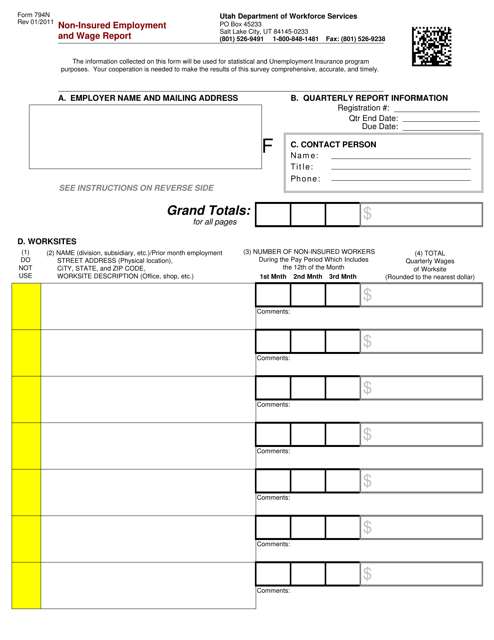

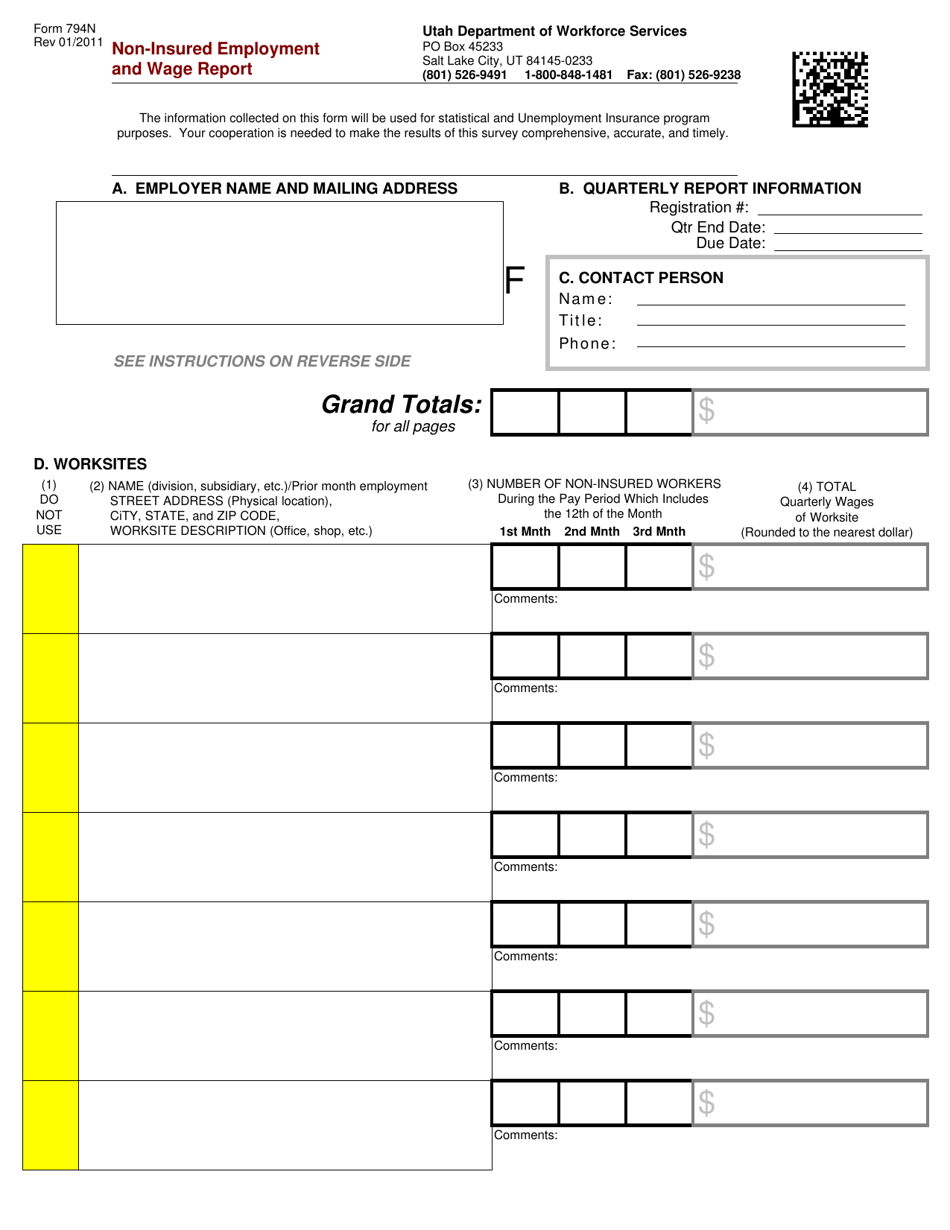

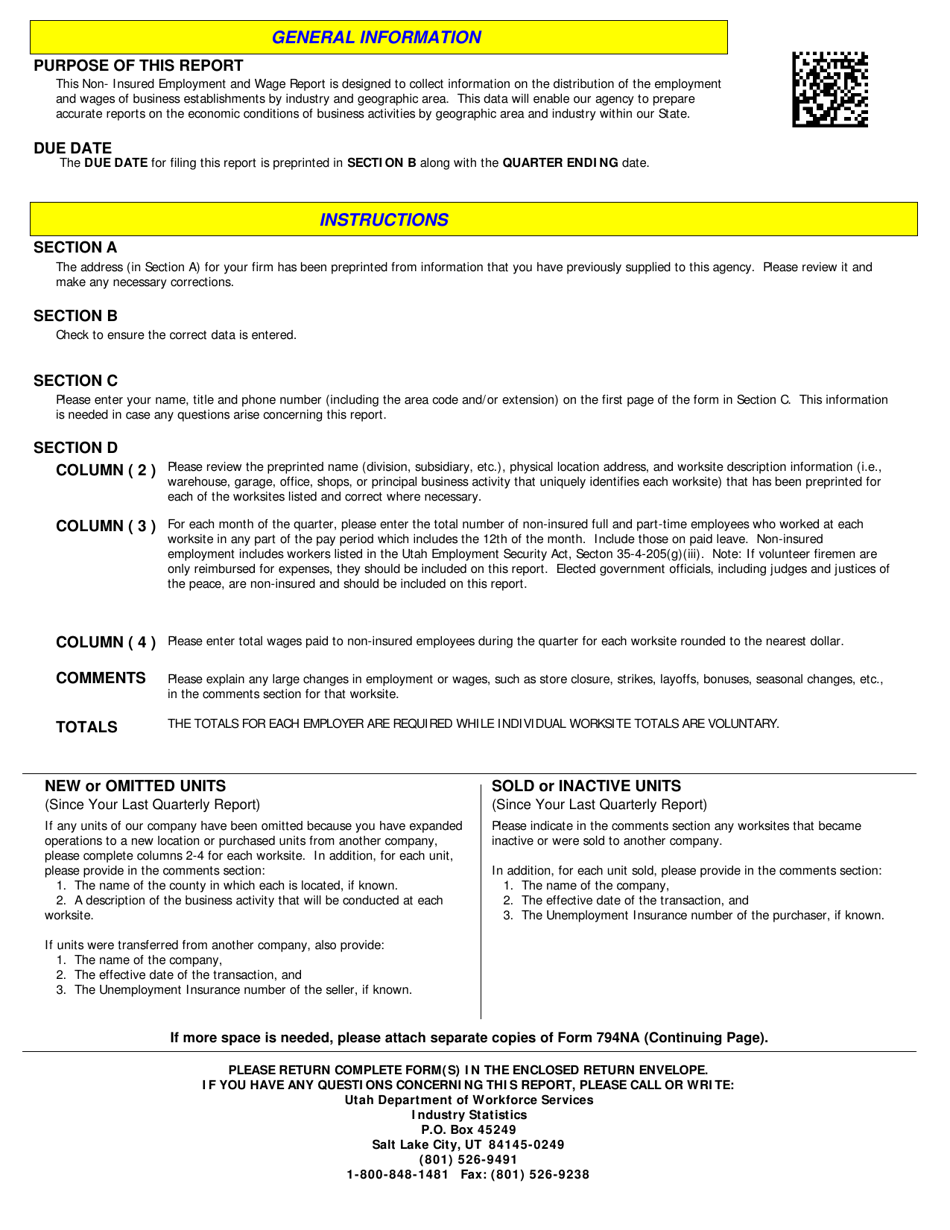

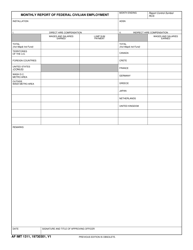

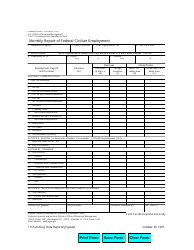

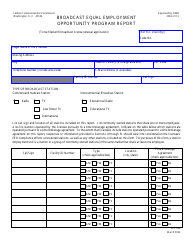

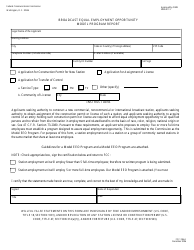

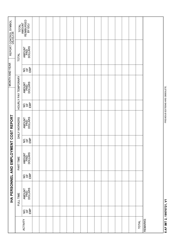

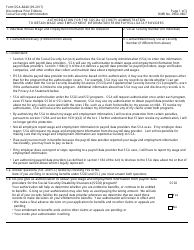

Form 794N Non-insured Employment and Wage Report - Utah

What Is Form 794N?

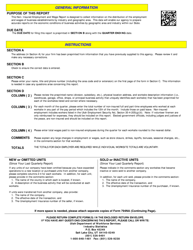

This is a legal form that was released by the Utah Department of Workforce Services - Unemployment Insurance - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 794N?

A: Form 794N is the Non-insured Employment and Wage Report in Utah.

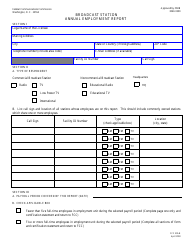

Q: Who is required to file Form 794N?

A: Employers in Utah who have non-insured employees must file Form 794N.

Q: What is the purpose of Form 794N?

A: Form 794N is used to report wages and employment information for non-insured employees in Utah.

Q: When is Form 794N due?

A: Form 794N is due quarterly, by the last day of the month following the end of the quarter.

Q: Are there any penalties for not filing Form 794N?

A: Yes, there may be penalties for not filing or for filing late or incorrect information on Form 794N.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the Utah Department of Workforce Services - Unemployment Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 794N by clicking the link below or browse more documents and templates provided by the Utah Department of Workforce Services - Unemployment Insurance.