This version of the form is not currently in use and is provided for reference only. Download this version of

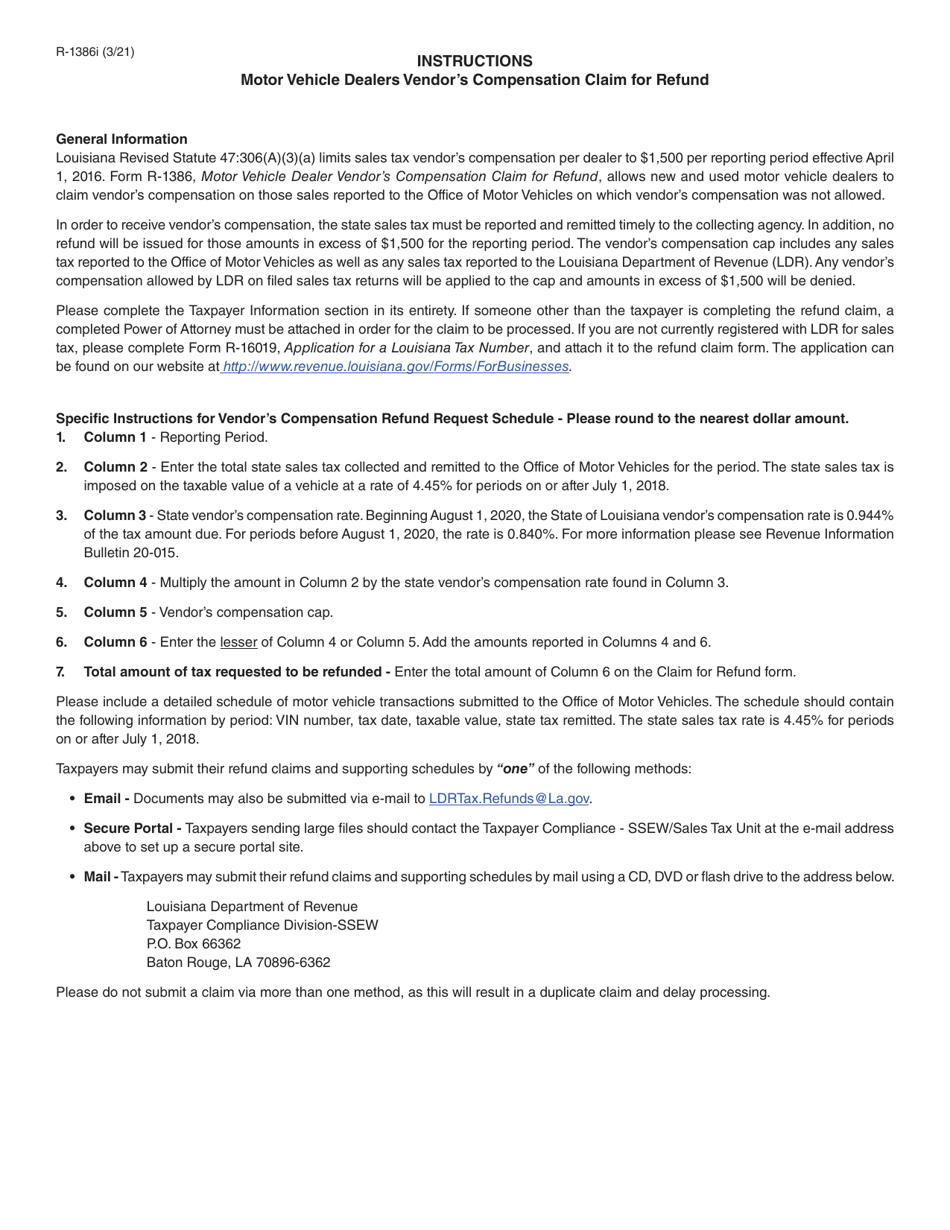

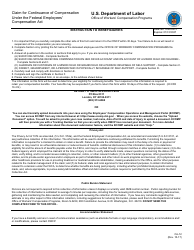

Form R-1386

for the current year.

