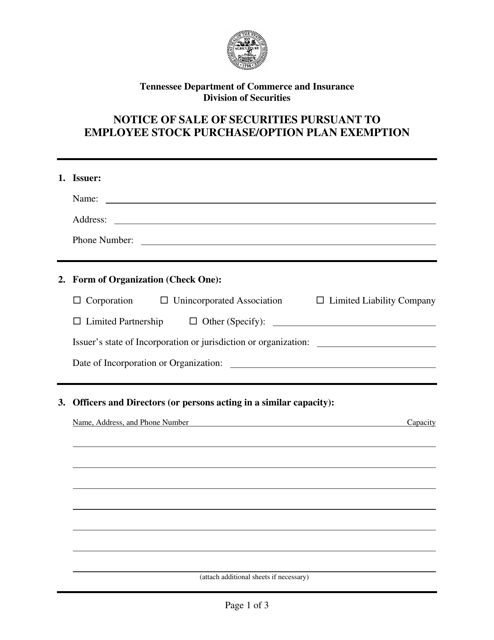

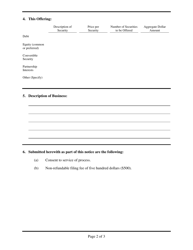

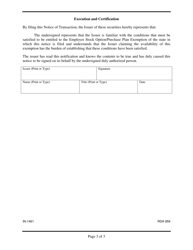

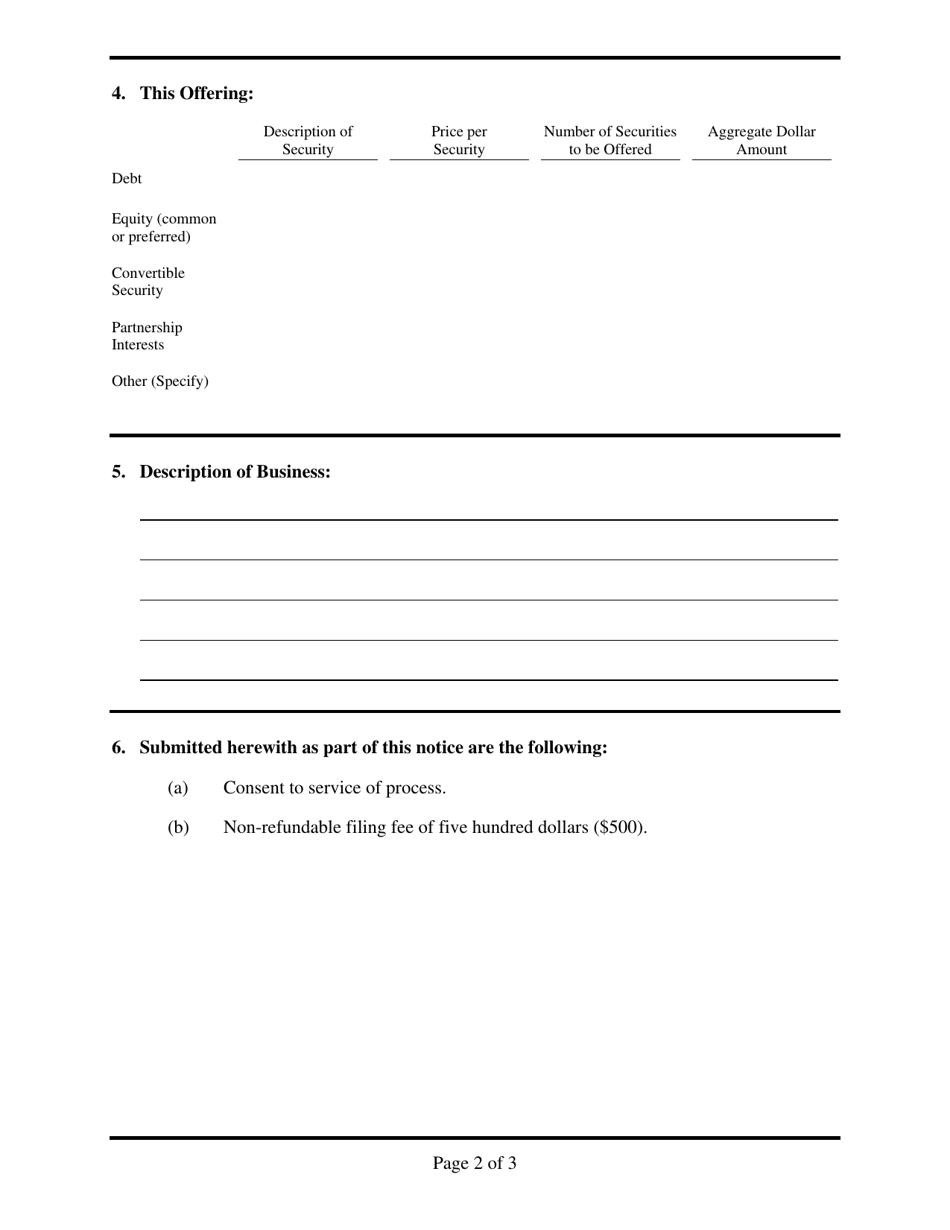

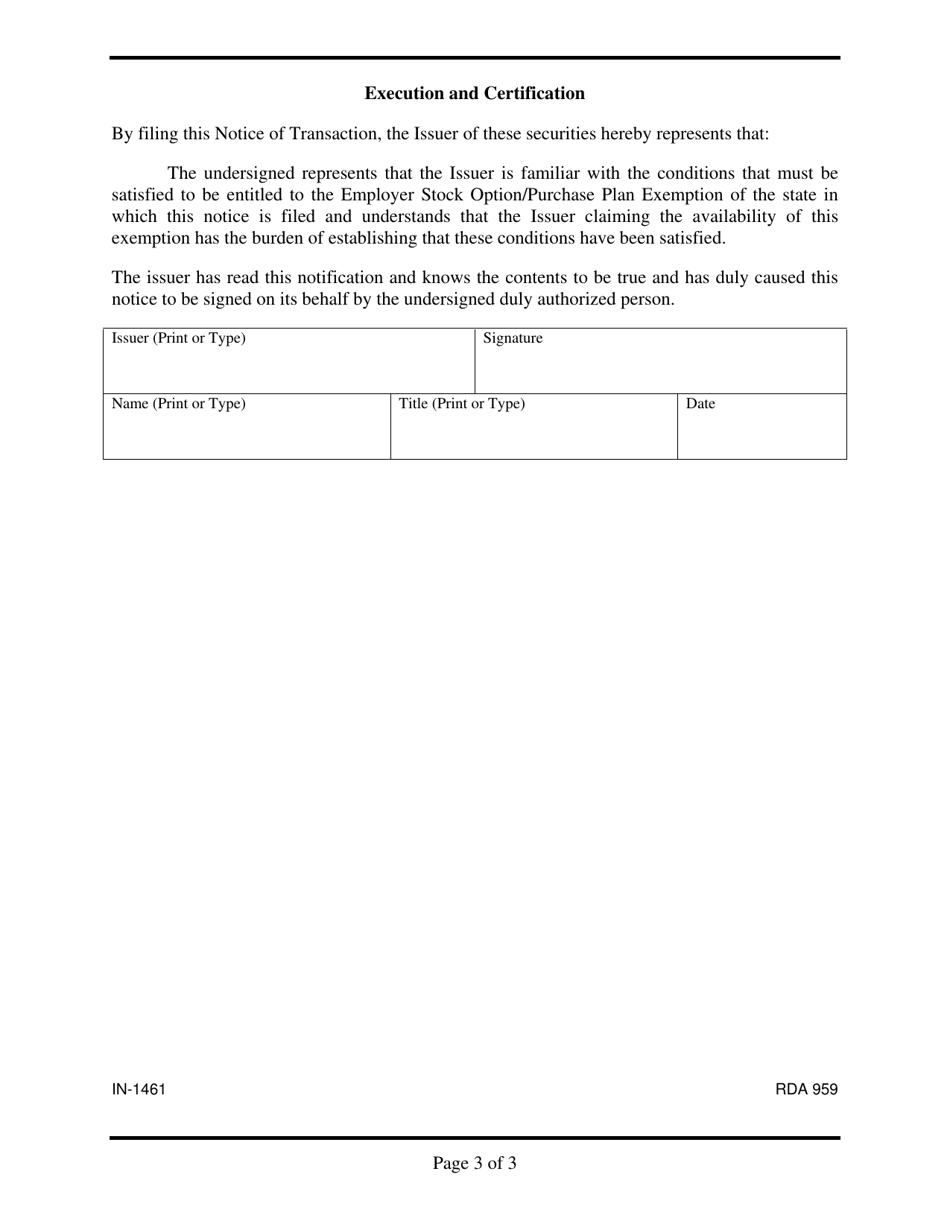

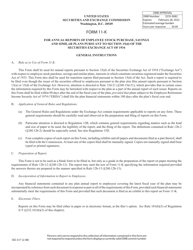

Form IN-1461 Notice of Sale of Securities Pursuant to Employee Stock Purchase / Option Plan Exemption - Tennessee

What Is Form IN-1461?

This is a legal form that was released by the Tennessee Department of Commerce and Insurance - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IN-1461?

A: Form IN-1461 is a notice required to be filed by an employer in Tennessee when selling securities under an employee stock purchase/option plan exemption.

Q: When is Form IN-1461 used?

A: Form IN-1461 is used when an employer is selling securities pursuant to an employee stock purchase/option plan exemption in Tennessee.

Q: What is the purpose of Form IN-1461?

A: The purpose of Form IN-1461 is to provide notice to the Tennessee Department of Commerce and Insurance about the sale of securities under an employee stock purchase/option plan exemption.

Q: Who is required to file Form IN-1461?

A: The employer who is selling the securities under an employee stock purchase/option plan exemption is required to file Form IN-1461 in Tennessee.

Form Details:

- The latest edition provided by the Tennessee Department of Commerce and Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IN-1461 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Commerce and Insurance.