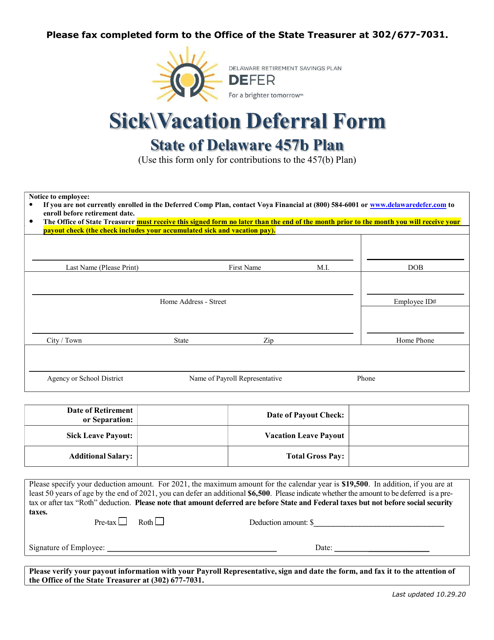

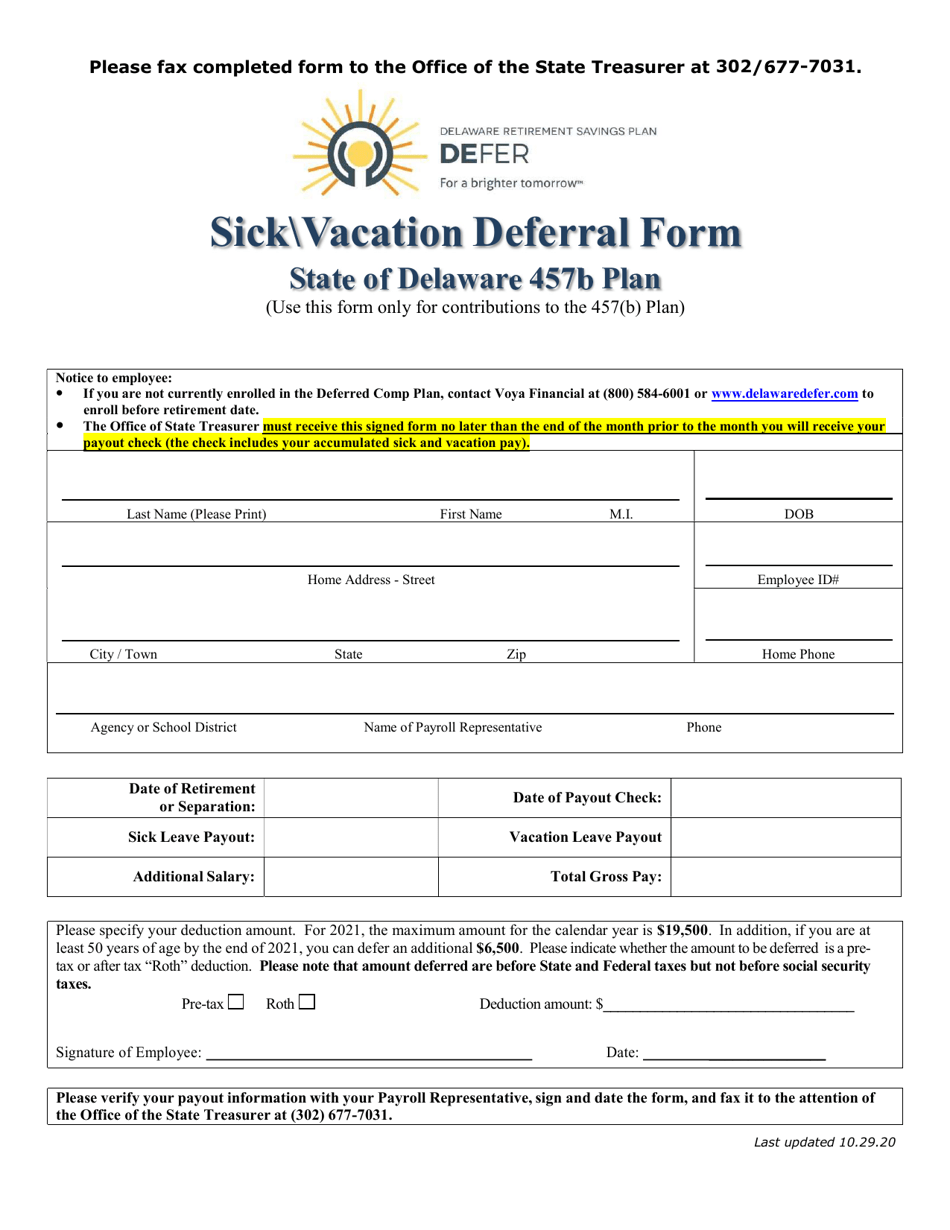

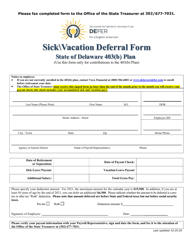

Sick and Vacation Deferral Form 457b - Delaware

Sick and Vacation Deferral Form 457b is a legal document that was released by the Delaware Office of the State Treasurer - a government authority operating within Delaware.

FAQ

Q: What is the Sick and Vacation Deferral Form 457b?

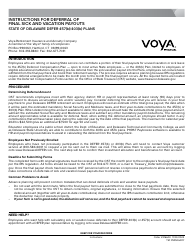

A: The Sick and Vacation Deferral Form 457b is a form used in Delaware to defer sick and vacation leave payouts into a tax-deferred retirement account.

Q: Who is eligible to use the Sick and Vacation Deferral Form 457b?

A: Employees in Delaware who have accumulated sick and vacation leave are eligible to use this form.

Q: What does it mean to defer sick and vacation leave payouts?

A: Deferring sick and vacation leave payouts means that instead of receiving a cash payout for unused leave, the amount is contributed to a retirement account and is not subject to immediate taxation.

Q: Is the use of the Sick and Vacation Deferral Form 457b mandatory?

A: No, the use of this form is voluntary. Employees have the option to choose whether to defer their sick and vacation leave payouts or receive them as cash.

Q: What are the benefits of using the Sick and Vacation Deferral Form 457b?

A: The main benefit is the tax advantage of deferring the payouts into a retirement account. It allows employees to potentially save on immediate taxes and increase their retirement savings.

Form Details:

- Released on October 29, 2020;

- The latest edition currently provided by the Delaware Office of the State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Office of the State Treasurer.