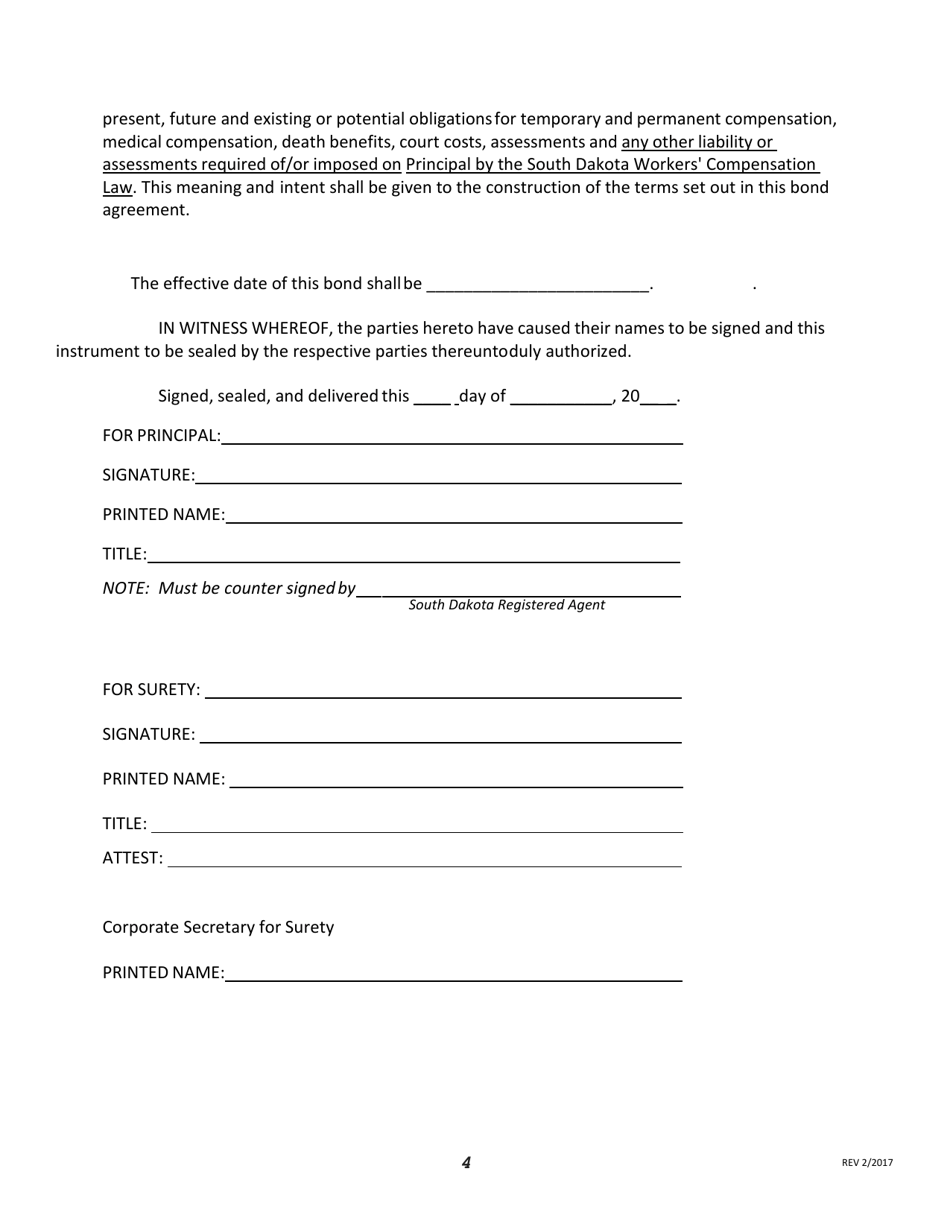

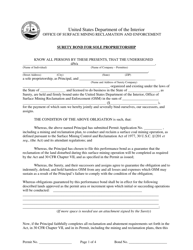

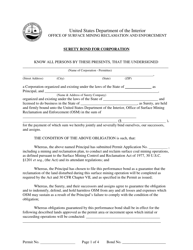

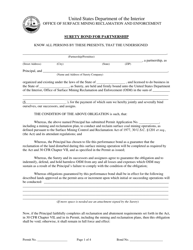

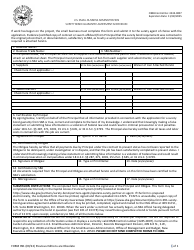

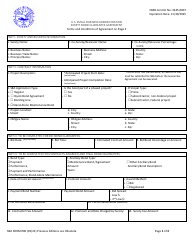

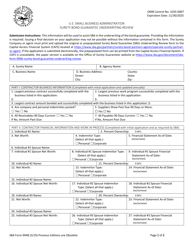

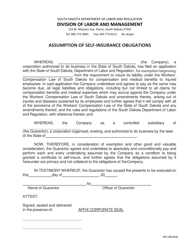

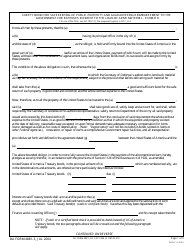

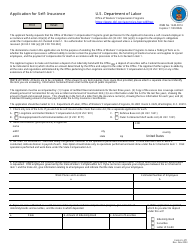

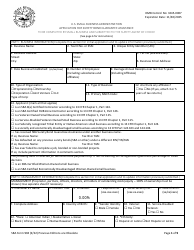

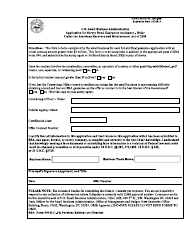

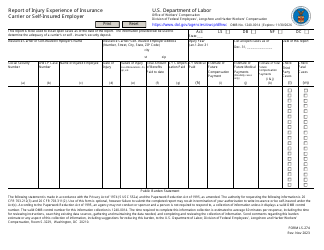

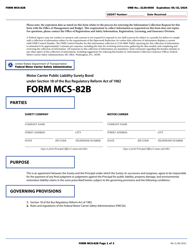

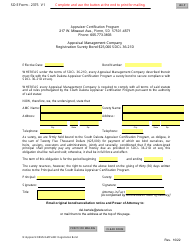

Self-insurance Aggregate Surety Bond - South Dakota

Self-insurance Aggregate Surety Bond is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

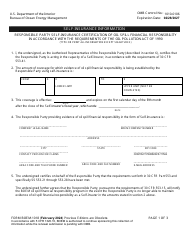

Q: What is a self-insurance aggregate surety bond?

A: It is a type of bond that allows a company to self-insure its liability instead of purchasing traditional insurance coverage.

Q: Why would a company choose to self-insure with a surety bond?

A: Self-insurance with a surety bond can be a cost-effective alternative to purchasing insurance, especially for companies with a strong financial position.

Q: How does a self-insurance aggregate surety bond work?

A: The bond is a guarantee that the company will have sufficient funds to cover any potential liability claims. If a claim arises, the bond is used to compensate the injured party.

