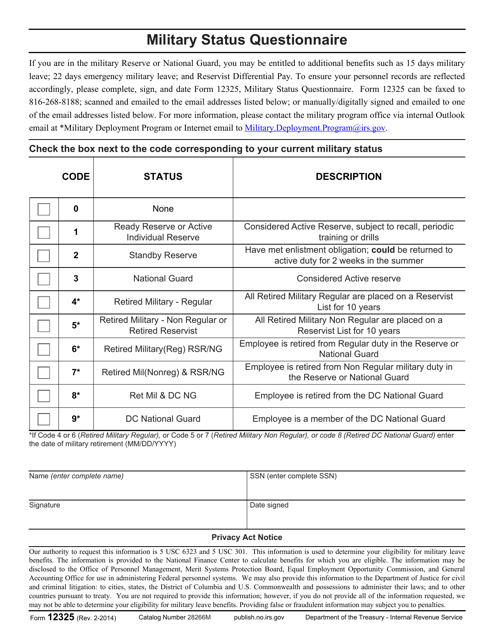

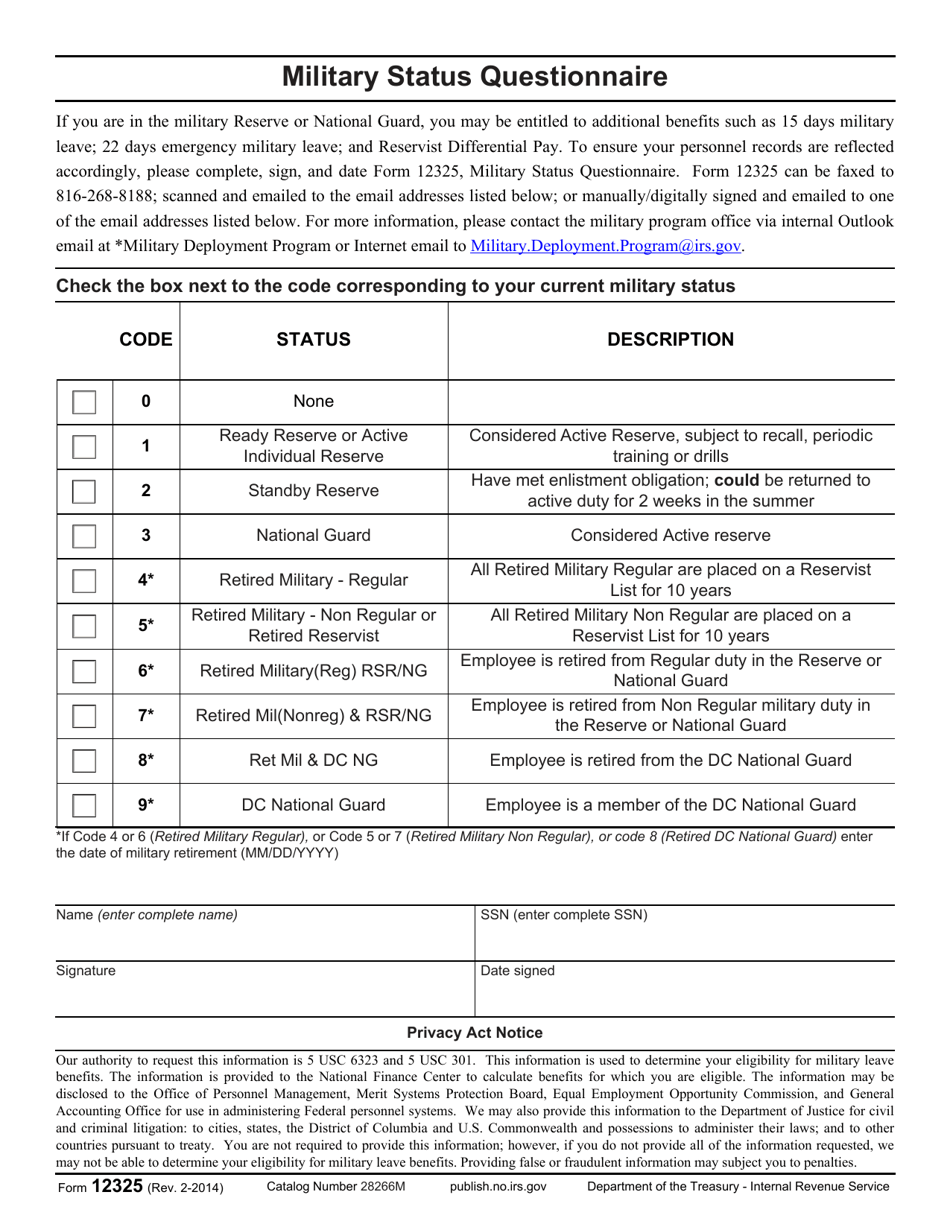

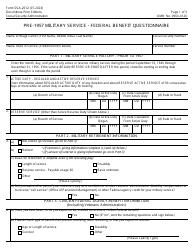

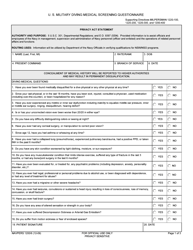

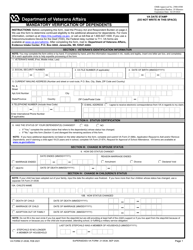

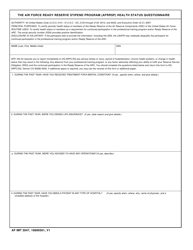

IRS Form 12325 Military Status Questionnaire

What Is IRS Form 12325?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2014. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 12325?

A: IRS Form 12325 is a Military Status Questionnaire.

Q: Who needs to fill out IRS Form 12325?

A: IRS Form 12325 is typically filled out by members of the military.

Q: Why is IRS Form 12325 required?

A: IRS Form 12325 is required to determine the tax status of military personnel.

Q: When should IRS Form 12325 be filed?

A: IRS Form 12325 should be filed when requested by the IRS or as part of the annual taxfiling process for military personnel.

Q: What information is required on IRS Form 12325?

A: IRS Form 12325 typically requires information such as name, rank, military unit, and other details related to military service.

Q: Is IRS Form 12325 confidential?

A: Yes, the information provided on IRS Form 12325 is confidential and protected by privacy laws.

Q: Can I e-file IRS Form 12325?

A: No, IRS Form 12325 cannot be e-filed and must be submitted in paper form.

Q: What happens if I don't fill out IRS Form 12325?

A: Failing to fill out IRS Form 12325 when required may result in delays or issues with tax filings for military personnel.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 12325 through the link below or browse more documents in our library of IRS Forms.