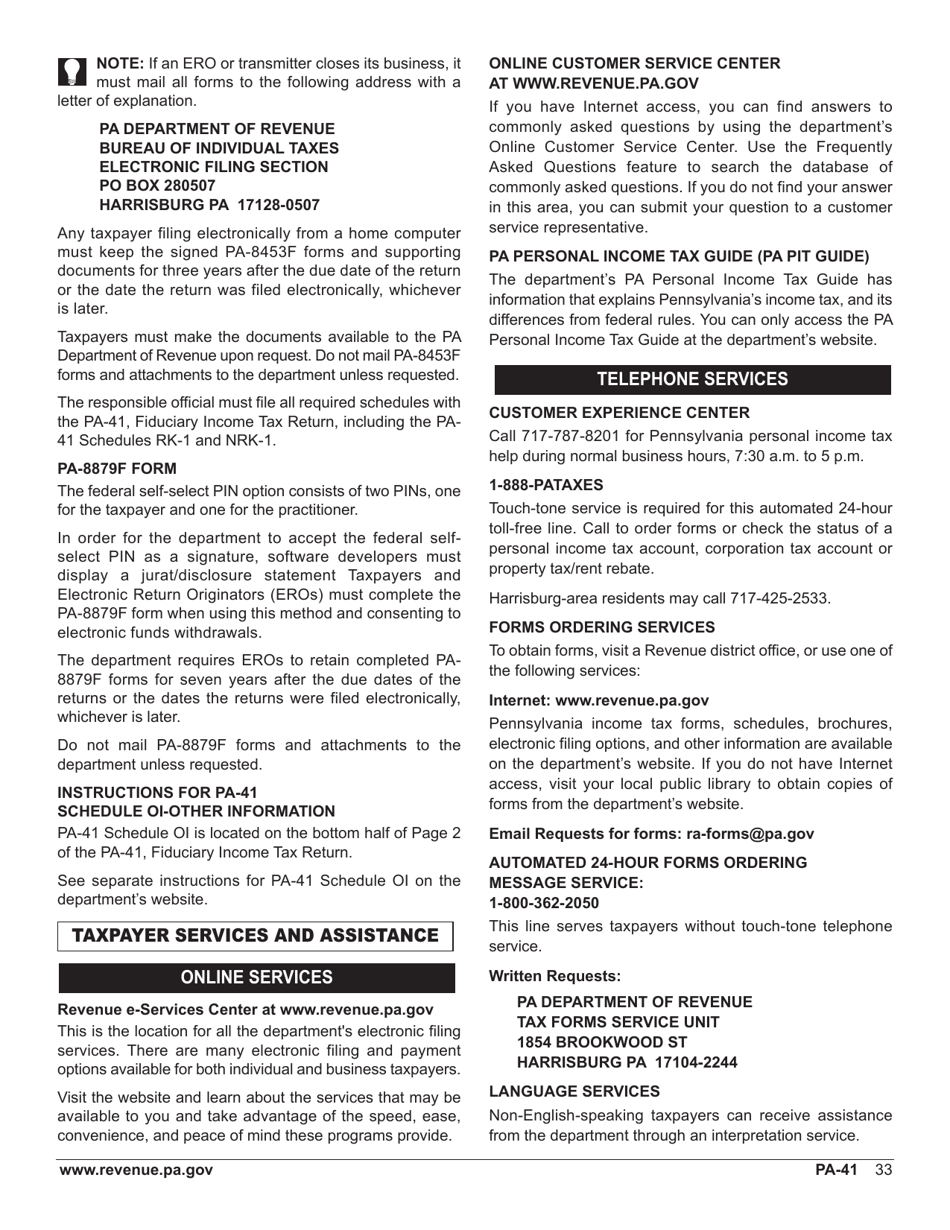

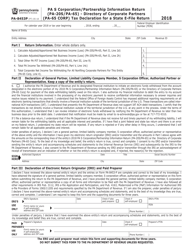

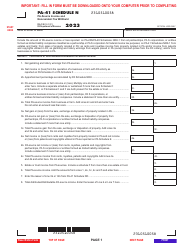

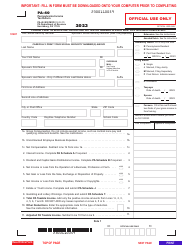

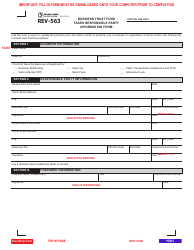

This version of the form is not currently in use and is provided for reference only. Download this version of

