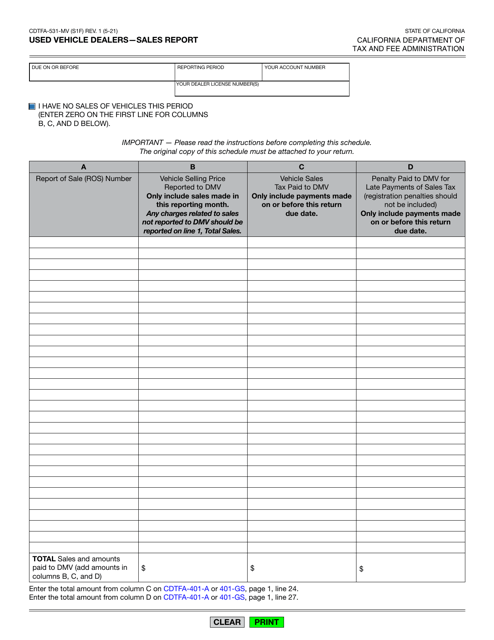

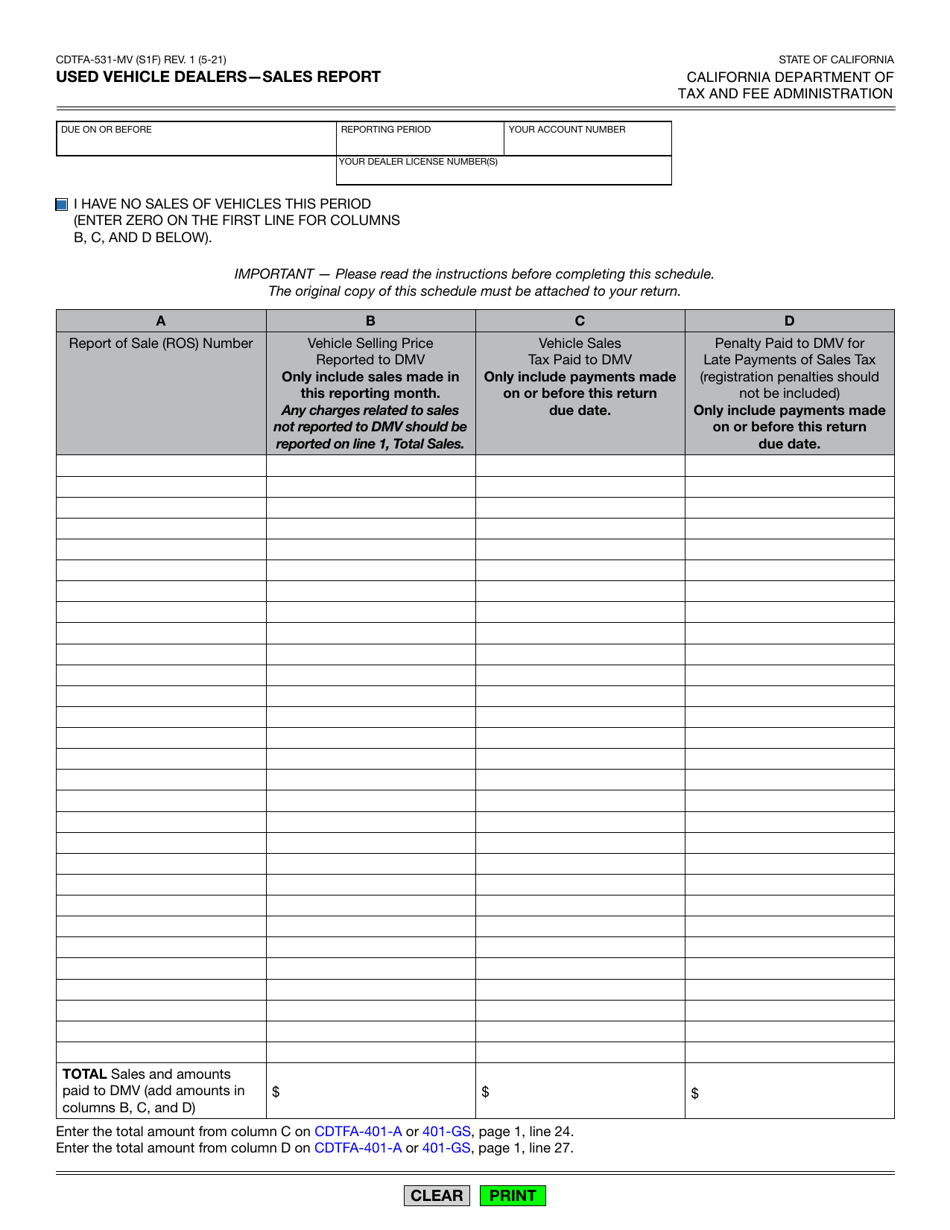

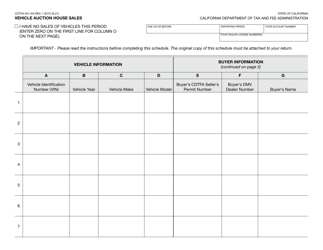

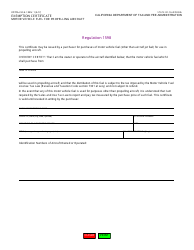

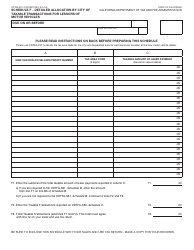

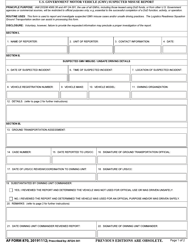

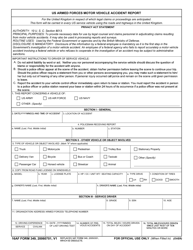

Form CDTFA-531-MV Used Vehicle Dealers - Sales Report - California

What Is Form CDTFA-531-MV?

