This version of the form is not currently in use and is provided for reference only. Download this version of

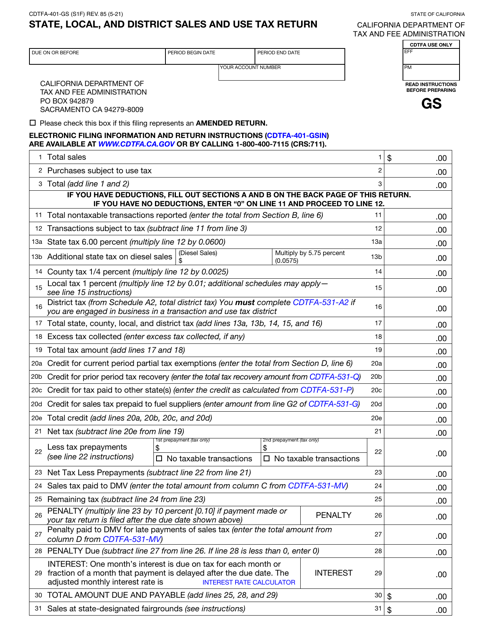

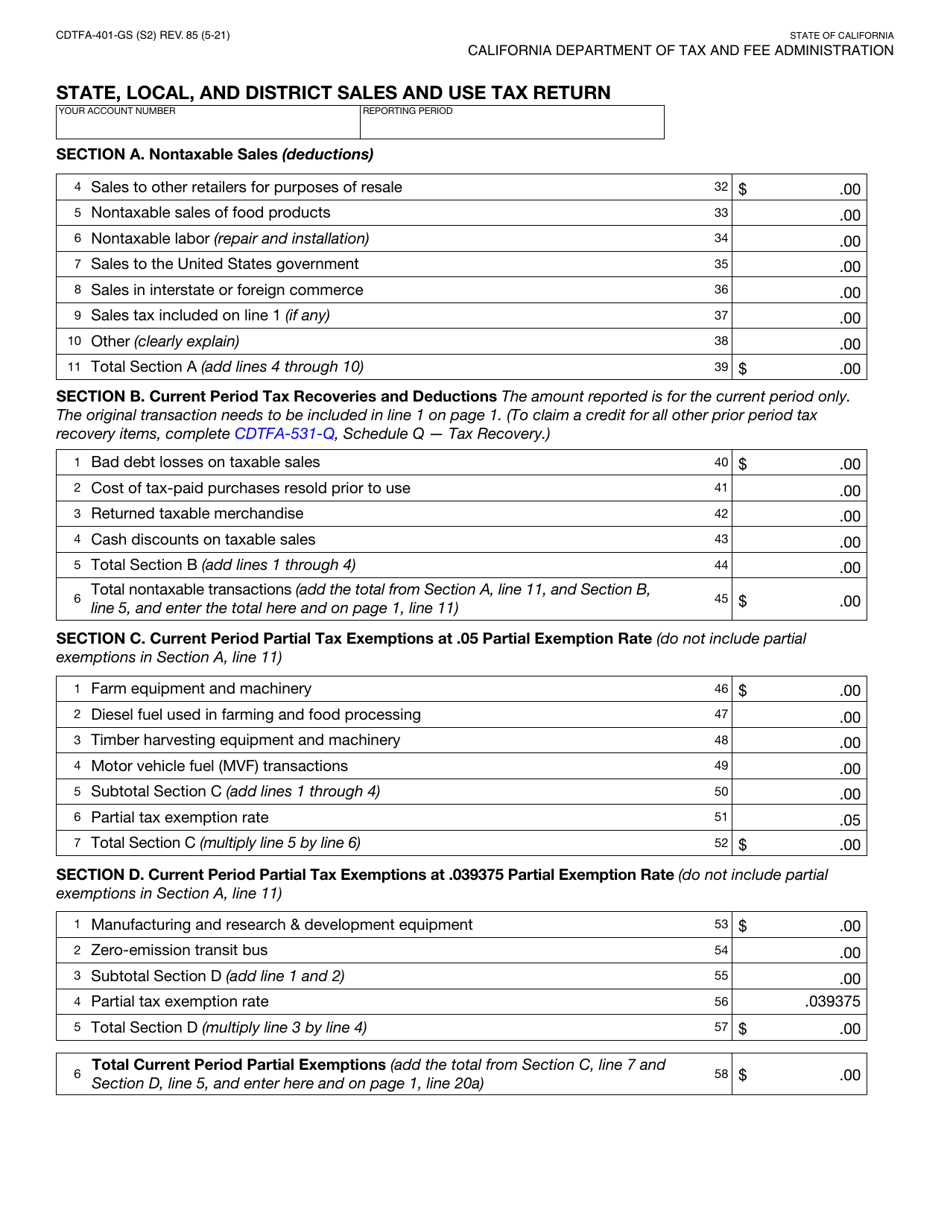

Form CDTFA-401-GS

for the current year.

