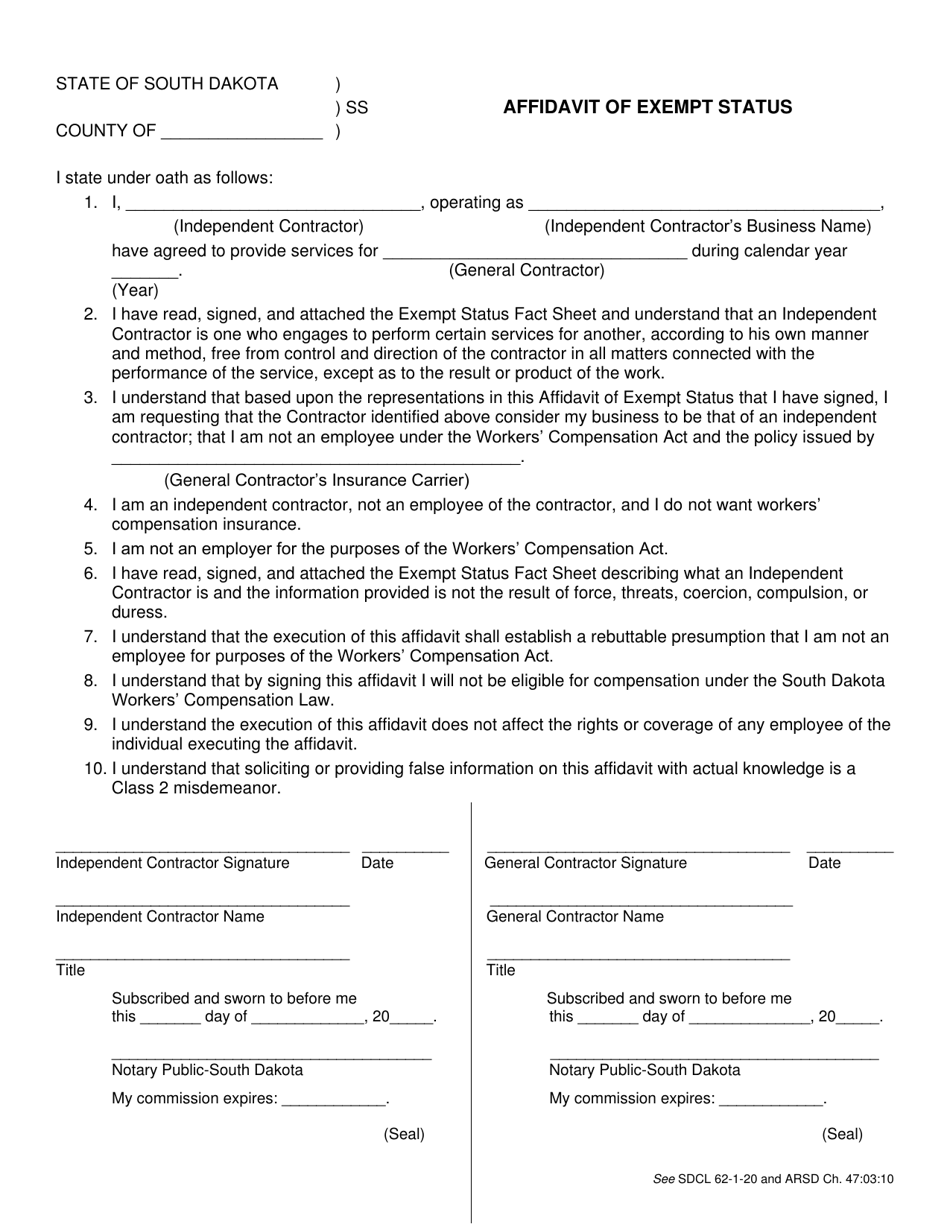

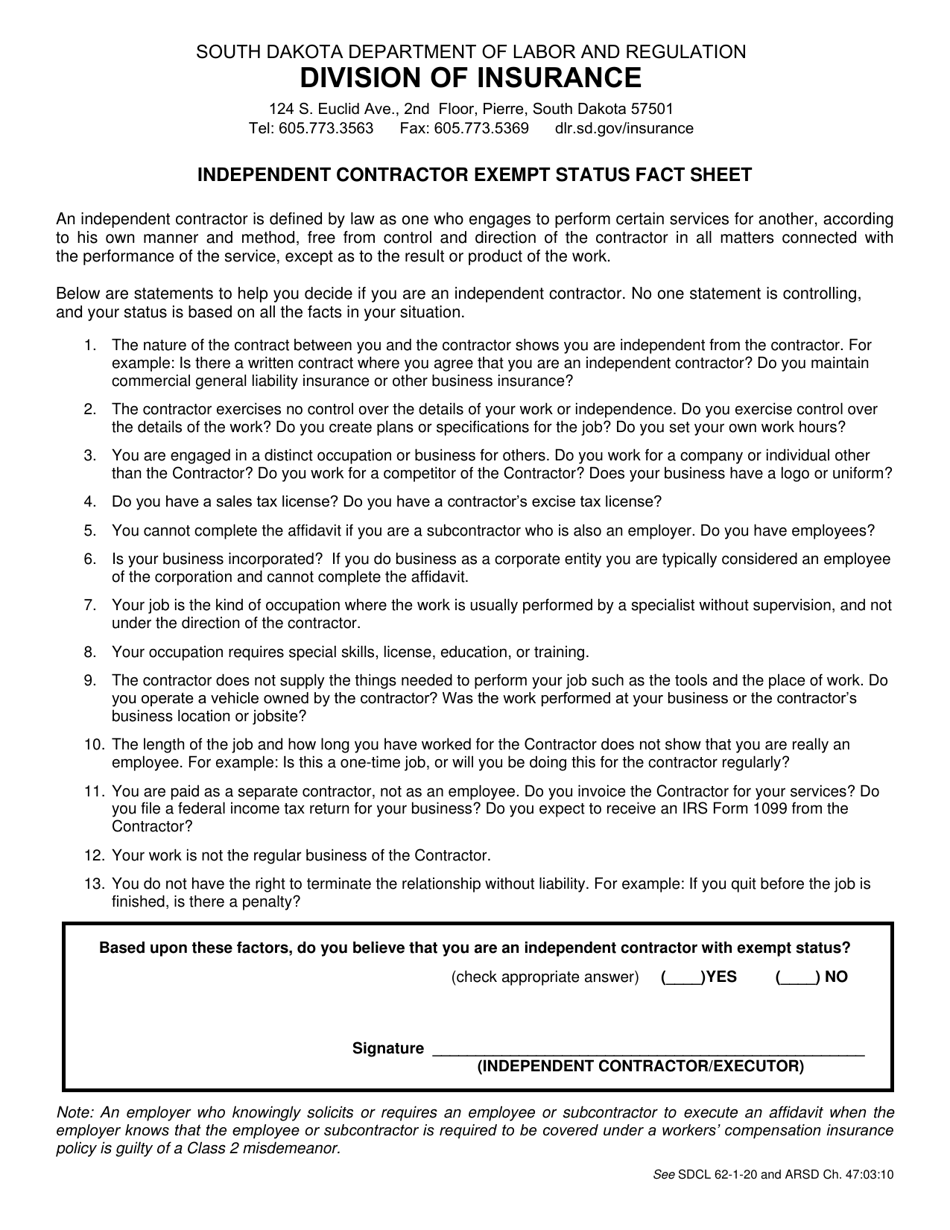

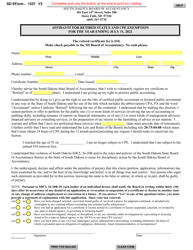

Affidavit of Exempt Status - South Dakota

Affidavit of Exempt Status is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

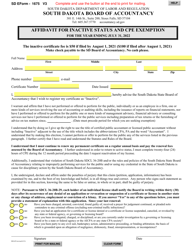

Q: What is an Affidavit of Exempt Status?

A: An Affidavit of Exempt Status is a legal document used in South Dakota to claim exemption from certain taxes or fees.

Q: Who can use an Affidavit of Exempt Status in South Dakota?

A: Individuals or organizations that meet the criteria for exemption from taxes or fees in South Dakota can use an Affidavit of Exempt Status.

Q: What taxes or fees can be exempted using an Affidavit of Exempt Status in South Dakota?

A: An Affidavit of Exempt Status can be used to claim exemption from sales tax, use tax, excise tax, and contractor's excise tax in South Dakota.

Q: What information is required in an Affidavit of Exempt Status in South Dakota?

A: The Affidavit of Exempt Status requires information such as the taxpayer's name, address, tax identification number, and the specific tax or fee being claimed as exempt.

Q: Is there a fee for submitting an Affidavit of Exempt Status in South Dakota?

A: No, there is no fee for submitting an Affidavit of Exempt Status in South Dakota.

Q: How often do I need to submit an Affidavit of Exempt Status in South Dakota?

A: You may need to submit an Affidavit of Exempt Status annually or whenever your exemption status changes.

Q: What should I do if my Affidavit of Exempt Status in South Dakota is denied?

A: If your Affidavit of Exempt Status is denied, you should contact the South Dakota Department of Revenue for further assistance.

Form Details:

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.