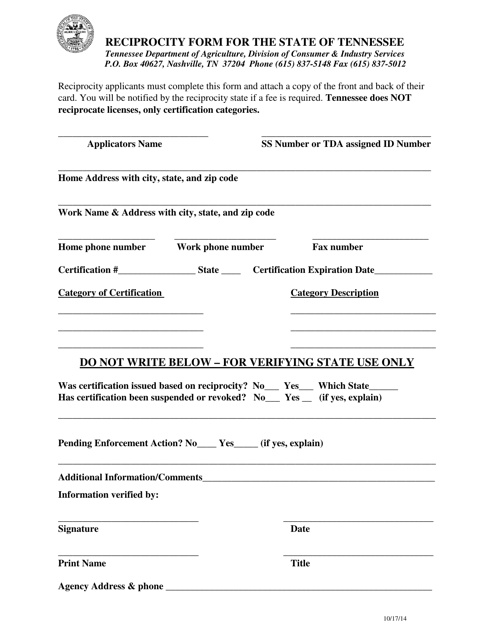

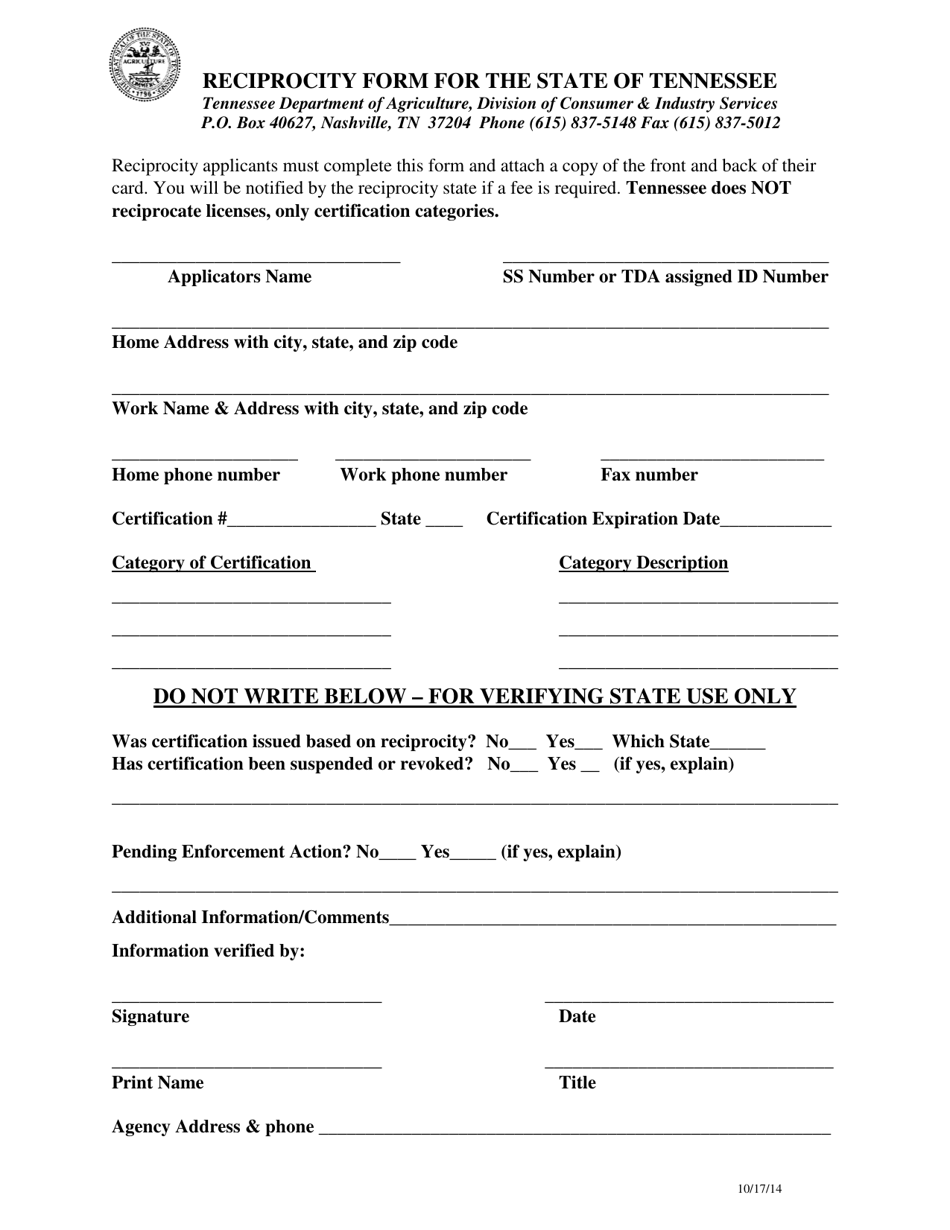

Reciprocity Form for the State of Tennessee - Tennessee

Reciprocity Form for the State of Tennessee is a legal document that was released by the Tennessee Department of Agriculture - a government authority operating within Tennessee.

FAQ

Q: What is a reciprocity form for the State of Tennessee?

A: A reciprocity form for the State of Tennessee is a document that allows residents of certain states to be exempt from paying income taxes in Tennessee.

Q: Who is eligible for a reciprocity form in Tennessee?

A: Residents of certain states are eligible for a reciprocity form in Tennessee. The specific states may vary.

Q: What is the purpose of a reciprocity form?

A: The purpose of a reciprocity form is to allow residents of eligible states to avoid double taxation on their income when working in Tennessee.

Q: How do I get a reciprocity form in Tennessee?

A: You can obtain a reciprocity form for Tennessee from your employer or the appropriate tax authority in your home state.

Q: Which states have reciprocity with Tennessee?

A: The states that have reciprocity with Tennessee for income tax purposes may change from year to year. It is best to check with the Tennessee Department of Revenue for the most up-to-date information.

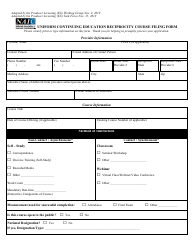

Form Details:

- Released on October 17, 2014;

- The latest edition currently provided by the Tennessee Department of Agriculture;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tennessee Department of Agriculture.