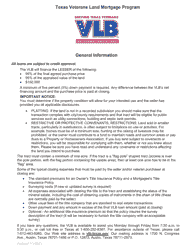

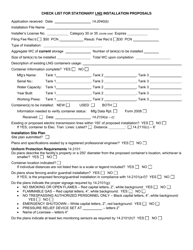

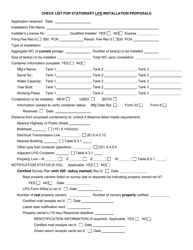

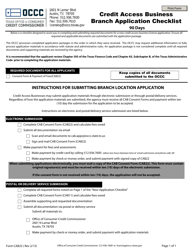

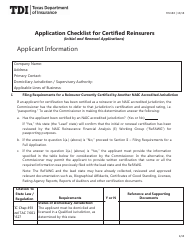

Land Loan Application Checklist - Texas

Land Loan Application Checklist is a legal document that was released by the Texas Veterans Land Board - a government authority operating within Texas.

FAQ

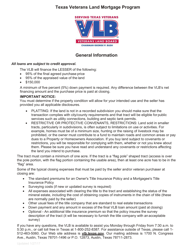

Q: What is a land loan?

A: A land loan is a loan used to purchase undeveloped land.

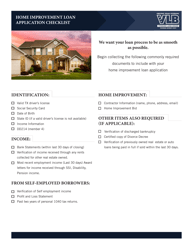

Q: What documents do I need to apply for a land loan?

A: You will typically need to provide documents such as income verification, credit history, land purchase contract, land appraisal, and property survey.

Q: What is the loan-to-value ratio for land loans?

A: Lenders usually offer land loans with a loan-to-value ratio of 70-80%, meaning they will lend up to 70-80% of the land's appraised value.

Q: What are the interest rates for land loans?

A: Interest rates for land loans can vary, but they are generally higher than rates for traditional home mortgages.

Q: What are the loan terms for land loans?

A: Loan terms for land loans are typically shorter than those for home mortgages, ranging from 5 to 20 years.

Q: Do I need a down payment for a land loan?

A: Yes, most lenders require a down payment of 20-50% of the land's purchase price.

Q: Can I use the land loan to build a house?

A: Some land loans include provisions for construction loans, allowing you to use the loan to build a house on the land.

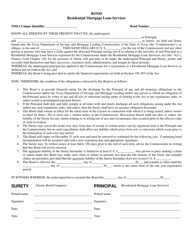

Q: What happens if I default on a land loan?

A: If you default on a land loan, the lender may take legal action to seize the property and sell it to recover their losses.

Q: Can I refinance a land loan?

A: Yes, you can refinance a land loan to potentially lower your interest rate or extend the loan term. However, the availability of refinancing options may vary depending on your lender.

Form Details:

- The latest edition currently provided by the Texas Veterans Land Board;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Veterans Land Board.