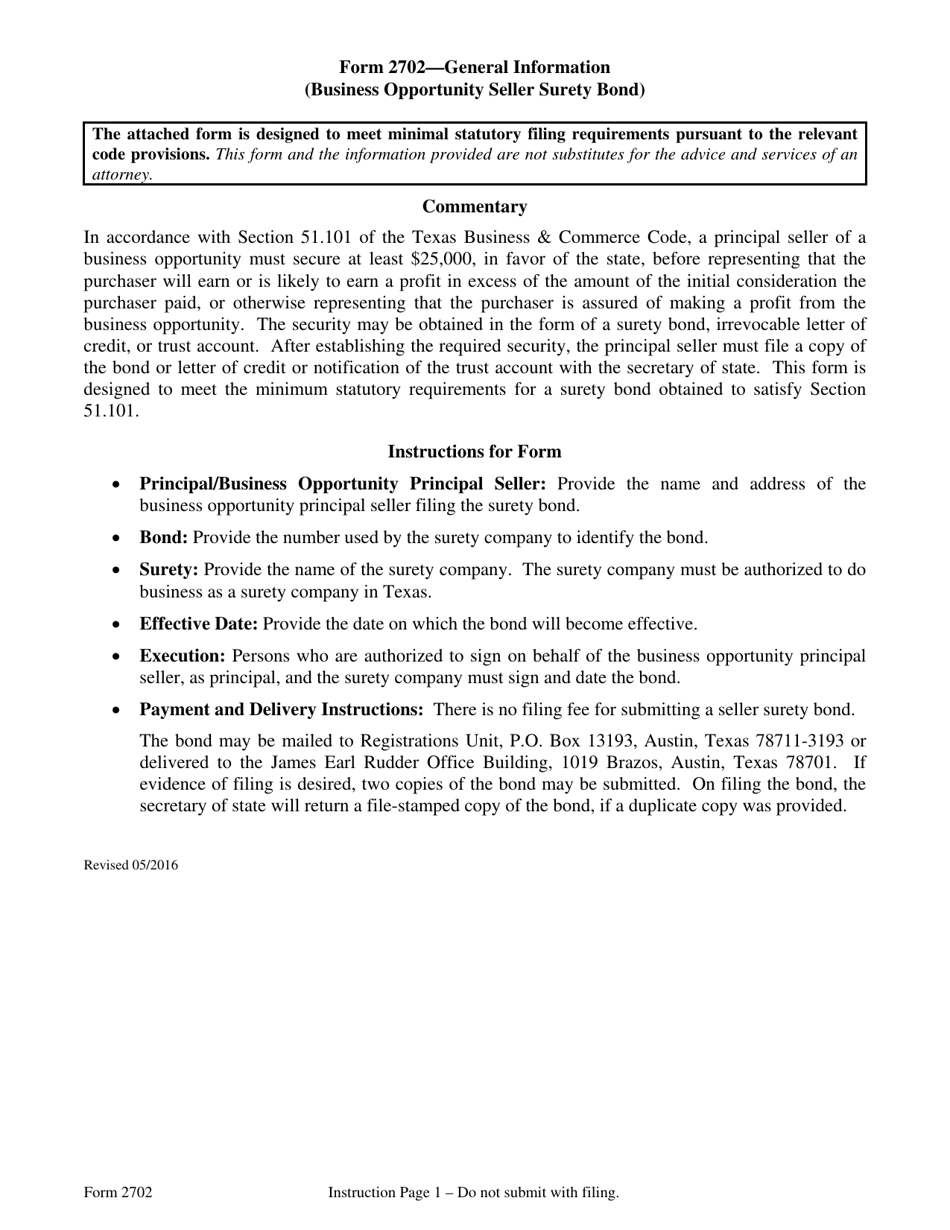

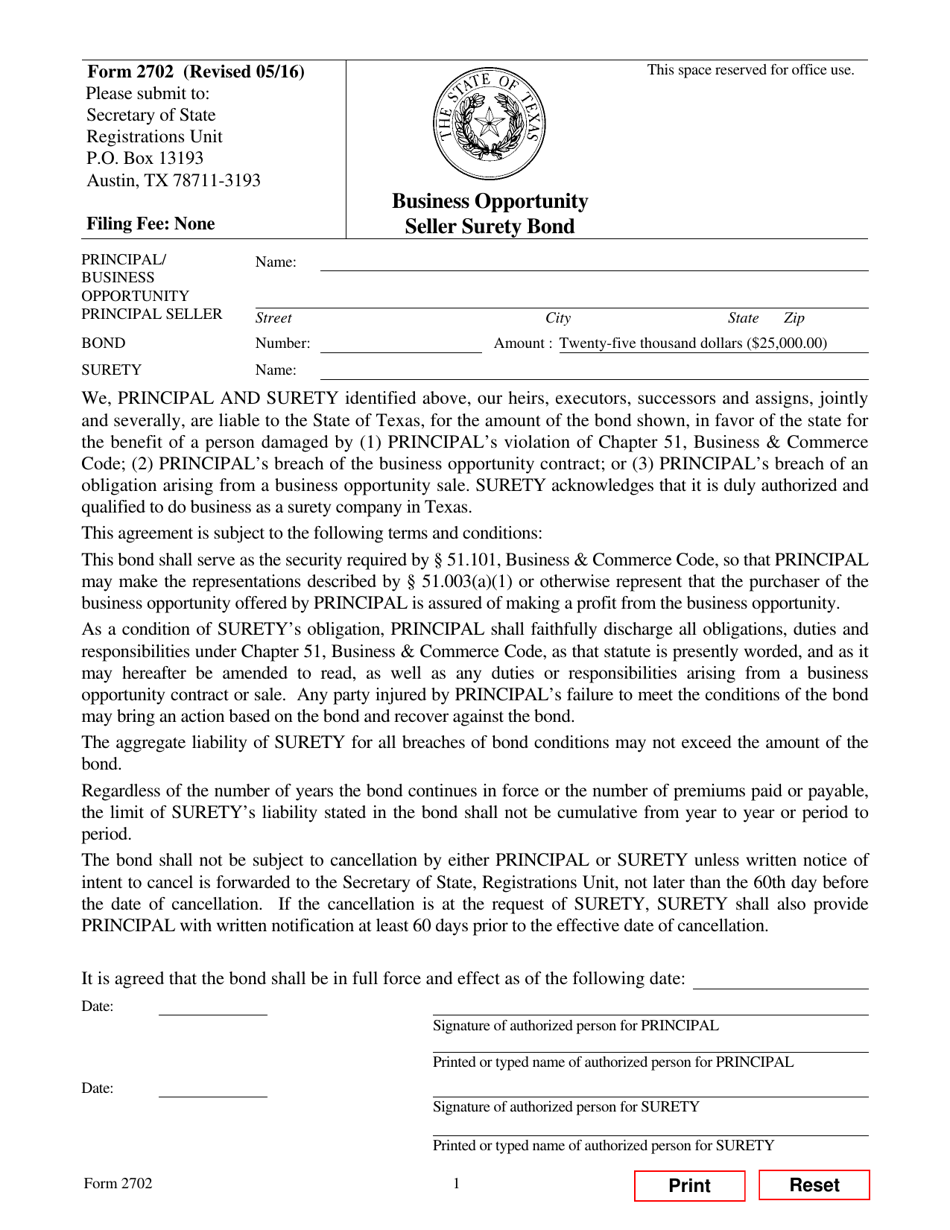

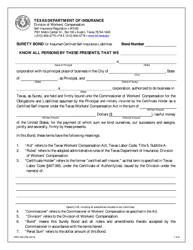

Form 2702 Business Opportunity Seller Surety Bond - Texas

What Is Form 2702?

This is a legal form that was released by the Texas Secretary of State - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2702?

A: Form 2702 is the Business Opportunity Seller Surety Bond in Texas.

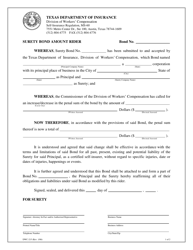

Q: What is a business opportunity seller surety bond?

A: A business opportunity seller surety bond is a type of bond that provides financial protection for consumers who purchase business opportunities.

Q: Who needs to file Form 2702?

A: Business opportunity sellers in Texas need to file Form 2702 to obtain a surety bond.

Q: Why do business opportunity sellers need to obtain a surety bond?

A: Business opportunity sellers need to obtain a surety bond to protect consumers from fraud or financial loss.

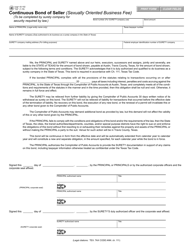

Q: How much does Form 2702 bond cost?

A: The cost of the Form 2702 bond varies depending on the value of the business opportunity being offered.

Q: What happens if a business opportunity seller fails to obtain a surety bond?

A: If a business opportunity seller fails to obtain a surety bond, they may be subject to penalties and legal consequences.

Q: How long does the Form 2702 bond need to be maintained?

A: The Form 2702 bond needs to be maintained for as long as the business opportunity seller is offering opportunities to consumers.

Q: Can a business opportunity seller cancel their surety bond?

A: Yes, a business opportunity seller can cancel their surety bond, but they must provide written notice to the Texas Secretary of State.

Q: Are there any exemptions from filing a surety bond for business opportunity sellers?

A: Yes, there are some exemptions for certain types of business opportunity sellers in Texas.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Texas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2702 by clicking the link below or browse more documents and templates provided by the Texas Secretary of State.