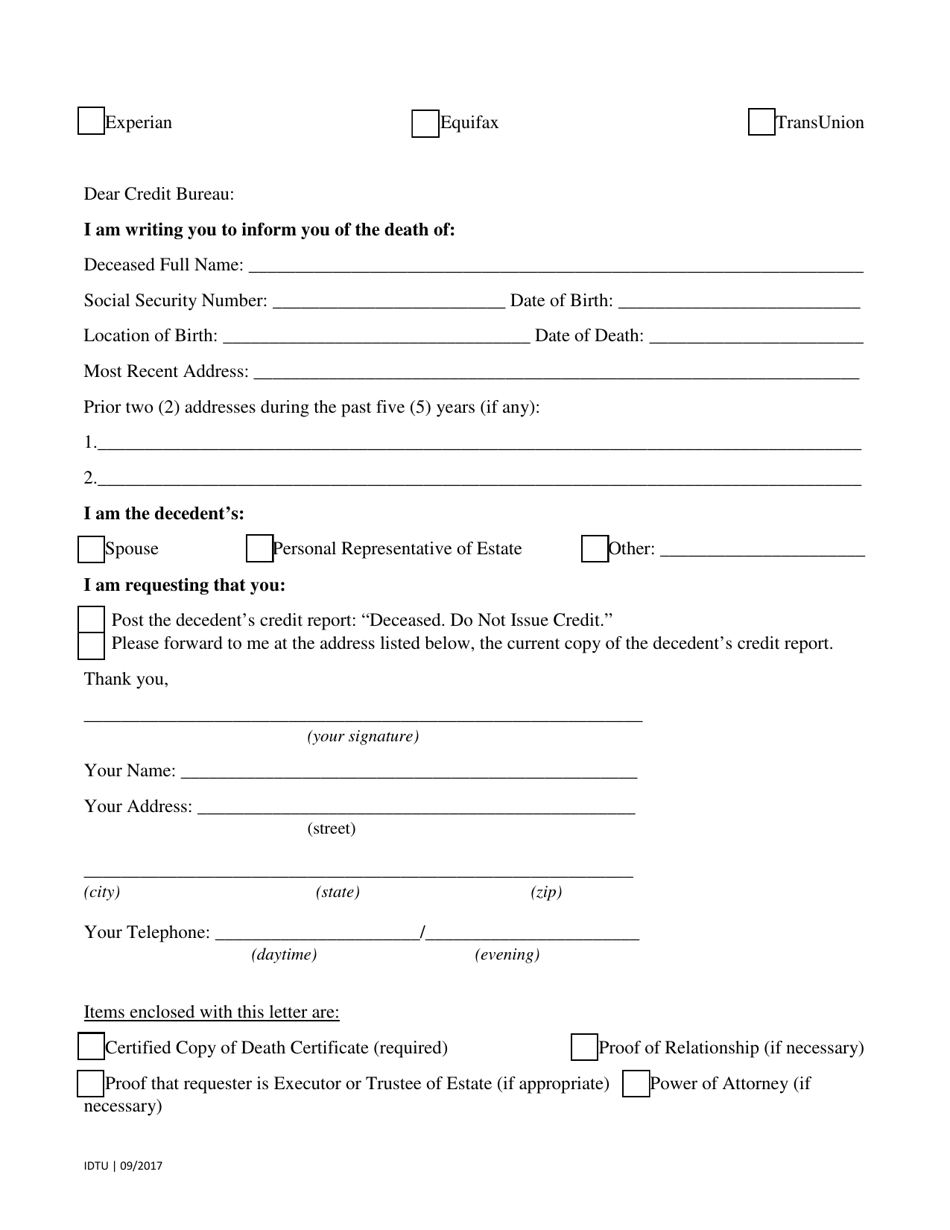

Notifying the Credit Bureaus of a Death - South Carolina

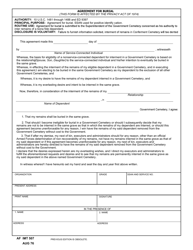

Notifying the Credit Bureaus of a Death is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: Why do I need to notify the credit bureaus of a death?

A: Notify the credit bureaus of a death to prevent identity theft and fraudulent activity on the deceased person's credit accounts.

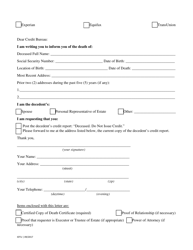

Q: How do I notify the credit bureaus of a death in South Carolina?

A: Contact the three major credit bureaus, Equifax, Experian, and TransUnion, and inform them of the death by providing a death certificate and other required documentation.

Q: What happens after notifying the credit bureaus of a death?

A: The credit bureaus will update the deceased person's credit report, preventing further use of their credit accounts and minimizing the risk of identity theft.

Q: Do I need to notify all three credit bureaus?

A: Yes, it is recommended to notify all three major credit bureaus to ensure comprehensive protection for the deceased person's credit accounts.

Q: What other steps should be taken after notifying the credit bureaus of a death?

A: Cancel the deceased person's credit cards, notify their financial institutions, and monitor their credit report for any suspicious activity.

Form Details:

- Released on September 1, 2017;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.