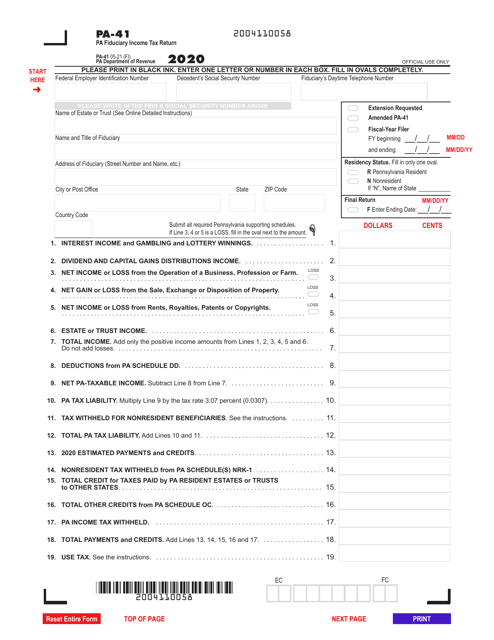

Form PA-41

for the current year.

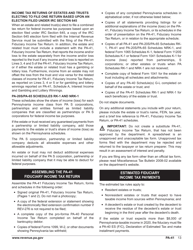

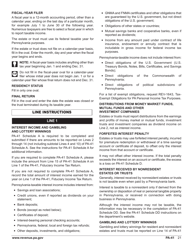

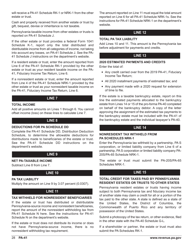

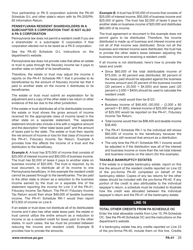

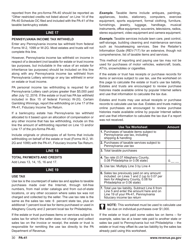

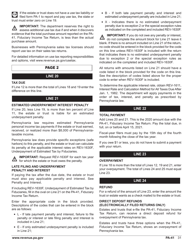

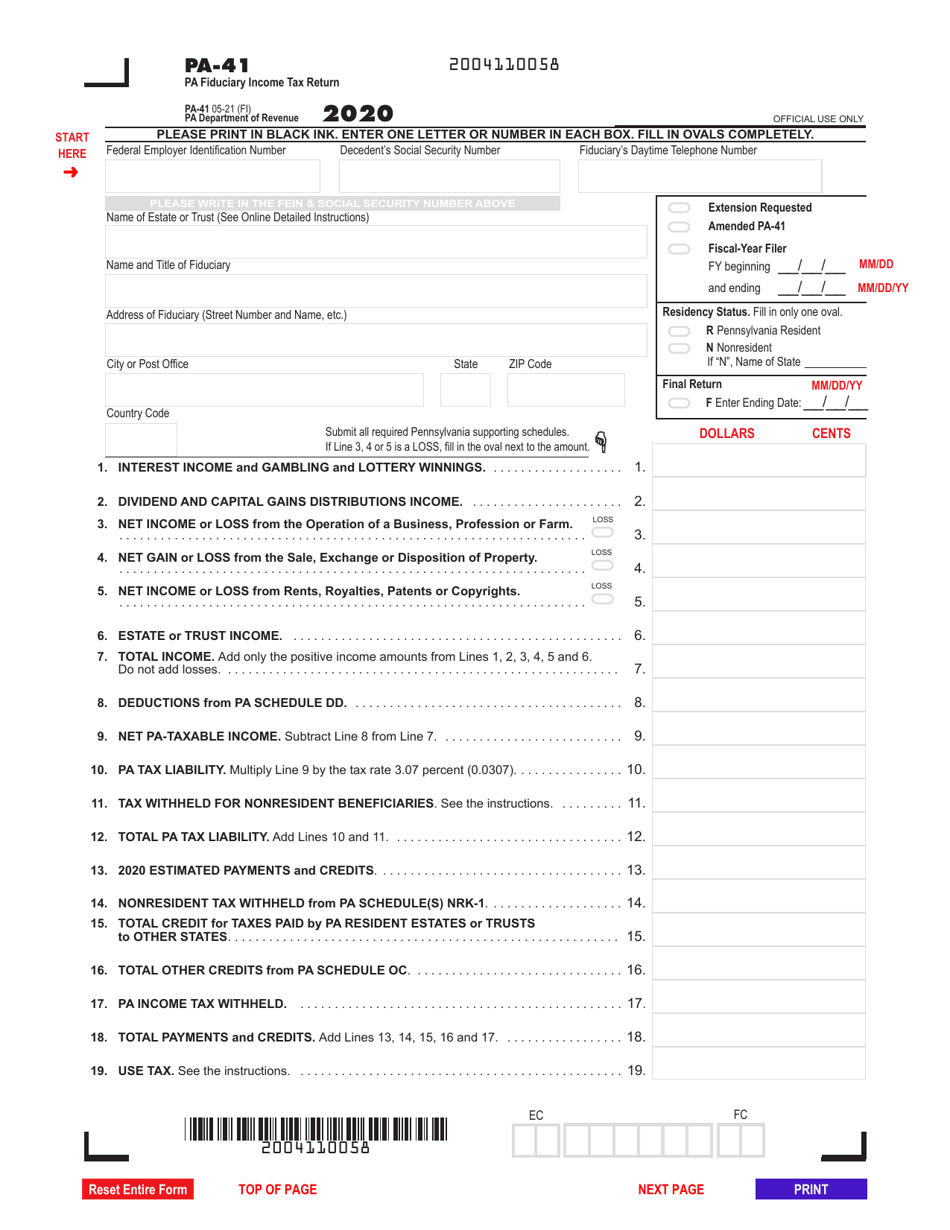

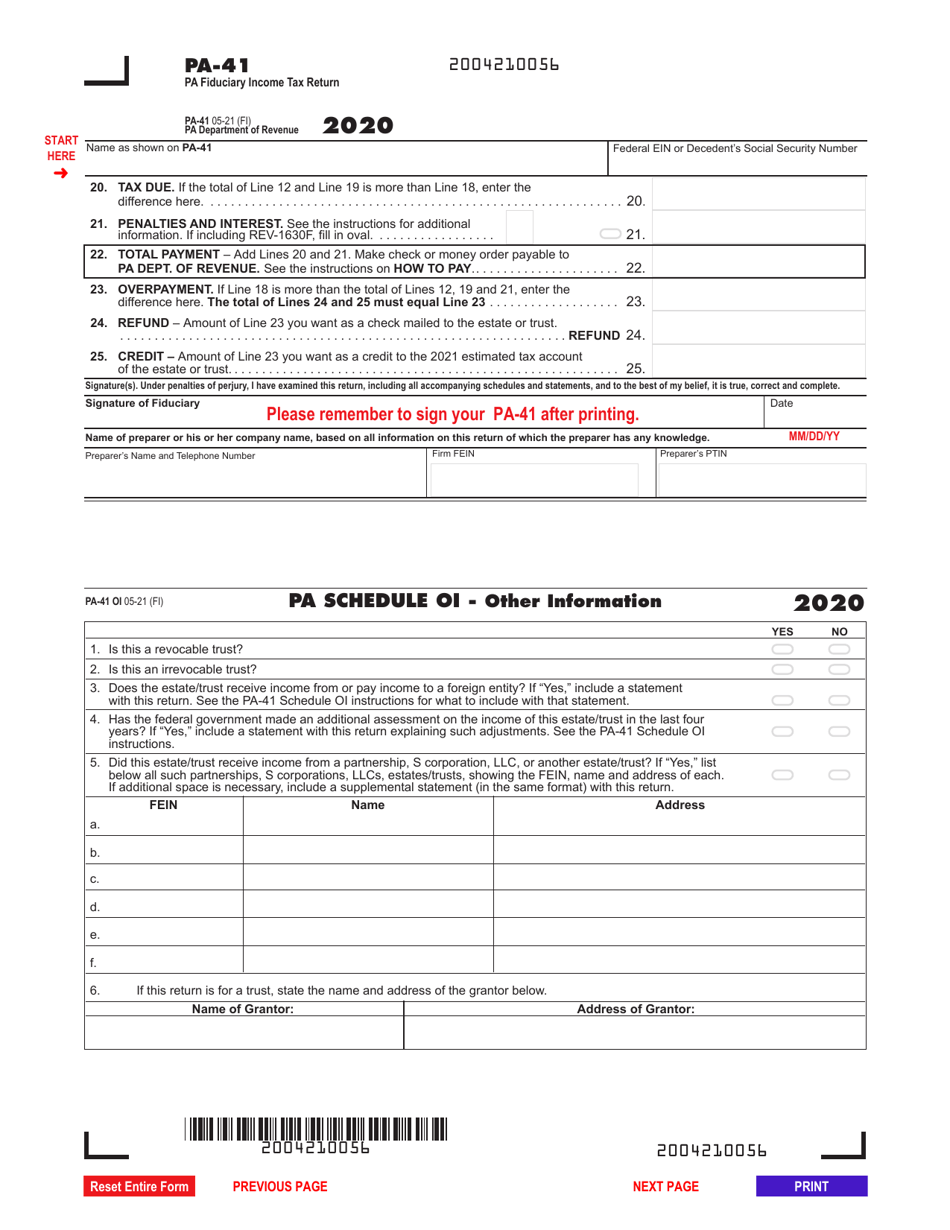

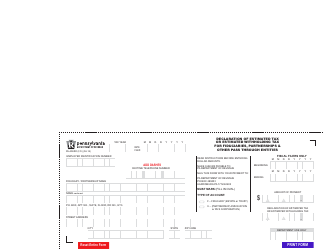

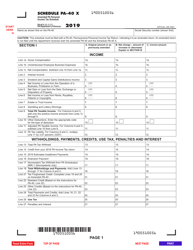

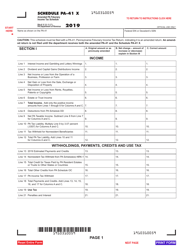

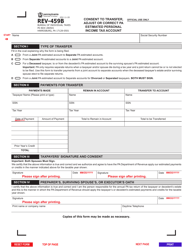

Form PA-41 Pa Fiduciary Income Tax Return - Pennsylvania

