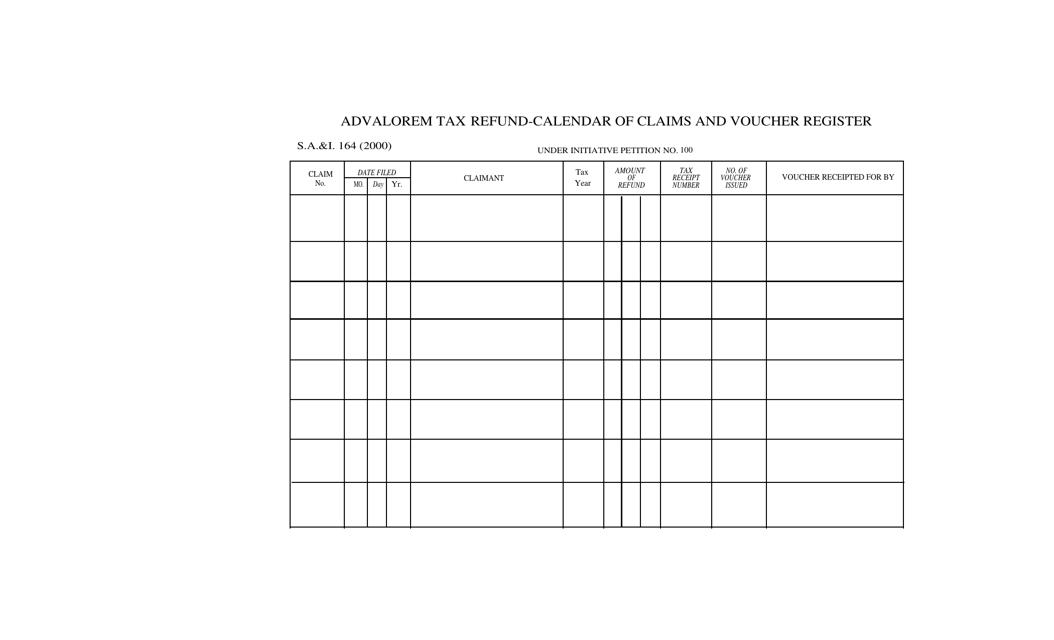

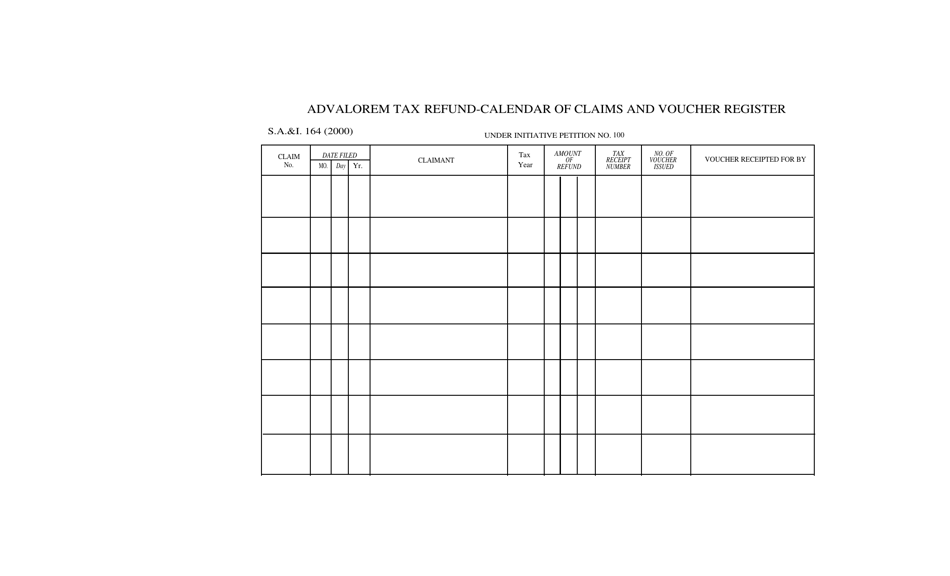

Form S.A.& I.164 Advalorem Tax Refund-Calendar of Claims and Voucher Register - Oklahoma

What Is Form S.A.& I.164?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.164?

A: Form S.A.& I.164 is a document used for claiming ad valorem tax refunds in Oklahoma.

Q: What is an ad valorem tax refund?

A: An ad valorem tax refund is a refund of taxes paid on property based on its assessed value.

Q: Who can use Form S.A.& I.164?

A: Anyone who has paid ad valorem taxes in Oklahoma can use Form S.A.& I.164 to claim a refund.

Q: What is the purpose of the Calendar of Claims and Voucher Register?

A: The Calendar of Claims and Voucher Register is used to keep track of ad valorem tax refund claims and vouchers.

Q: When should I file Form S.A.& I.164?

A: Form S.A.& I.164 should be filed by the deadline specified by the Oklahoma Tax Commission.

Q: How long does it take to receive an ad valorem tax refund?

A: The time it takes to receive an ad valorem tax refund can vary, but it is typically processed within a few weeks to a few months.

Q: Can I e-file Form S.A.& I.164?

A: No, currently Form S.A.& I.164 cannot be e-filed and must be submitted by mail or in person.

Q: What documents do I need to include with Form S.A.& I.164?

A: You may need to include documentation such as property tax statements, payment receipts, and proof of residency with Form S.A.& I.164.

Q: Can I claim ad valorem tax refunds for multiple years on one Form S.A.& I.164?

A: Yes, you can claim multiple years of ad valorem tax refunds on one Form S.A.& I.164.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.164 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.