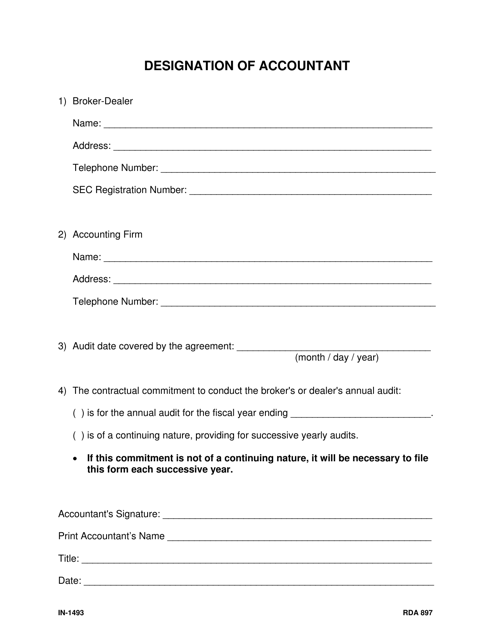

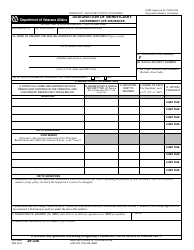

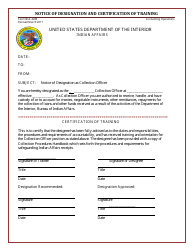

Form IN-1493 Designation of Accountant - Tennessee

What Is Form IN-1493?

This is a legal form that was released by the Tennessee Department of Commerce and Insurance - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form IN-1493?

A: Form IN-1493 is the Designation of Accountant form for Tennessee.

Q: What is the purpose of form IN-1493?

A: The purpose of form IN-1493 is to designate an accountant for Tennessee.

Q: Who needs to fill out form IN-1493?

A: Anyone who wants to designate an accountant in Tennessee needs to fill out form IN-1493.

Q: Is there a fee for filing form IN-1493?

A: No, there is no fee for filing form IN-1493.

Q: Do I need to renew form IN-1493?

A: No, form IN-1493 does not need to be renewed unless there is a change in the designated accountant.

Q: Can I change the designated accountant on form IN-1493?

A: Yes, you can change the designated accountant by filing a new form IN-1493 with the updated information.

Q: Are there any penalties for not filing form IN-1493?

A: Failure to file form IN-1493 or provide accurate information may result in penalties or other legal consequences.

Q: Can I designate multiple accountants on form IN-1493?

A: No, form IN-1493 only allows for the designation of one accountant.

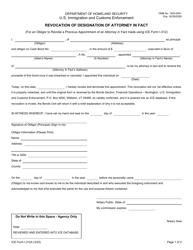

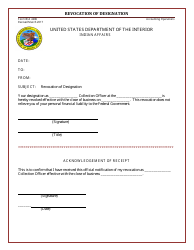

Q: Can I revoke the designation of an accountant on form IN-1493?

A: Yes, you can revoke the designation of an accountant by filing a new form IN-1493 with the updated information.

Form Details:

- The latest edition provided by the Tennessee Department of Commerce and Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IN-1493 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Commerce and Insurance.