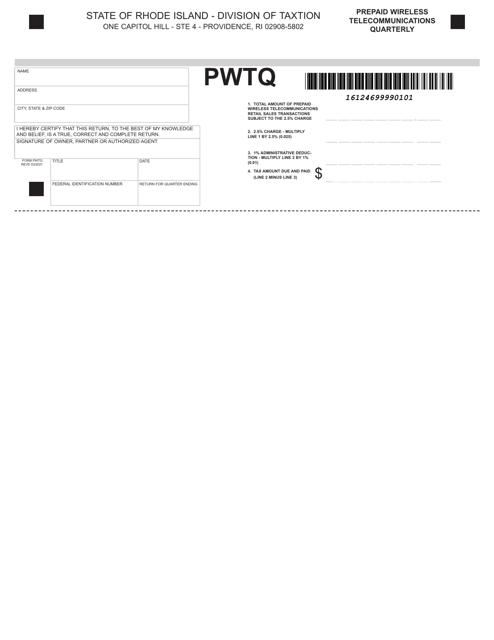

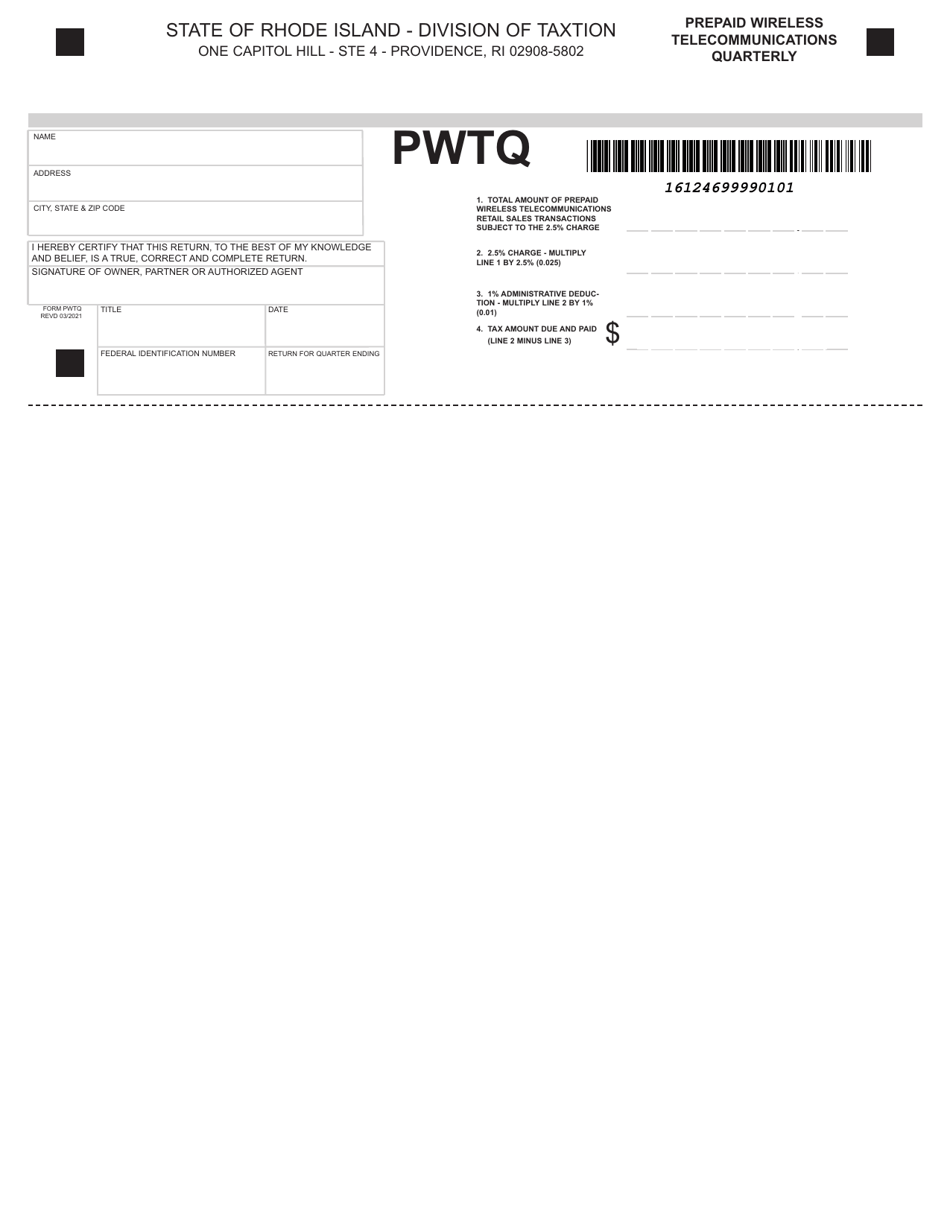

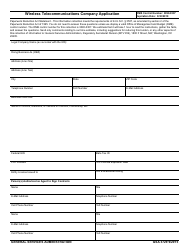

Form PWTQ Prepaid Wireless Telecommunications Quarterly - Rhode Island

What Is Form PWTQ?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PWTQ?

A: PWTQ stands for Prepaid Wireless Telecommunications Quarterly.

Q: What is the purpose of PWTQ?

A: The purpose of PWTQ is to report and remit taxes on prepaid wireless services.

Q: Who needs to file PWTQ?

A: Any business that sells prepaid wireless services in Rhode Island needs to file PWTQ.

Q: How often do you need to file PWTQ?

A: PWTQ needs to be filed on a quarterly basis.

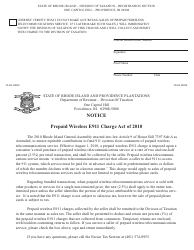

Q: What taxes are reported on PWTQ?

A: PWTQ is used to report and remit the prepaid wireless E-911 and sales and use taxes.

Q: Is there a penalty for late filing of PWTQ?

A: Yes, there are penalties for late filing of PWTQ. It is important to file on time to avoid penalties.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PWTQ by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.