Form CDTFA-401-GS State, Local, and District Sales and Use Tax Return - California

What Is Form CDTFA-401-GS?

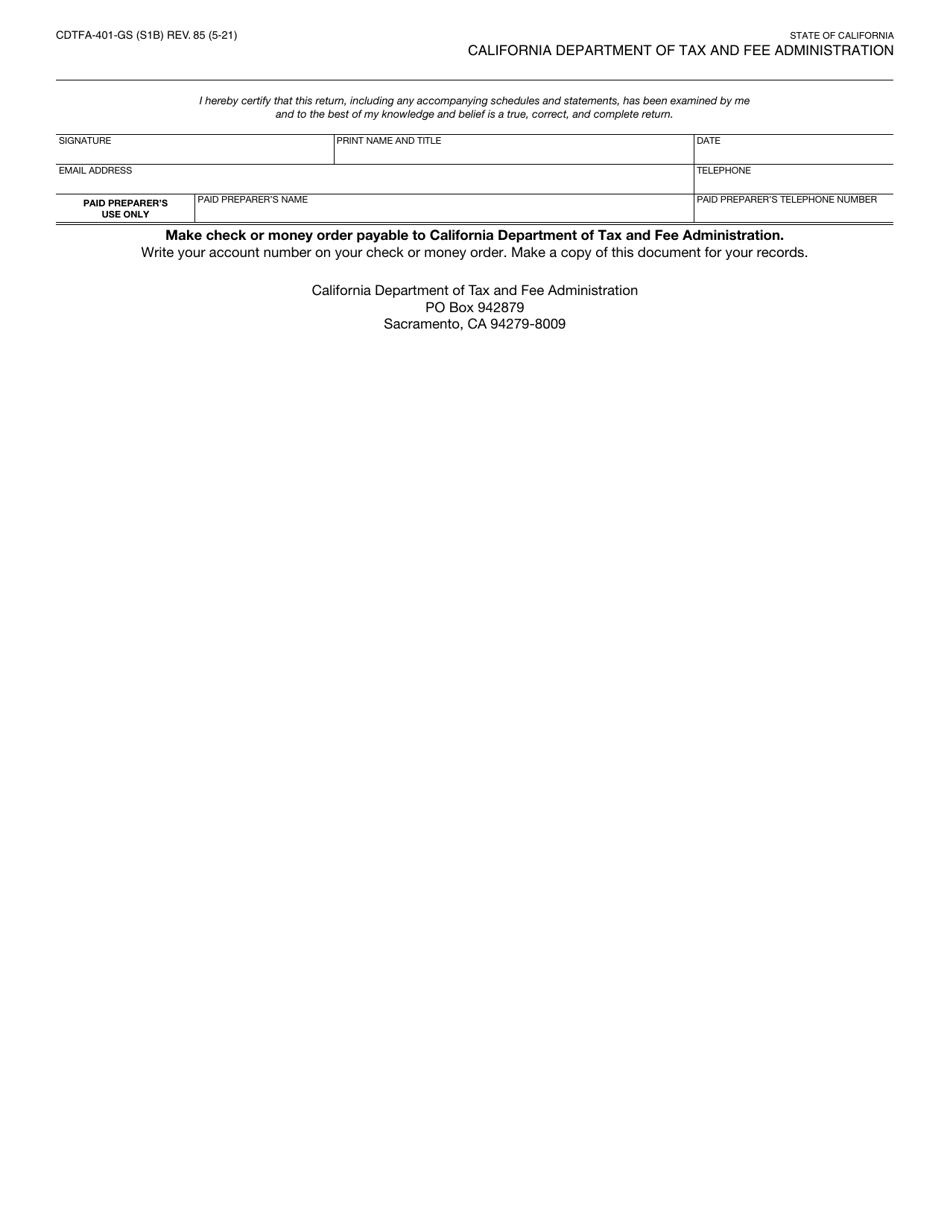

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is CDTFA-401-GS?

A: CDTFA-401-GS is the State, Local, and District Sales and Use Tax Return form for California.

Q: What is the purpose of CDTFA-401-GS?

A: The purpose of CDTFA-401-GS is to report and pay the state, local, and district sales and use taxes in California.

