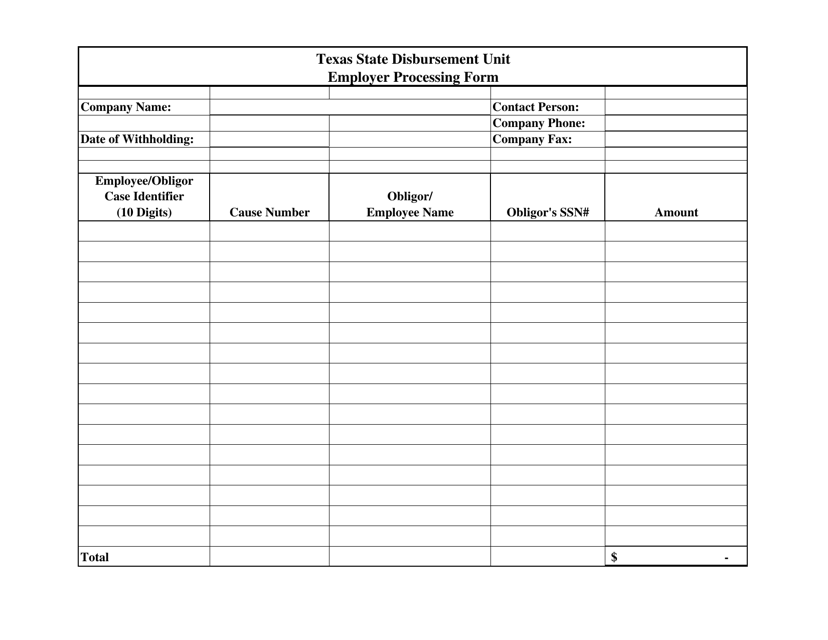

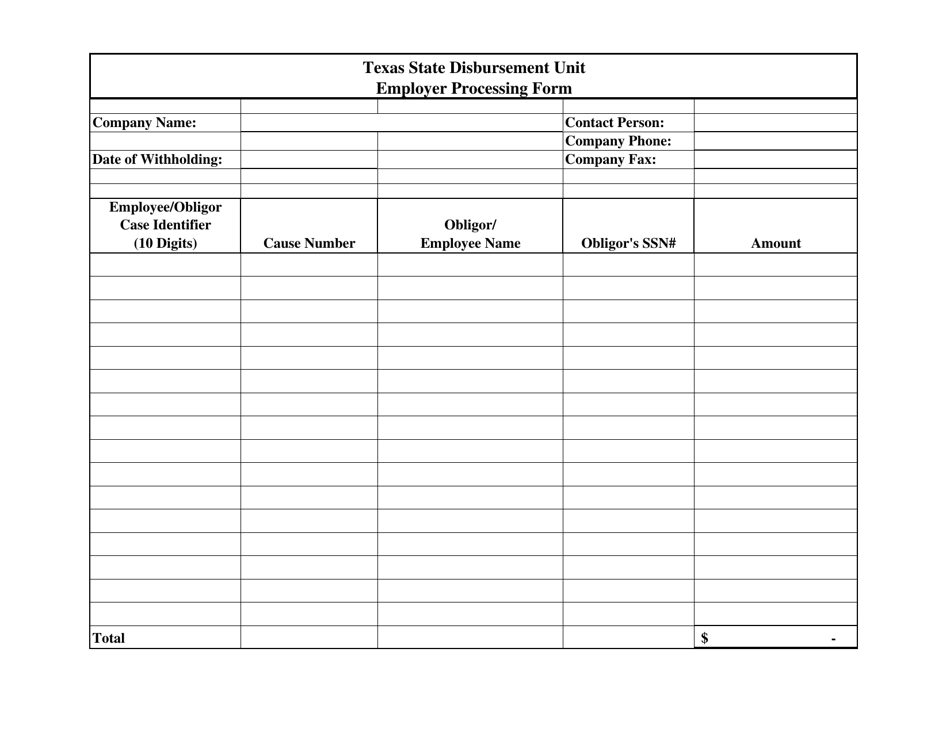

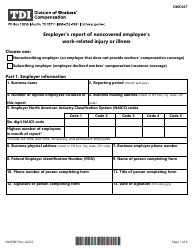

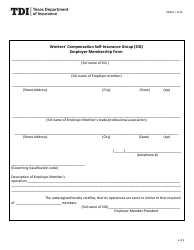

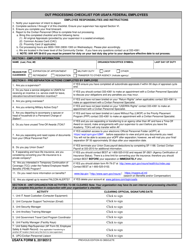

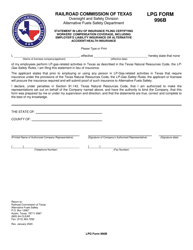

Employer Processing Form - Texas

Employer Processing Form is a legal document that was released by the Texas Office of the Attorney General - a government authority operating within Texas.

FAQ

Q: What is an Employer Processing Form?

A: An Employer Processing Form is a document used by employers in Texas to report employee wages and taxes to the Texas Workforce Commission.

Q: Why do employers need to submit an Employer Processing Form?

A: Employers need to submit an Employer Processing Form to comply with state reporting requirements and ensure accurate and timely payment of unemployment taxes.

Q: How often do employers need to submit an Employer Processing Form in Texas?

A: Employers in Texas need to submit an Employer Processing Form on a quarterly basis.

Q: What information is required on an Employer Processing Form?

A: An Employer Processing Form typically requires information such as employee wages, hours worked, and any deductions or exemptions.

Q: Is there a deadline for submitting an Employer Processing Form in Texas?

A: Yes, employers in Texas must submit their Employer Processing Form by the last day of the month following the end of the reporting period.

Q: Are there any penalties for non-compliance with the Employer Processing Form requirements in Texas?

A: Yes, employers may face penalties for late or inaccurate submission of Employer Processing Forms in Texas.

Q: Can employers make changes to an already submitted Employer Processing Form?

A: Yes, employers can make corrections or amendments to an already submitted Employer Processing Form.

Q: Who can employers contact for assistance with the Employer Processing Form in Texas?

A: Employers can contact the Texas Workforce Commission or their local workforce office for assistance with the Employer Processing Form.

Q: Are there any exceptions or exemptions to the Employer Processing Form requirement in Texas?

A: There may be exceptions or exemptions for certain types of employers or specific circumstances, employers should contact the Texas Workforce Commission for more information.

Form Details:

- The latest edition currently provided by the Texas Office of the Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Office of the Attorney General.