This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

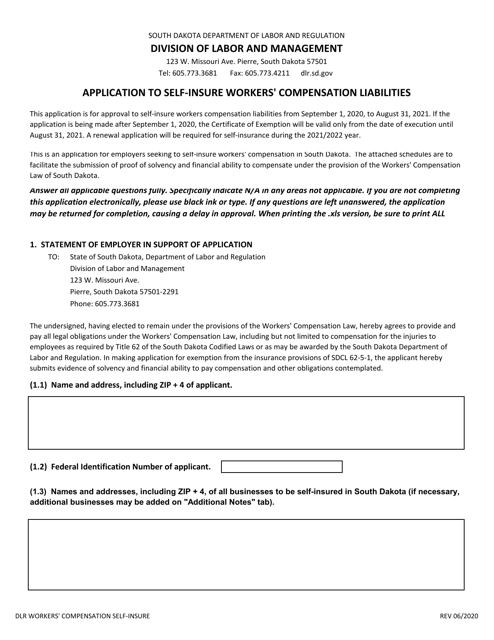

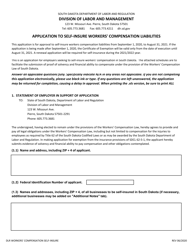

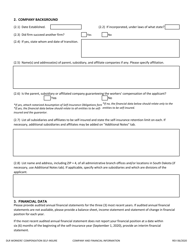

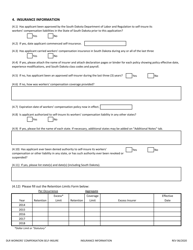

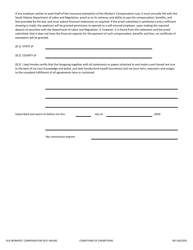

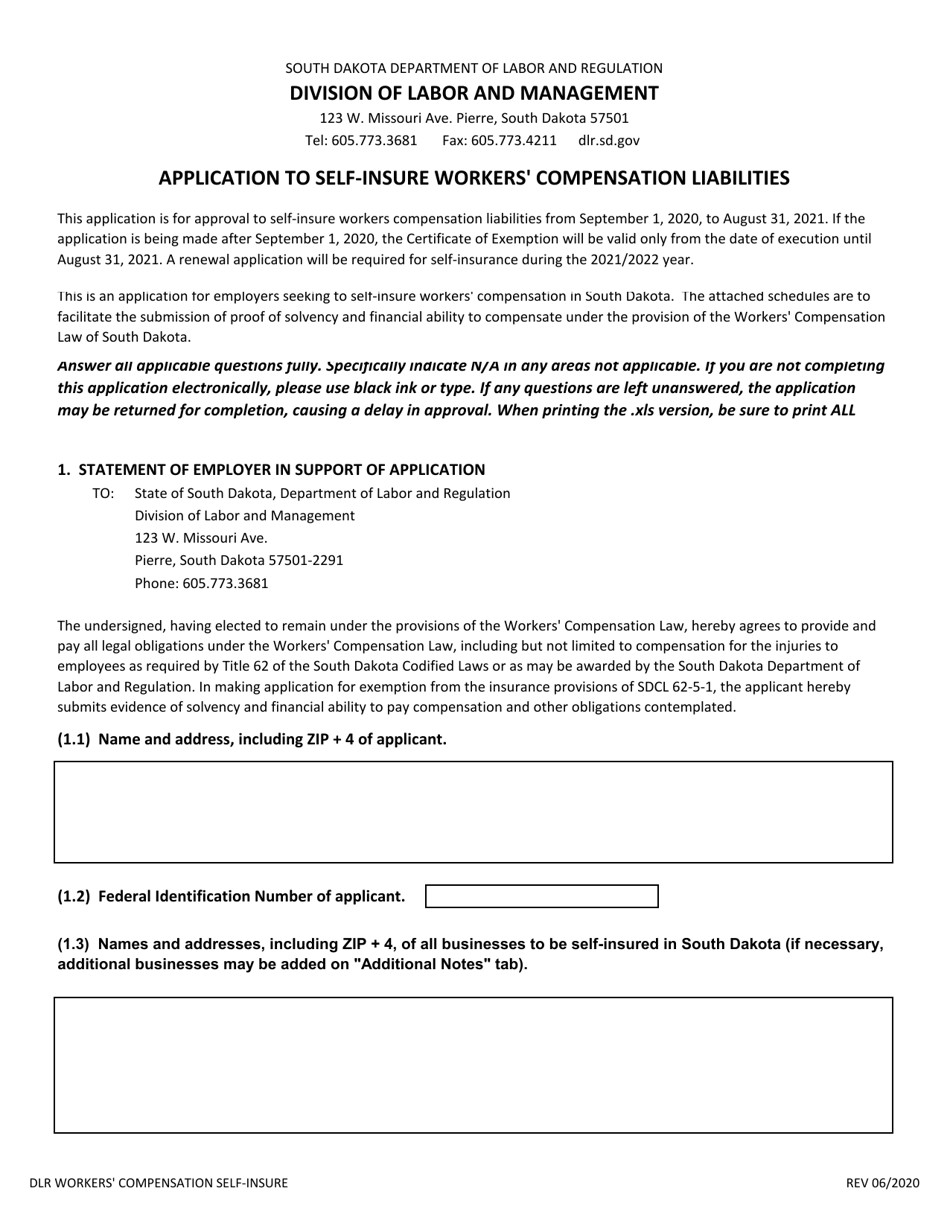

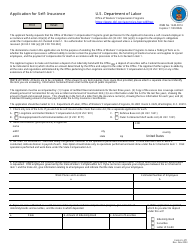

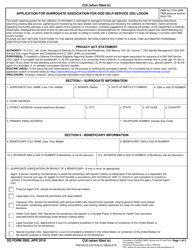

Application to Self-insure Workers' Compensation Liabilities - South Dakota

Application to Self-insure Workers' Compensation Liabilities is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

Q: What is self-insurance for workers' compensation liabilities?

A: Self-insurance for workers' compensation liabilities refers to a system where employers take on the responsibility of providing medical and wage replacement benefits to injured employees instead of purchasing traditional workers' compensation insurance.

Q: Why would a company choose to self-insure its workers' compensation liabilities?

A: Companies may choose to self-insure their workers' compensation liabilities to have more control over the claims process, potentially save costs, and have the ability to customize their benefits program.