Q: Is a self-insurance aggregate surety bond required in South Dakota?

A: Yes, South Dakota requires certain types of self-insured businesses to obtain a surety bond as a financial guarantee.

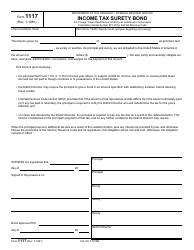

Q: How much does a self-insurance aggregate surety bond cost?

A: The cost of the bond varies depending on the size and risk profile of the company. It is usually a percentage of the self-insured liability.

Q: Are there any financial requirements to qualify for a self-insurance aggregate surety bond?

A: Yes, companies must meet certain financial criteria, such as having a strong balance sheet and sufficient assets to cover potential claims.

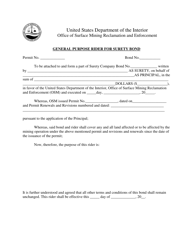

Q: Can a company switch from self-insurance with a surety bond to traditional insurance?

A: Yes, companies have the option to transition from self-insurance to traditional insurance coverage if they choose to do so.

Q: How long does a self-insurance aggregate surety bond last?

A: The bond is typically issued for a specific term, usually one year, and must be renewed annually to maintain self-insurance status.

Q: Can a self-insured company cancel its surety bond?

A: Yes, a self-insured company can cancel its bond, but it must provide an alternative form of financial guarantee to cover its liability.

Form Details:

- Released on February 1, 2017;

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.