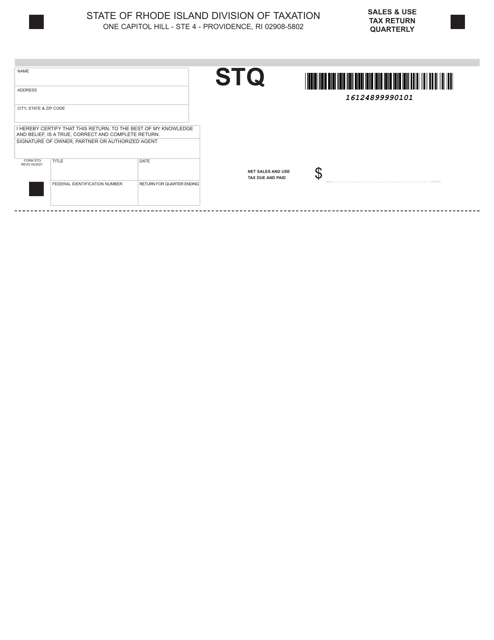

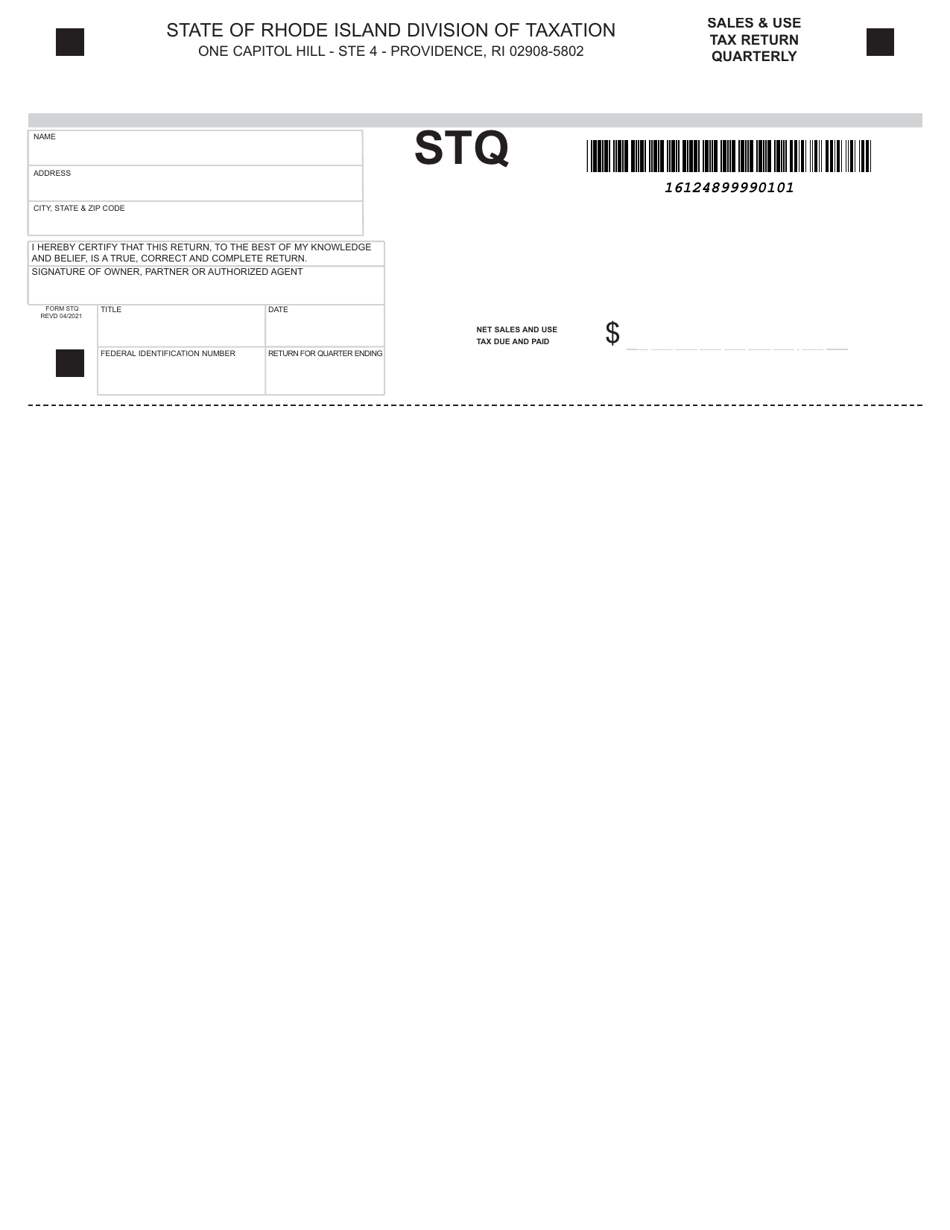

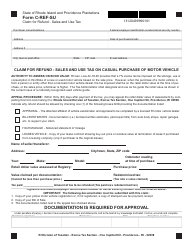

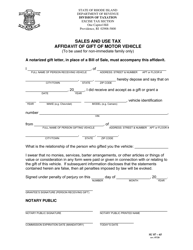

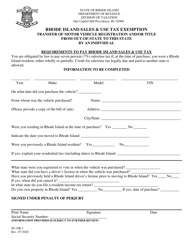

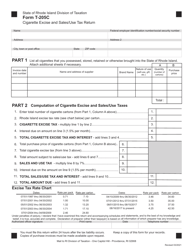

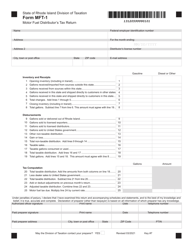

Form STQ Quarterly Sales / Use Tax Return for Sales / Use, Cigarette Retailers and Motor Vehicle Dealer Sales - Rhode Island

What Is Form STQ?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STQ?

A: Form STQ is the Quarterly Sales/Use Tax Return for Sales/Use, Cigarette Retailers and Motor Vehicle Dealer Sales in Rhode Island.

Q: Who needs to file Form STQ?

A: Businesses engaged in sales or use tax, cigarette retail, or motor vehicle dealer sales in Rhode Island need to file Form STQ.

Q: What is the purpose of Form STQ?

A: Form STQ is used to report and pay sales/use tax, cigarette retail, and motor vehicle dealer sales tax in Rhode Island.

Q: How often is Form STQ filed?

A: Form STQ is filed quarterly, meaning it is due every three months.

Q: What information do I need to complete Form STQ?

A: You will need to gather information about your sales, use tax, cigarette retail, and motor vehicle dealer sales in Rhode Island.

Q: Are there any penalties for not filing Form STQ?

A: Yes, failure to file Form STQ or pay the required taxes can result in penalties and interest.

Q: Can I make changes to Form STQ after filing?

A: Yes, you can make changes to your Form STQ after filing by filing an amended return.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STQ by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.