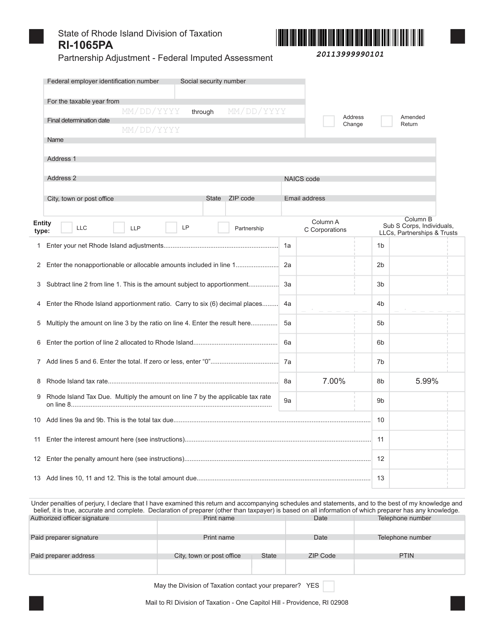

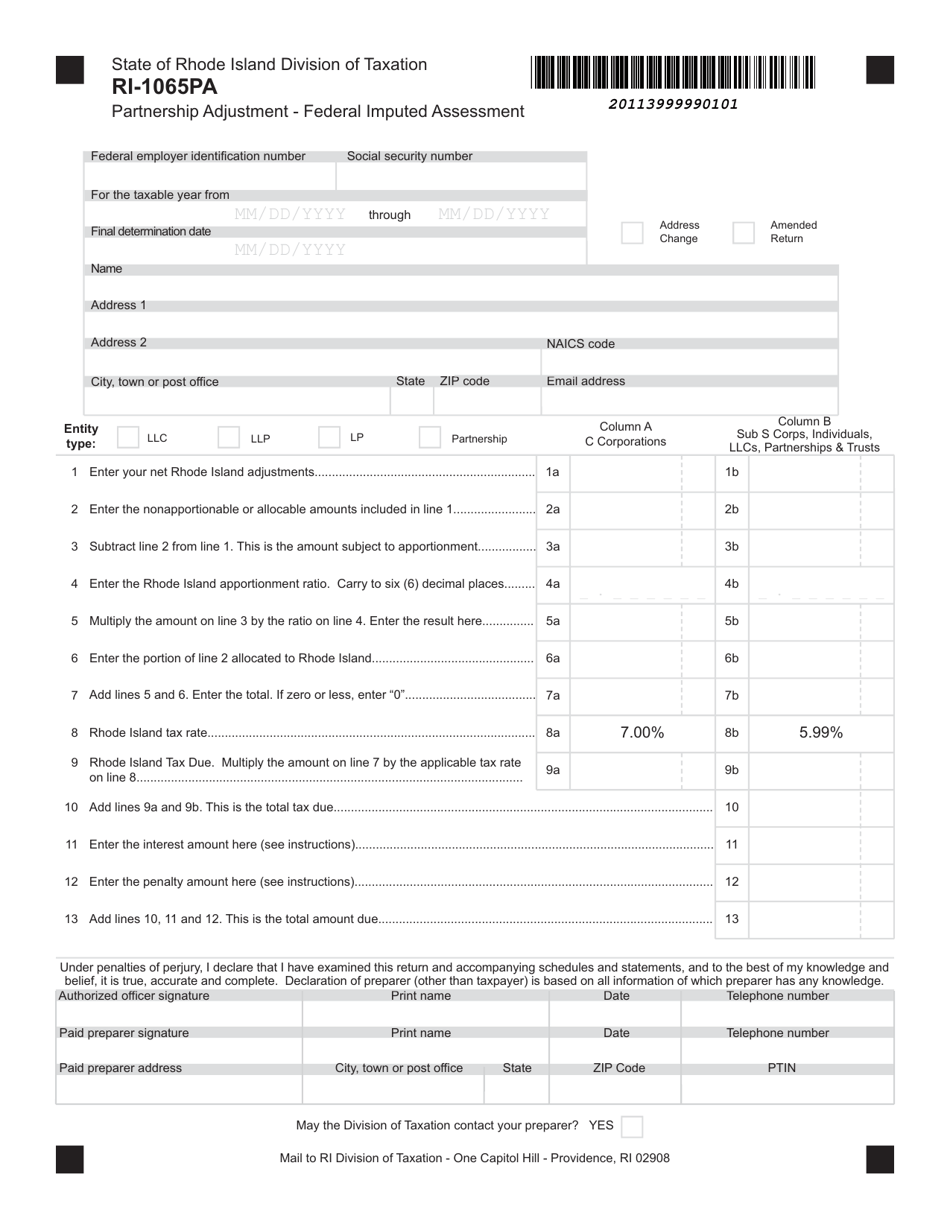

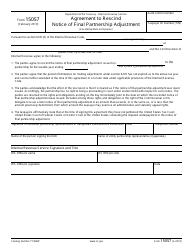

Form RI-1065PA Partnership Adjustment - Federal Imputed Assessment - Rhode Island

What Is Form RI-1065PA?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

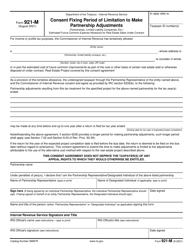

Q: What is Form RI-1065PA?

A: Form RI-1065PA is a partnership adjustment form used in Rhode Island.

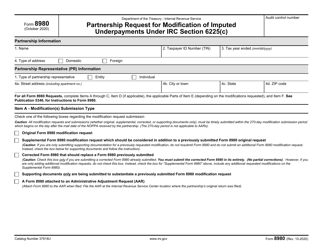

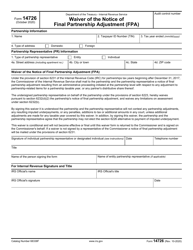

Q: What is a partnership adjustment?

A: A partnership adjustment refers to changes made to the income, deductions, credits, or other tax items reported by a partnership.

Q: What is a federal imputed assessment?

A: A federal imputed assessment is the amount determined by the Internal Revenue Service (IRS) for Rhode Island purposes.

Q: Who needs to file Form RI-1065PA?

A: Partnerships that have received a federal imputed assessment from the IRS and are doing business in Rhode Island need to file Form RI-1065PA.

Q: What information do I need to complete Form RI-1065PA?

A: You will need information about the federal imputed assessment, including the amount and any related adjustments.

Q: When is the deadline to file Form RI-1065PA?

A: The deadline to file Form RI-1065PA is the same as the partnership's federal income tax return due date, including extensions.

Q: Are there any penalties for late filing?

A: Yes, late filing of Form RI-1065PA may result in penalties and interest.

Q: Can Form RI-1065PA be e-filed?

A: No, Form RI-1065PA cannot be e-filed. It must be filed by mail or delivered in person to the Rhode Island Division of Taxation.

Q: Is there a fee to file Form RI-1065PA?

A: No, there is no fee to file Form RI-1065PA.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1065PA by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.