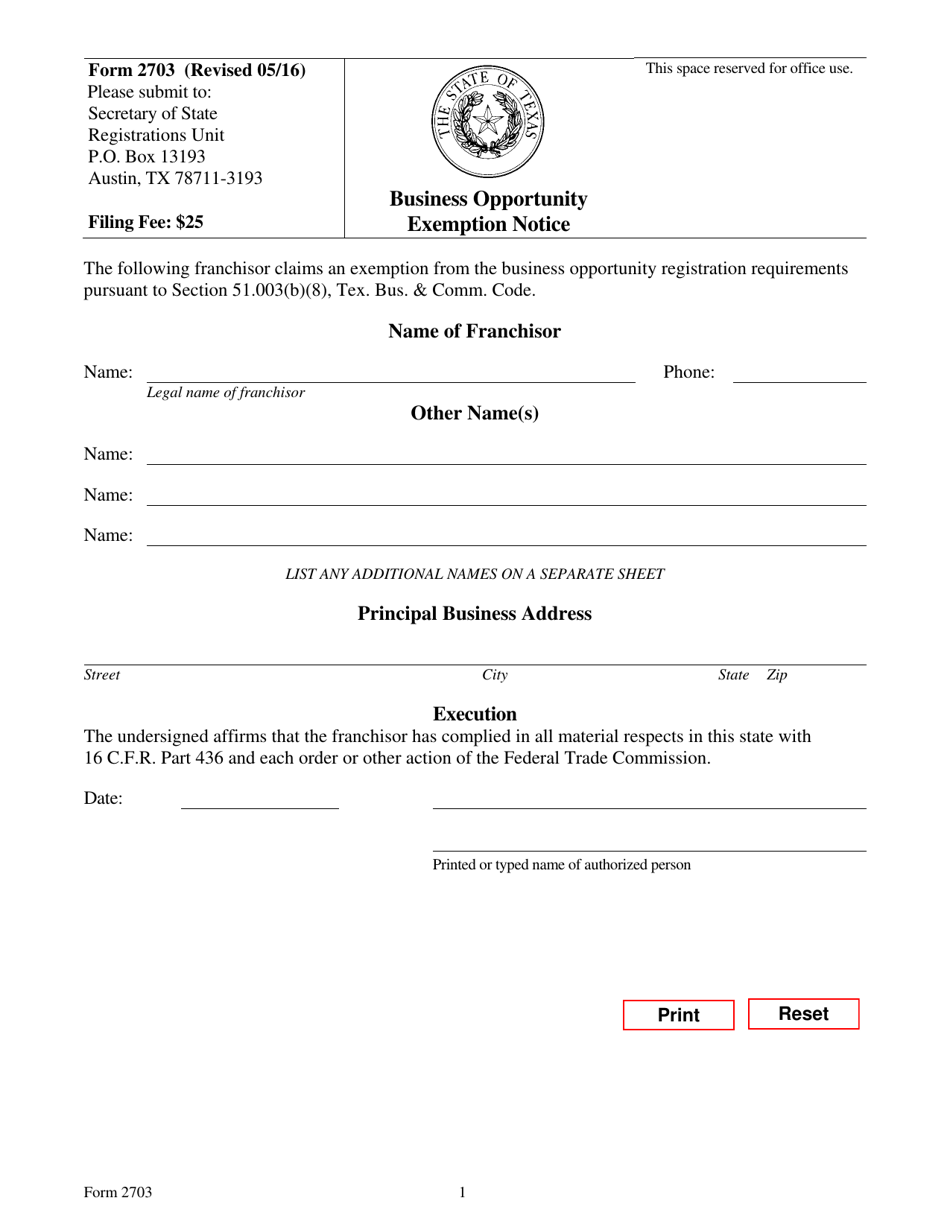

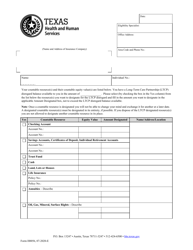

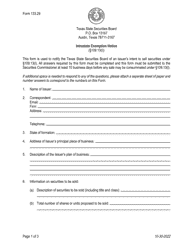

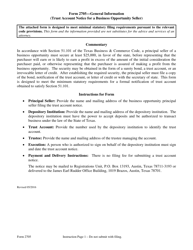

Form 2703 Business Opportunity Exemption Notice - Texas

What Is Form 2703?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2703?

A: Form 2703 is a Business Opportunity Exemption Notice in Texas.

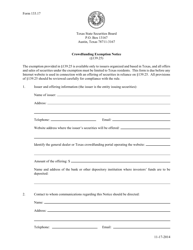

Q: Who needs to file Form 2703?

A: Any individual or entity offering a business opportunity in Texas needs to file Form 2703.

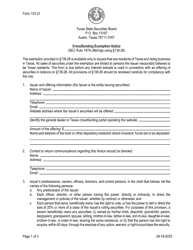

Q: What is a business opportunity?

A: A business opportunity is an agreement where an individual or entity sells or leases a product, service, or business plan for the purpose of starting a business.

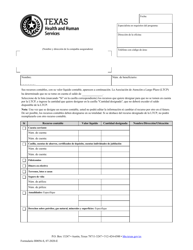

Q: What is the purpose of Form 2703?

A: Form 2703 is used to notify the Texas Attorney General's office about the offering of a business opportunity in the state.

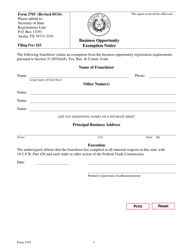

Q: What information is required on Form 2703?

A: Form 2703 requires information about the business opportunity, including the seller's contact information, financial statements, and details about the offering.

Q: Are there any exemptions to filing Form 2703?

A: Yes, certain business opportunities may be exempt from filing Form 2703. It is recommended to consult the Texas Business Opportunity Act for specific exemptions.

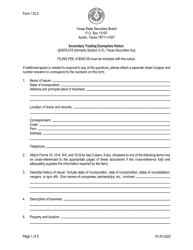

Q: When should Form 2703 be filed?

A: Form 2703 should be filed at least 10 days before offering a business opportunity in Texas.

Q: Is there a fee for filing Form 2703?

A: Yes, there is a filing fee for Form 2703. The fee amount may vary, so it is important to check the latest fee schedule.

Q: What happens after filing Form 2703?

A: After filing Form 2703, the Texas Attorney General's office will review the information provided and may take further action if necessary.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2703 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.