Q: Who needs to fill out CDTFA-401-GS?

A: Anyone who is liable for collecting and remitting sales and use taxes in California needs to fill out CDTFA-401-GS.

Q: How often do I need to file CDTFA-401-GS?

A: The frequency of filing CDTFA-401-GS depends on your sales tax liability. It can be filed monthly, quarterly, or annually.

Q: What if I don't file CDTFA-401-GS?

A: Failure to file CDTFA-401-GS or remit the correct amount of sales and use tax can result in penalties and interest.

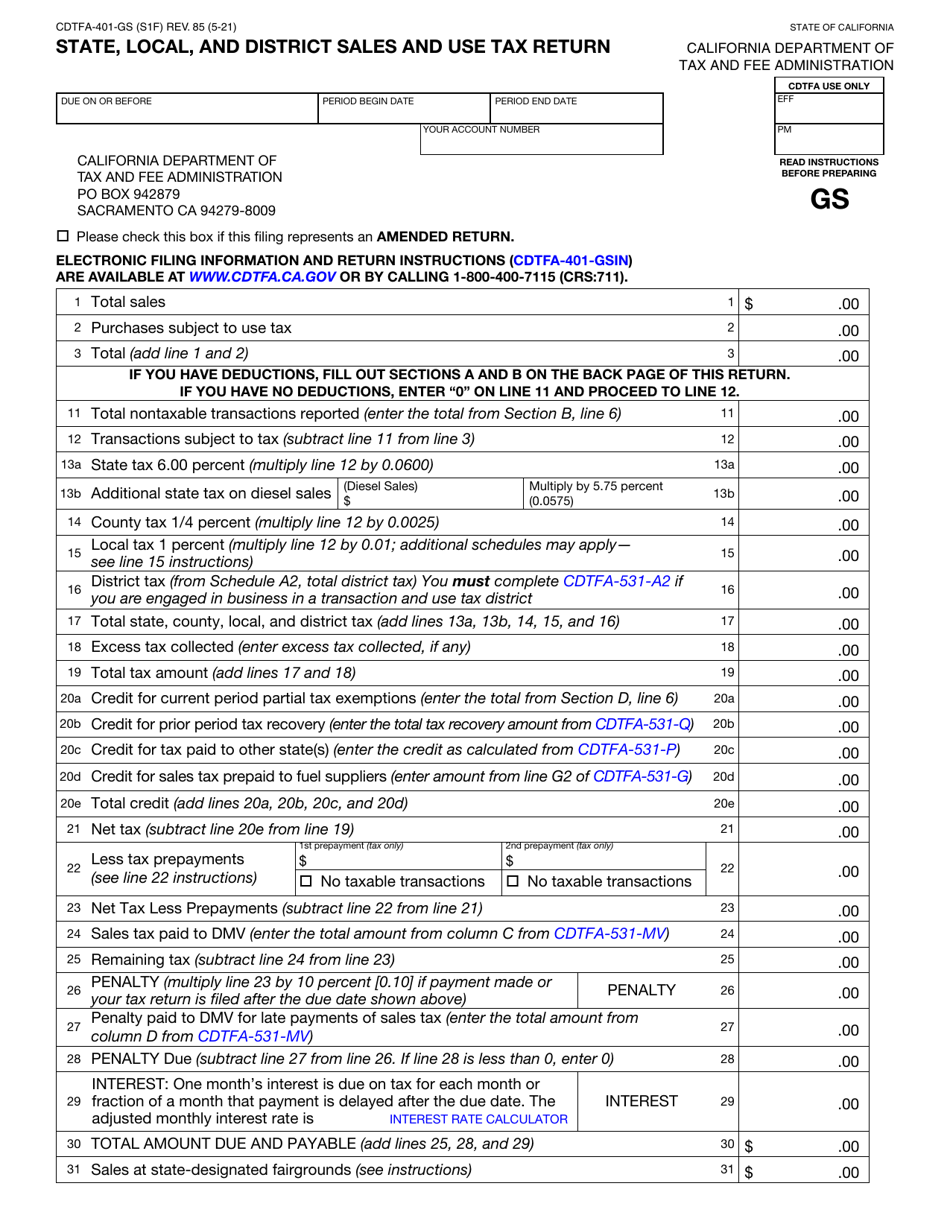

Q: Are there any exemptions or deductions on CDTFA-401-GS?

A: Yes, there are certain exemptions and deductions that may apply on CDTFA-401-GS. The instructions on the form provide details on how to claim them.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-GS by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.