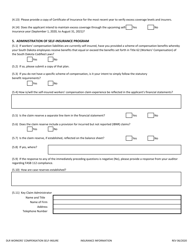

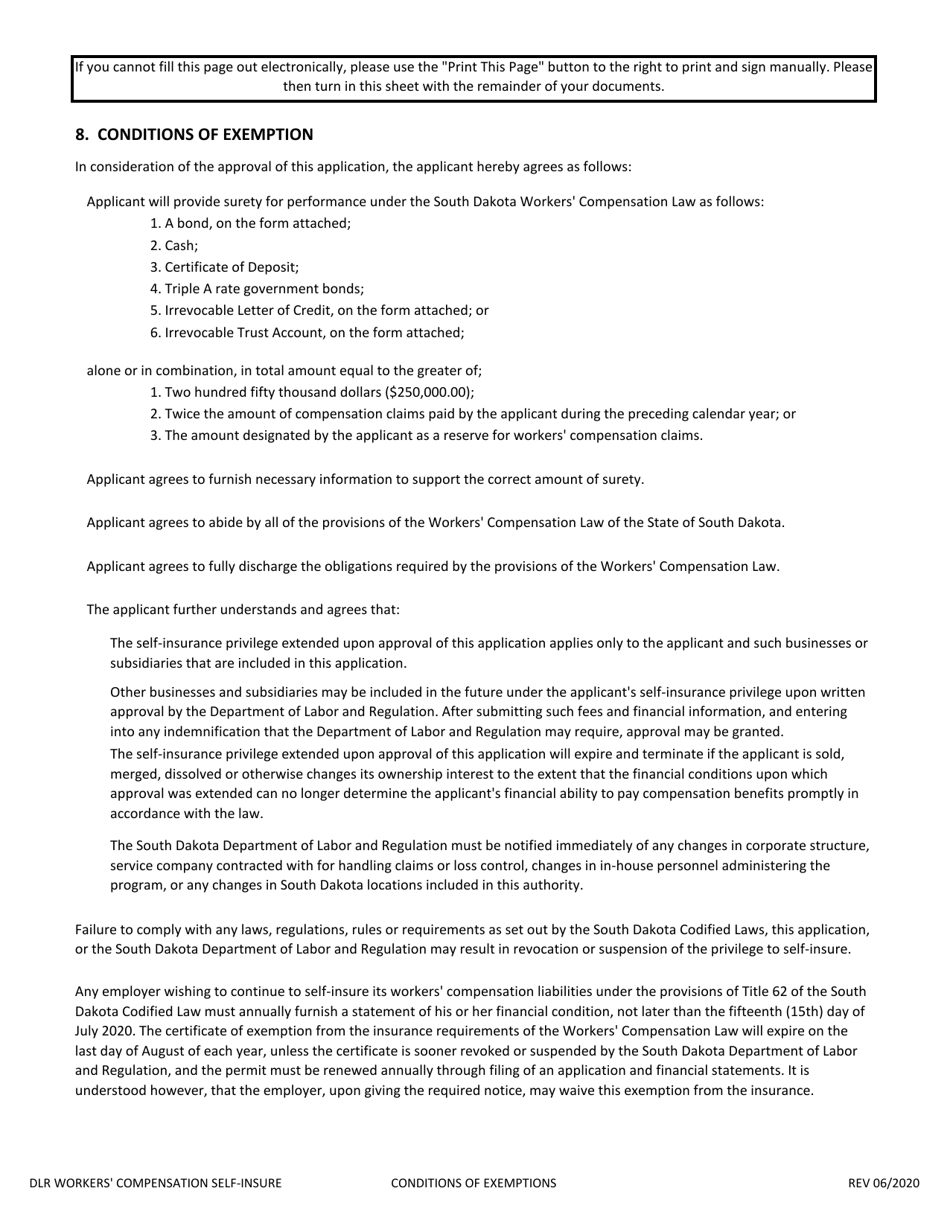

Q: How does the self-insurance application process work in South Dakota?

