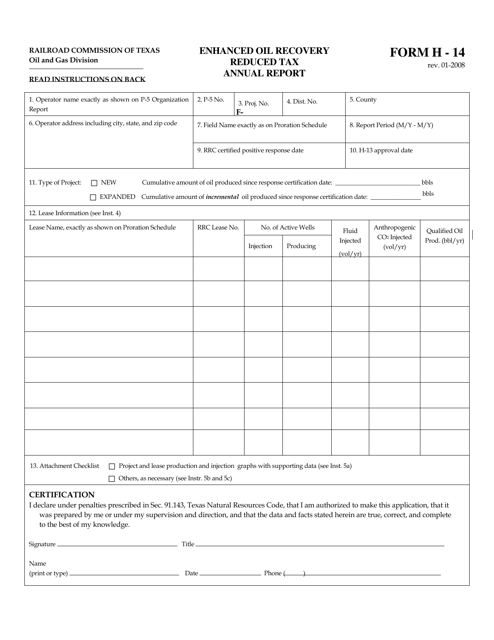

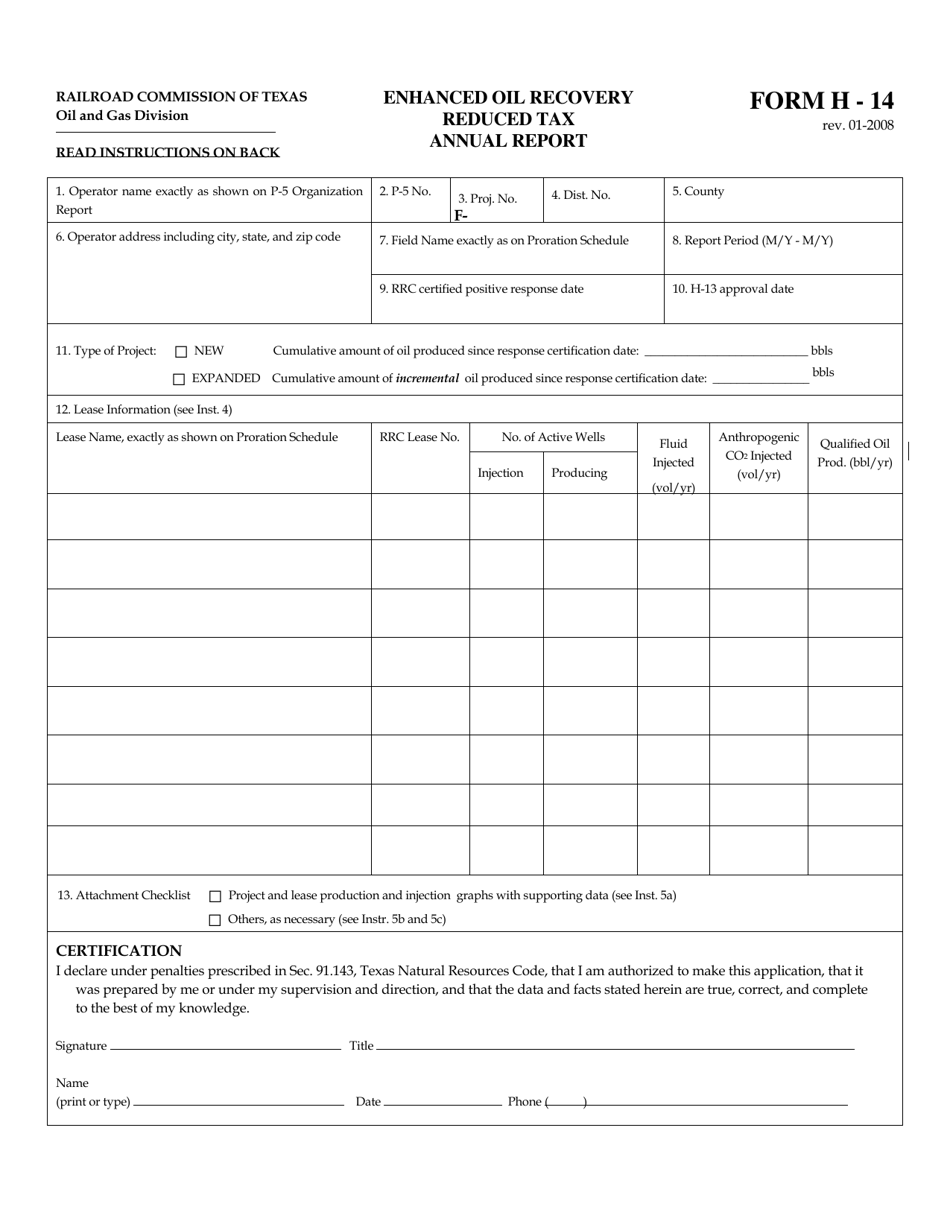

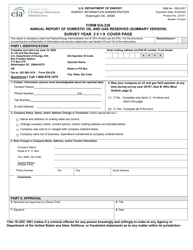

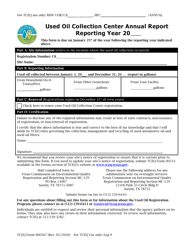

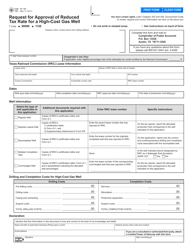

Form H-14 Enhanced Oil Recovery Reduced Tax Annual Report - Texas

What Is Form H-14?

This is a legal form that was released by the Railroad Commission of Texas - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

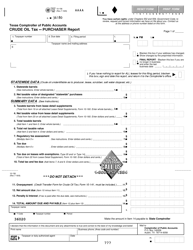

Q: What is Form H-14?

A: Form H-14 is the Enhanced Oil RecoveryReduced Tax Annual Report.

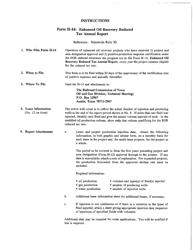

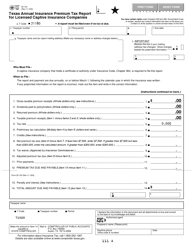

Q: Who needs to file Form H-14?

A: Oil producers in Texas who wish to claim the Enhanced Oil Recovery Reduced Tax must file Form H-14.

Q: What is the purpose of Form H-14?

A: The purpose of Form H-14 is to report and claim the Enhanced Oil Recovery Reduced Tax.

Q: What is Enhanced Oil Recovery?

A: Enhanced Oil Recovery refers to the use of various techniques to increase the amount of oil that can be extracted from a reservoir.

Q: What is the Reduced Tax?

A: The Reduced Tax is a tax incentive provided to oil producers in Texas who engage in Enhanced Oil Recovery activities.

Q: When is Form H-14 due?

A: Form H-14 is due annually on or before March 1st.

Q: Are there any penalties for late filing of Form H-14?

A: Yes, there are penalties for late filing. The penalty for filing after the due date but within 30 days is $50, and the penalty for filing more than 30 days late is $200.

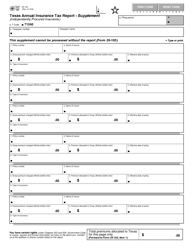

Q: What information is required on Form H-14?

A: Form H-14 requires information such as the tax period, taxpayer name and address, total crude oil produced, and details of Enhanced Oil Recovery expenses and credits.

Form Details:

- Released on January 1, 2008;

- The latest edition provided by the Railroad Commission of Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form H-14 by clicking the link below or browse more documents and templates provided by the Railroad Commission of Texas.