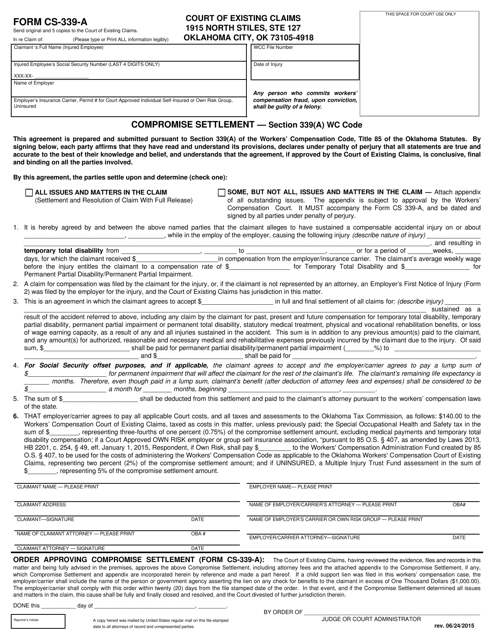

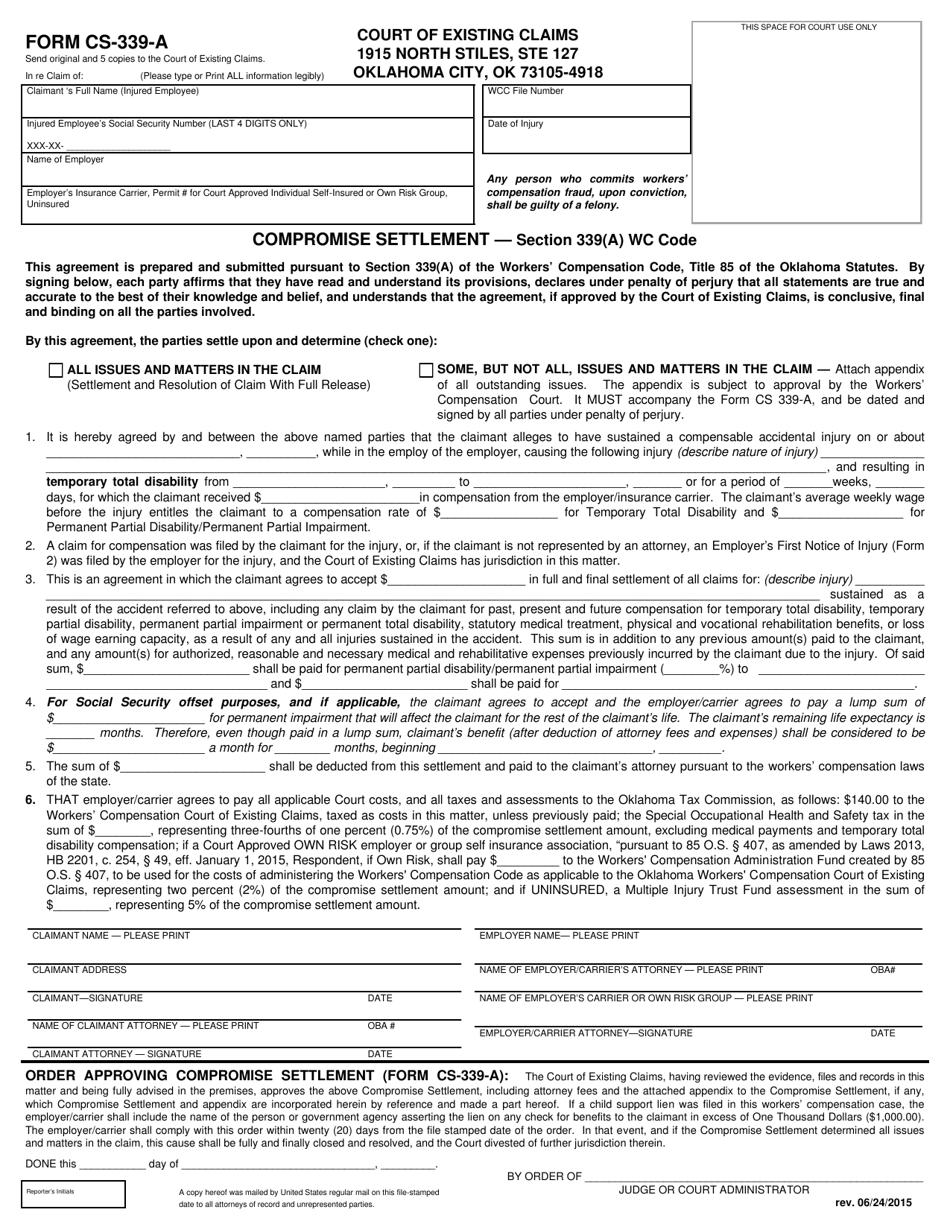

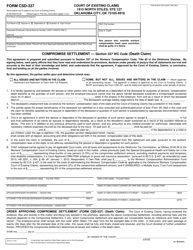

Form CS-339-A Compromise Settlement - Oklahoma

What Is Form CS-339-A?

This is a legal form that was released by the Oklahoma Workers' Compensation Court of Existing Claims - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CS-339-A?

A: Form CS-339-A is a Compromise Settlement form in Oklahoma.

Q: What is a Compromise Settlement?

A: A Compromise Settlement is an agreement between parties to settle a dispute by mutual agreement.

Q: Who uses Form CS-339-A?

A: Form CS-339-A is typically used by individuals or businesses in Oklahoma who wish to reach a compromise settlement.

Q: What is the purpose of Form CS-339-A?

A: The purpose of Form CS-339-A is to document the terms and conditions of a compromise settlement and ensure that all parties involved are in agreement.

Q: Are there any fees associated with submitting Form CS-339-A?

A: There may be fees associated with submitting Form CS-339-A. It is recommended to check with the Oklahoma Tax Commission or a legal professional for specific information.

Q: What happens after Form CS-339-A is submitted?

A: After Form CS-339-A is submitted, the Oklahoma Tax Commission will review the proposed compromise settlement and either approve or reject it.

Q: Can Form CS-339-A be used for any type of dispute?

A: No, Form CS-339-A is specifically designed for tax-related disputes in Oklahoma.

Q: Are there any time limitations for submitting Form CS-339-A?

A: Yes, there may be time limitations for submitting Form CS-339-A. It is important to consult the instructions or contact the Oklahoma Tax Commission for specific deadlines.

Q: Is legal representation required when submitting Form CS-339-A?

A: Legal representation is not required, but it is recommended, especially for complex or high-stakes settlements.

Form Details:

- Released on June 24, 2015;

- The latest edition provided by the Oklahoma Workers' Compensation Court of Existing Claims;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CS-339-A by clicking the link below or browse more documents and templates provided by the Oklahoma Workers' Compensation Court of Existing Claims.