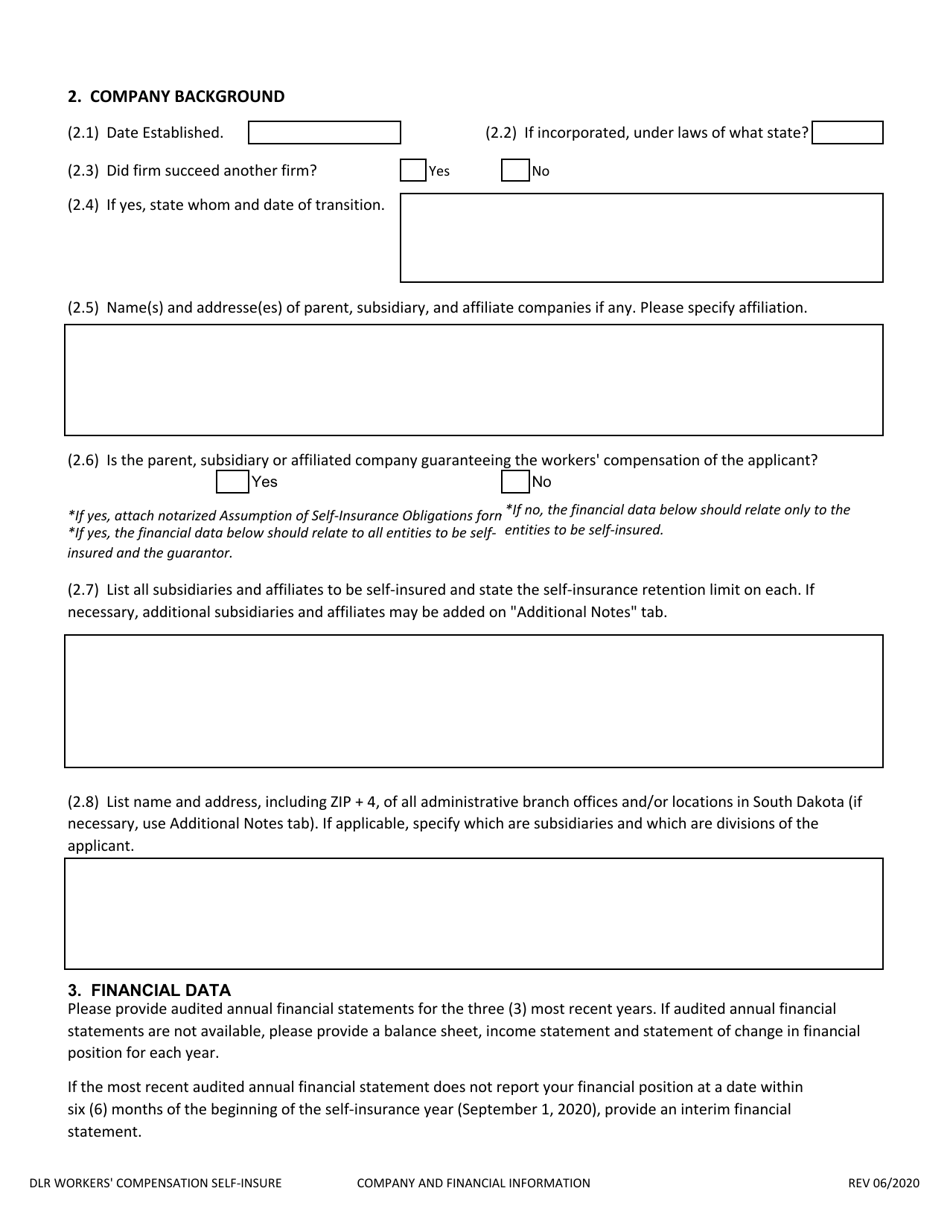

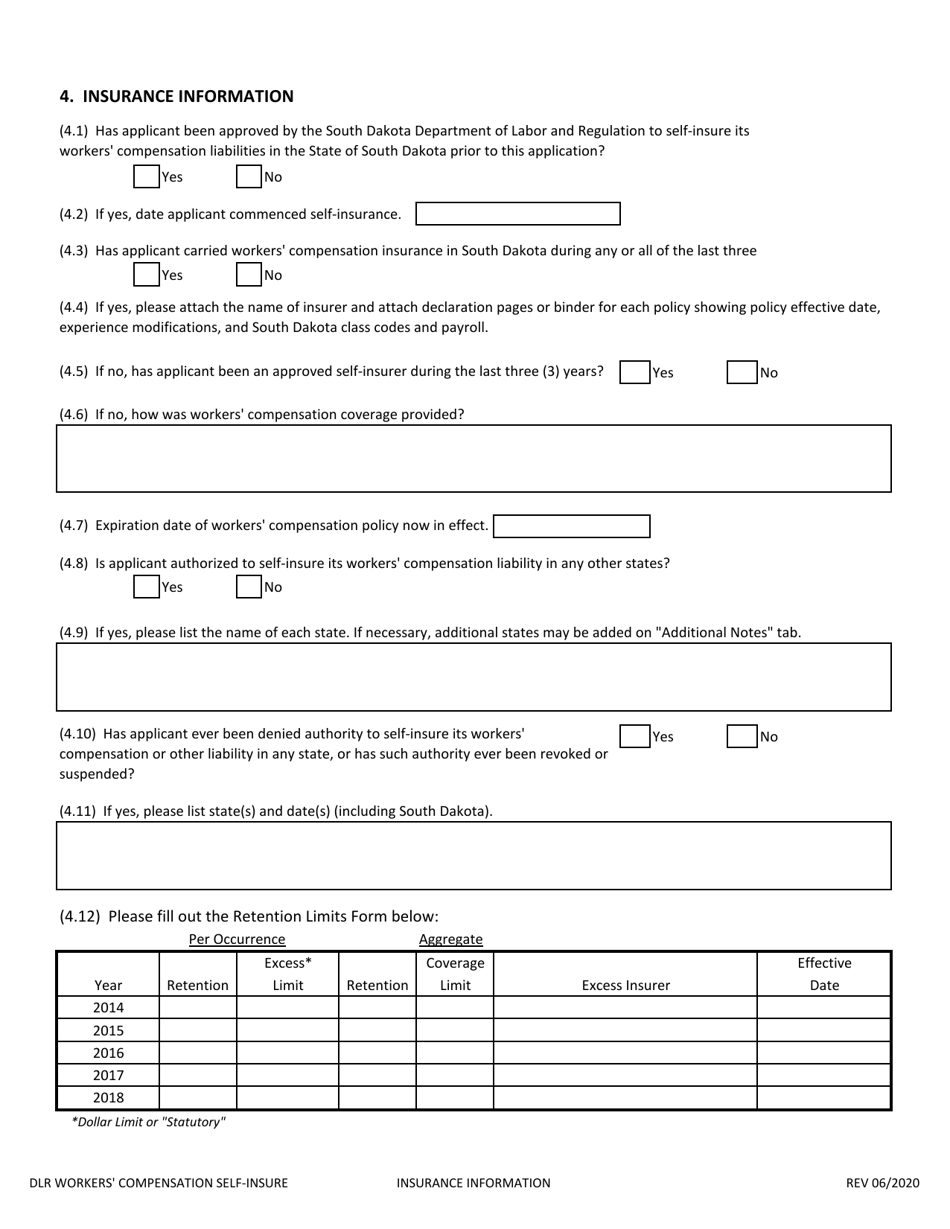

A: In South Dakota, employers interested in self-insuring their workers' compensation liabilities need to submit an application to the South Dakota Department of Labor and Regulation. The application will be reviewed and evaluated to determine if the employer meets the necessary requirements.

