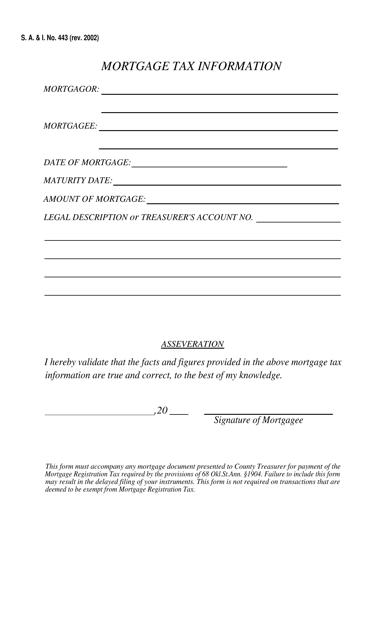

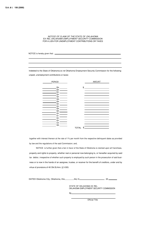

Form S.A.& I.443 Mortgage Tax Information - Oklahoma

What Is Form S.A.& I.443?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.443?

A: Form S.A.& I.443 is the Mortgage Tax Information form for the state of Oklahoma.

Q: What is the purpose of Form S.A.& I.443?

A: The purpose of this form is to provide information about mortgage taxes in Oklahoma.

Q: Who needs to fill out Form S.A.& I.443?

A: Anyone who is involved in a mortgage transaction in Oklahoma needs to fill out this form.

Q: What information is required on Form S.A.& I.443?

A: The form requires information about the mortgage, including the loan amount, the mortgage instrument number, and the names of the mortgagor and mortgagee.

Q: When is Form S.A.& I.443 due?

A: The form must be filed and the mortgage tax paid within 30 days of the recording date of the mortgage instrument.

Q: Are there any exceptions or exemptions to the mortgage tax in Oklahoma?

A: Yes, there are certain exemptions and exclusions available, such as mortgages on agricultural lands or federally subsidized mortgages. It is recommended to consult the Oklahoma Tax Commission or a tax professional for specific details.

Q: What happens if I don't file Form S.A.& I.443 or pay the mortgage tax?

A: Failure to file the form or pay the tax within the prescribed time can result in penalties and interest charges.

Q: Can I e-file Form S.A.& I.443?

A: No, at this time, electronic filing is not available for this form. It must be filed in paper format.

Q: Is Form S.A.& I.443 specific to Oklahoma?

A: Yes, this form is specific to the state of Oklahoma, and other states may have different requirements for mortgage taxes.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.443 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.