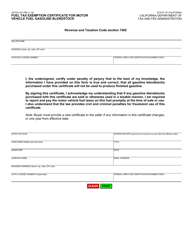

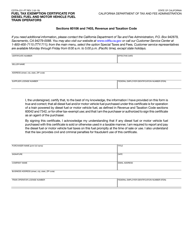

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-531-MV?

A: Form CDTFA-531-MV is a sales report used by used vehicle dealers in California.

Q: Who uses Form CDTFA-531-MV?

A: Used vehicle dealers in California use Form CDTFA-531-MV.

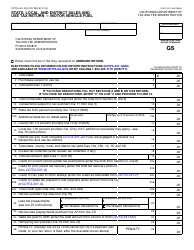

Q: What is the purpose of Form CDTFA-531-MV?

A: The purpose of Form CDTFA-531-MV is to report sales made by used vehicle dealers in California.

Q: When should Form CDTFA-531-MV be filed?

A: Form CDTFA-531-MV should be filed quarterly.

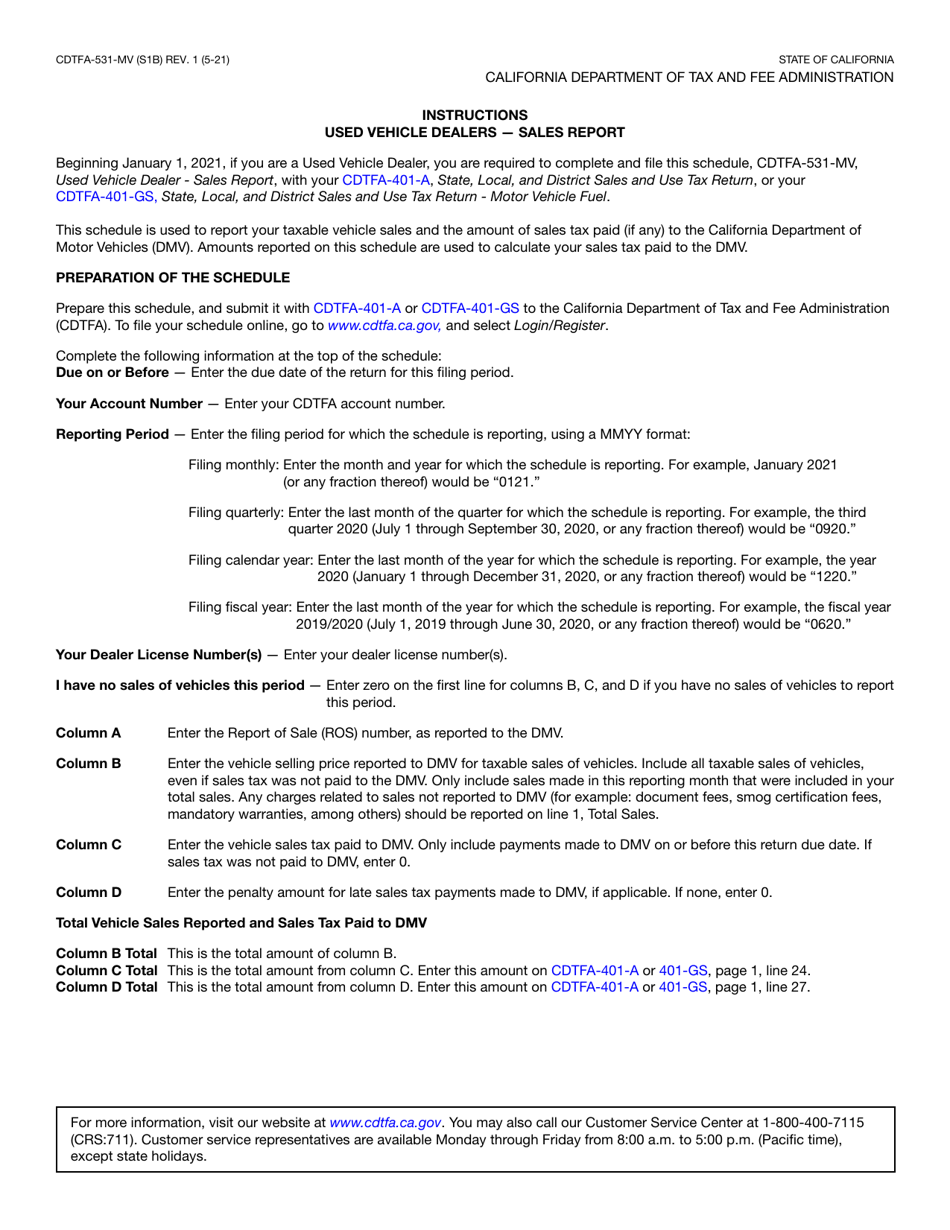

Q: Are there any specific requirements for filling out Form CDTFA-531-MV?

A: Yes, there are specific requirements for filling out Form CDTFA-531-MV. These requirements include providing detailed information about the sales made by the used vehicle dealer.

Q: Is Form CDTFA-531-MV used for both new and used vehicle sales?

A: No, Form CDTFA-531-MV is specifically used for reporting sales of used vehicles.

Q: What are the consequences of not filing Form CDTFA-531-MV?

A: Failure to file Form CDTFA-531-MV can result in penalties and interest charges.

Q: Is there a fee for filing Form CDTFA-531-MV?

A: No, there is no fee for filing Form CDTFA-531-MV.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-531-MV by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.