What Is Form PA-41?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

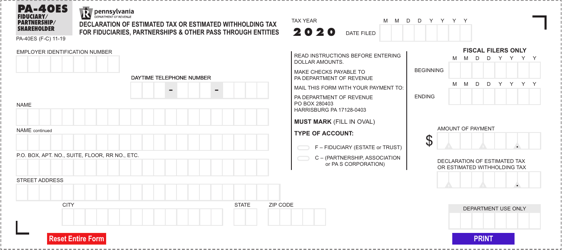

Q: What is Form PA-41?

A: Form PA-41 is the Pennsylvania Fiduciary Income Tax Return.

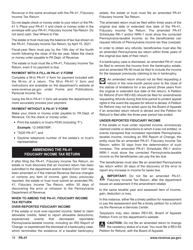

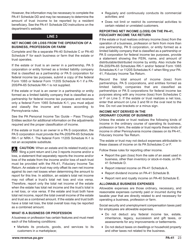

Q: What is a fiduciary?

A: A fiduciary is a person or entity that is responsible for managing the financial affairs of another person or estate.

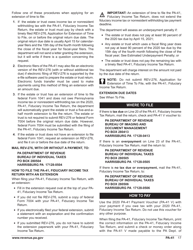

Q: Who needs to file Form PA-41?

A: Any fiduciary who has taxable income or a filing obligation in Pennsylvania needs to file Form PA-41.

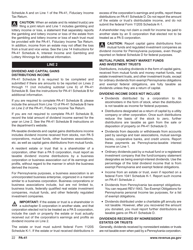

Q: What is considered taxable income for a fiduciary?

A: Taxable income for a fiduciary includes income earned on behalf of the estate or trust, such as interest, dividends, and capital gains.

Q: Are there any exemptions or deductions available for fiduciaries?

A: Yes, fiduciaries may be eligible for certain exemptions and deductions, such as deductions for expenses related to administering the estate or trust.

Q: When is Form PA-41 due?

A: Form PA-41 is due on the 15th day of the fourth month following the close of the tax year.

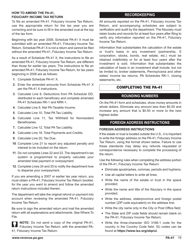

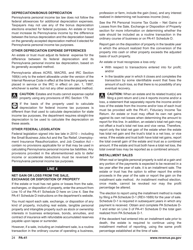

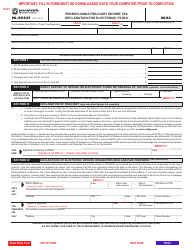

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.