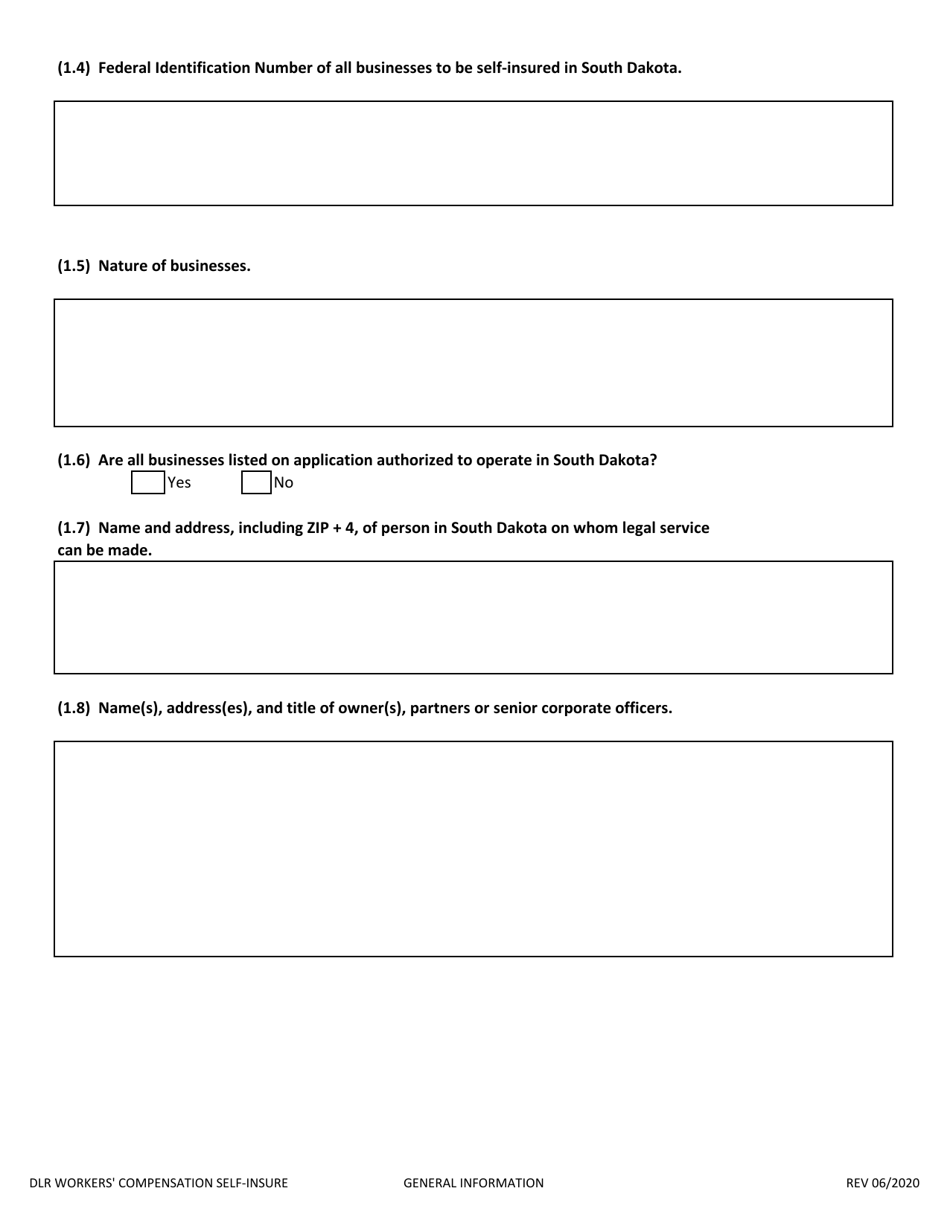

Q: What are the requirements to qualify for self-insurance of workers' compensation liabilities in South Dakota?

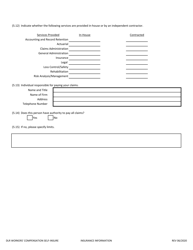

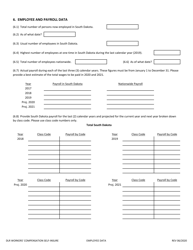

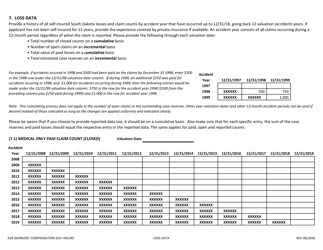

A: To qualify for self-insurance of workers' compensation liabilities in South Dakota, employers must meet certain financial stability criteria, demonstrate ability to administer claims, provide appropriate security deposit, and comply with other statutory requirements.

Q: Are there any ongoing obligations for employers who self-insure their workers' compensation liabilities in South Dakota?

A: Yes, employers who self-insure their workers' compensation liabilities in South Dakota have ongoing obligations such as maintaining financial solvency, submitting annual reports, and complying with reporting and auditing requirements set by the Department of Labor and Regulation.

Q: Are there any advantages to self-insuring workers' compensation liabilities in South Dakota?

A: Some advantages of self-insuring workers' compensation liabilities in South Dakota include potential cost savings, increased control over claims management, flexibility in benefits design, and the ability to retain investment income on reserves.

Q: Are there any risks associated with self-insuring workers' compensation liabilities in South Dakota?

A: Yes, there are risks associated with self-insuring workers' compensation liabilities in South Dakota. These include financial risks if there are a significant number of costly claims, the need to maintain a strong claims management system, and potential regulatory compliance challenges.

Q: Can all employers in South Dakota self-insure their workers' compensation liabilities?

A: No, not all employers in South Dakota can self-insure their workers' compensation liabilities. The self-insurance option is generally available to larger companies with the financial capabilities to meet the requirements and obligations of self-insurance.

Form Details:

- Released on June 1, 2020;

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.