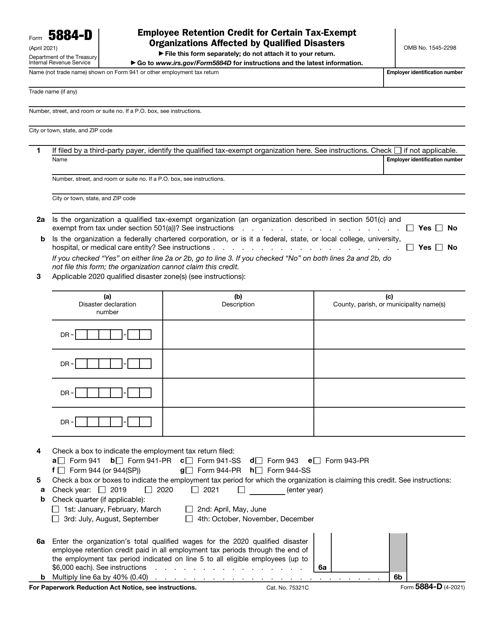

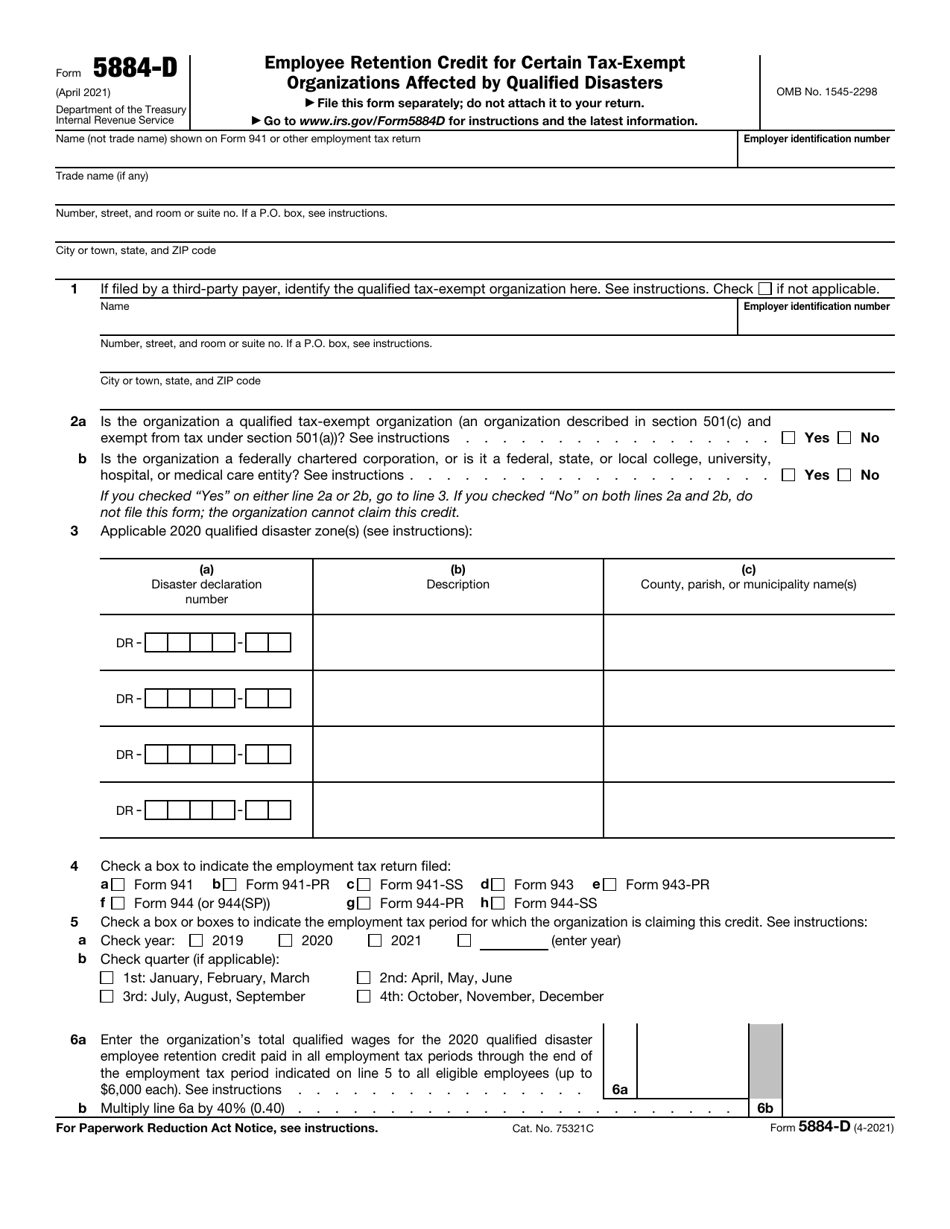

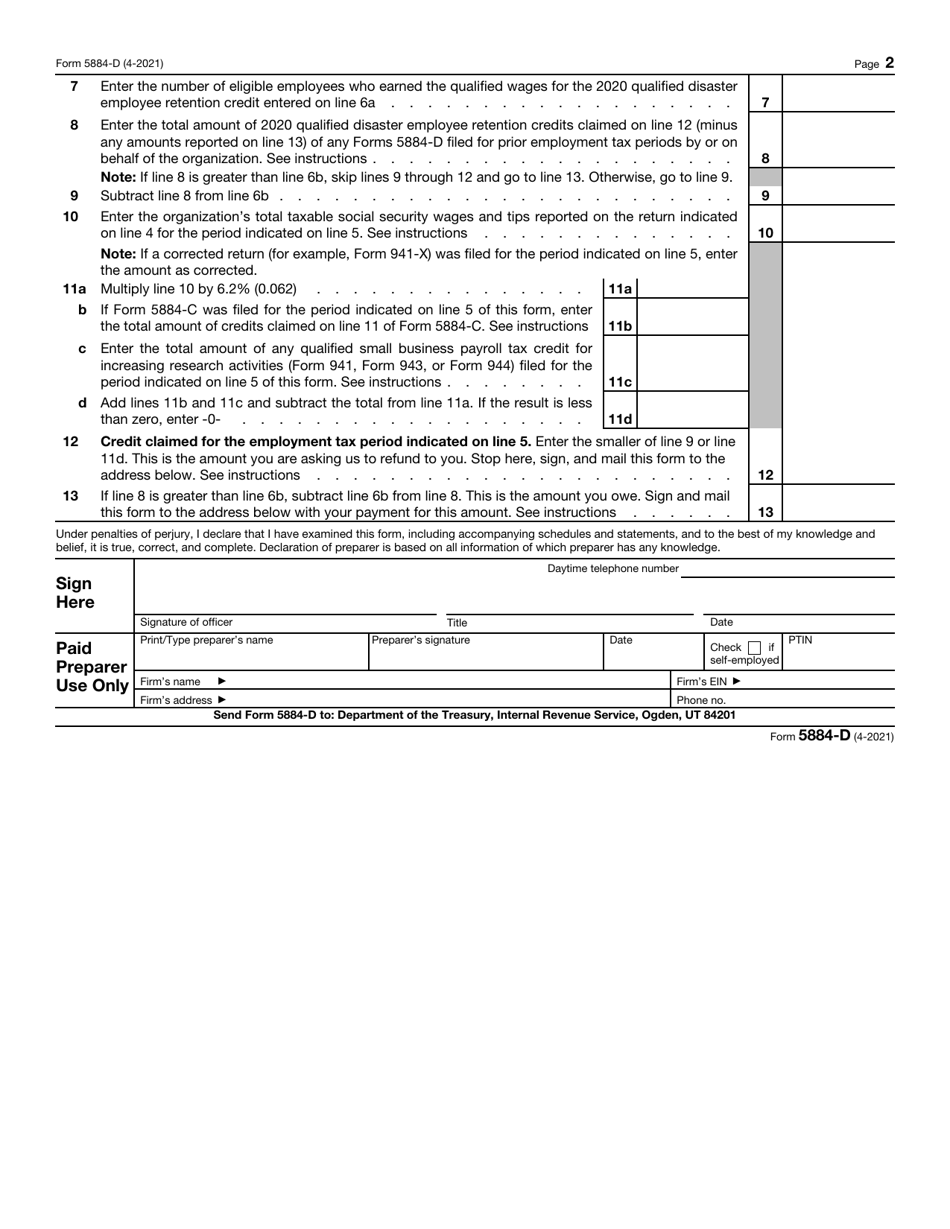

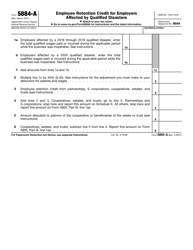

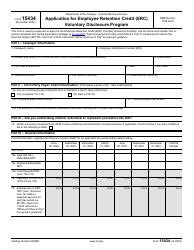

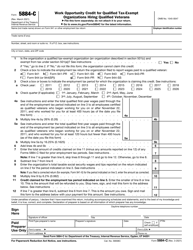

IRS Form 5884-D Employee Retention Credit for Certain Tax-Exempt Organizations Affected by Qualified Disasters

What Is IRS Form 5884-D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 5884-D?

A: IRS Form 5884-D is the Employee Retention Credit for Certain Tax-Exempt Organizations Affected by Qualified Disasters.

Q: Who is eligible to use IRS Form 5884-D?

A: Tax-exempt organizations that have been affected by qualified disasters are eligible to use IRS Form 5884-D.

Q: What is the Employee Retention Credit?

A: The Employee Retention Credit is a tax credit available to eligible employers who retain employees during periods of qualified disaster.

Q: What are qualified disasters?

A: Qualified disasters are events such as hurricanes, wildfires, tornadoes, or other natural disasters as declared by the President of the United States.

Q: What is the purpose of IRS Form 5884-D?

A: IRS Form 5884-D is used to calculate and claim the Employee Retention Credit for certain tax-exempt organizations affected by qualified disasters.

Q: Are there any deadlines to submit IRS Form 5884-D?

A: Yes, the deadlines to submit IRS Form 5884-D may vary depending on the specific disaster event. It is important to consult the IRS guidelines or seek professional advice to determine the deadline for a particular situation.

Q: What documentation is required when filing IRS Form 5884-D?

A: When filing IRS Form 5884-D, you may need to provide documentation such as records of employee wages and hours, accounting reports, and other relevant information.

Q: Can tax-exempt organizations claim the Employee Retention Credit for multiple qualified disasters?

A: Yes, tax-exempt organizations can claim the Employee Retention Credit for multiple qualified disasters, as long as they meet the eligibility criteria for each event.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5884-D through the link below or browse more documents in our library of IRS Forms.