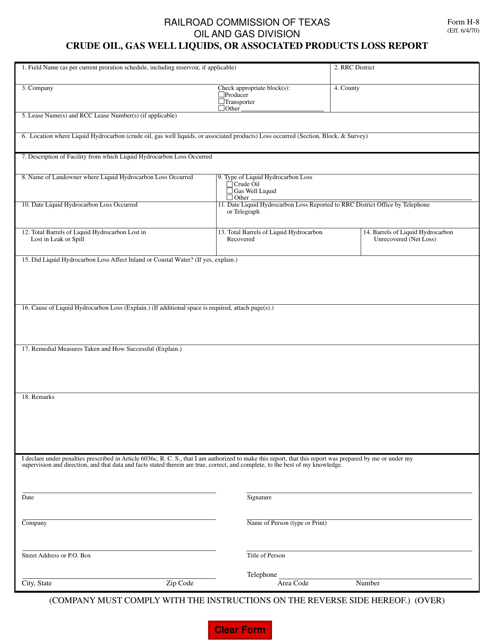

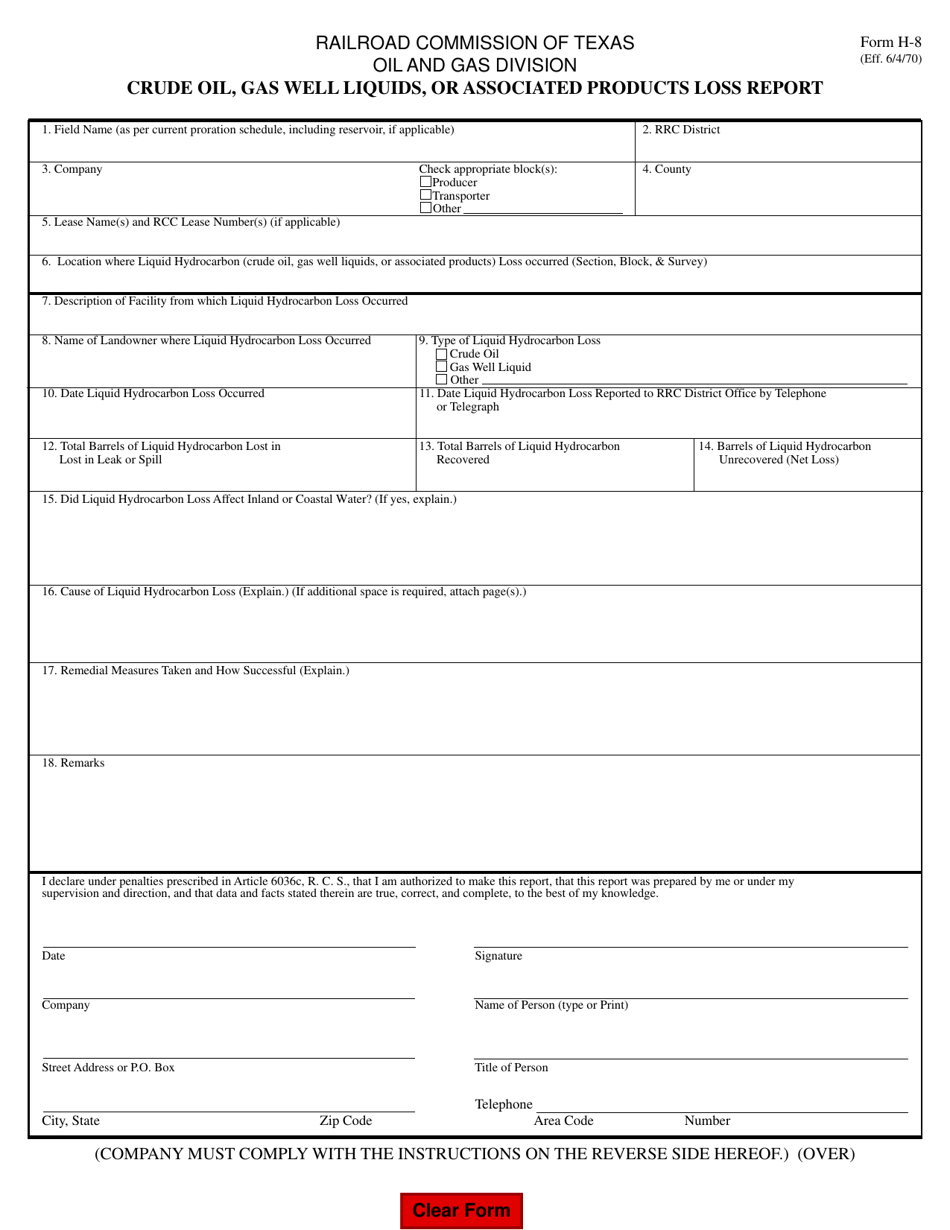

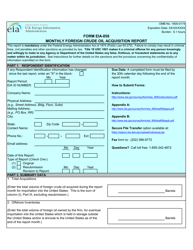

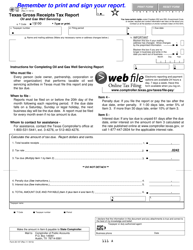

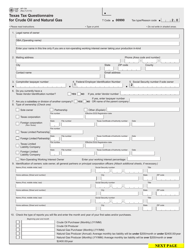

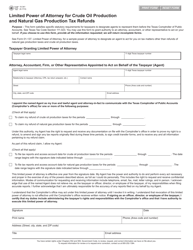

Form H-8 Crude Oil, Gas Well Liquids, or Associated Products Loss Report - Texas

What Is Form H-8?

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H-8?

A: Form H-8 is the Crude Oil, Gas Well Liquids, or Associated Products Loss Report used in Texas.

Q: What is the purpose of Form H-8?

A: The purpose of Form H-8 is to report losses of crude oil, gas well liquids, or associated products in Texas.

Q: Who needs to file Form H-8?

A: Operators of crude oil, gas well liquids, or associated products in Texas need to file Form H-8.

Q: When should Form H-8 be filed?

A: Form H-8 should be filed within 10 days of the discovery of a loss.

Q: Is there a penalty for not filing Form H-8?

A: Yes, there may be penalties for not filing or late filing of Form H-8.

Form Details:

- Released on June 4, 1970;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form H-8 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.