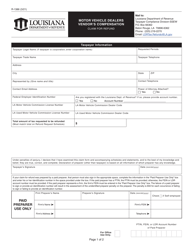

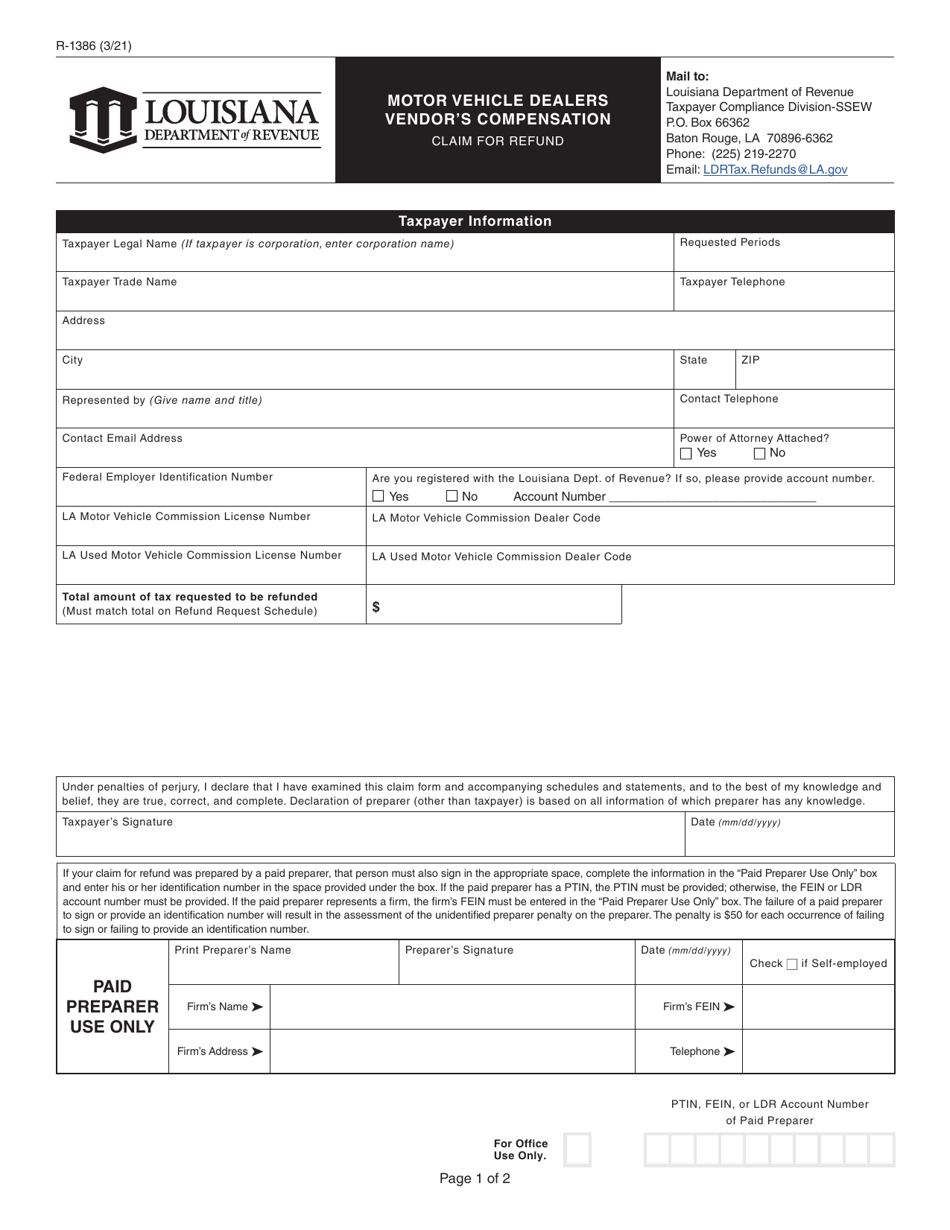

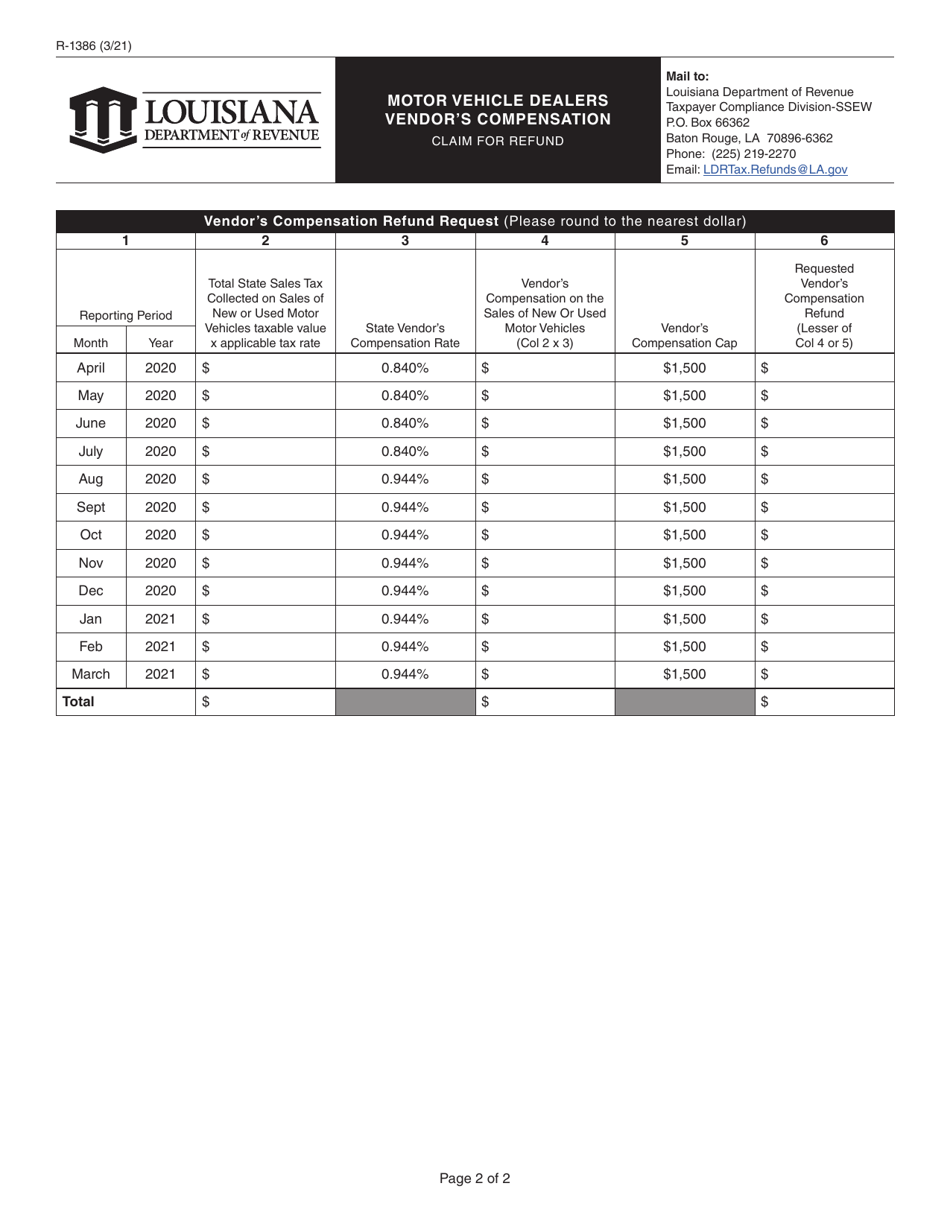

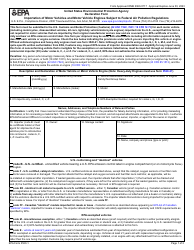

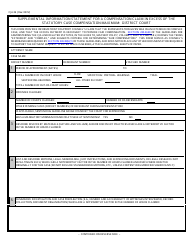

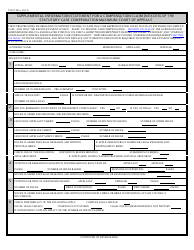

Form R-1386 Motor Vehicle Dealers Vendor's Compensation Claim for Refund - Louisiana

What Is Form R-1386?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1386?

A: Form R-1386 is a Motor Vehicle Dealers Vendor's Compensation Claim for Refund form in Louisiana.

Q: Who should use Form R-1386?

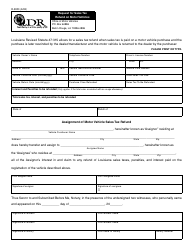

A: Motor vehicle dealers in Louisiana should use Form R-1386 to claim vendor compensation refunds.

Q: What is vendor compensation?

A: Vendor compensation is a refund given to motor vehicle dealers for collecting and remitting sales and use tax.

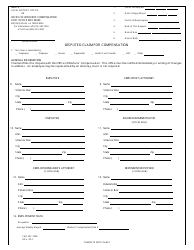

Q: What information is required on Form R-1386?

A: Form R-1386 requires information such as dealer's name and address, vehicle identification numbers, and sales tax collected.

Q: How should I submit Form R-1386?

A: You should submit Form R-1386 to the Louisiana Department of Revenue along with supporting documentation.

Q: Is there a deadline for submitting Form R-1386?

A: Yes, Form R-1386 must be filed within three years from the date the tax was paid or within one year of the final determination of a claim or refund.

Q: What should I do if I need assistance with Form R-1386?

A: If you need assistance with Form R-1386, you can contact the Louisiana Department of Revenue or consult a tax professional.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1386 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.